Region:Europe

Author(s):Geetanshi

Product Code:KRAB2727

Pages:89

Published On:October 2025

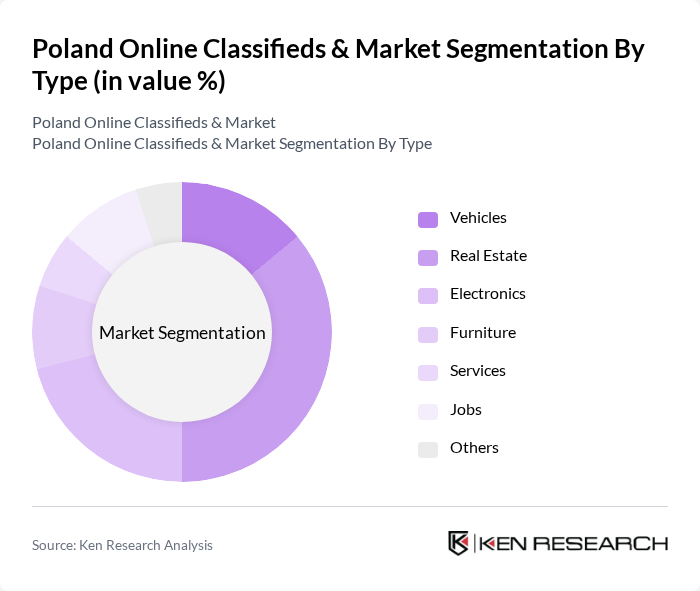

By Type:The market is segmented into various types, including Vehicles, Real Estate, Electronics, Furniture, Services, Jobs, and Others. Among these, the Real Estate segment is particularly dominant due to the increasing demand for housing and commercial properties in urban areas. The trend of remote work has also led to a surge in interest in suburban properties, further driving this segment's growth .

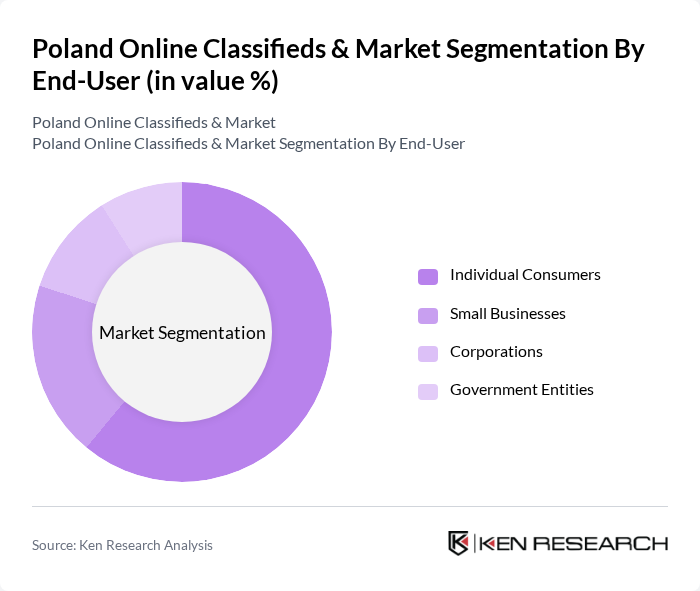

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Corporations, and Government Entities. Individual Consumers dominate the market, driven by the growing trend of peer-to-peer selling and buying. The convenience of online platforms allows consumers to easily access a variety of products and services, making this segment the largest contributor to market growth .

The Poland Online Classifieds & Market is characterized by a dynamic mix of regional and international players. Leading participants such as OLX Poland, Allegro.pl, Gumtree Poland, Gratka.pl, Oferteo.pl, Sprzedajemy.pl, Lento.pl, eBay Poland, Facebook Marketplace, Ceneo.pl, Targowisko.pl, Zumi.pl, Trovit.pl, Domy.pl, AutoScout24.pl, OtoMoto.pl, Nieruchomosci-online.pl, Morizon.pl, Szybko.pl contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online classifieds market in Poland appears promising, driven by technological advancements and changing consumer behaviors. As mobile commerce continues to rise, platforms that prioritize user experience and security will likely thrive. Additionally, the integration of AI for personalized recommendations and enhanced search functionalities will attract more users. The increasing focus on sustainability will also shape market dynamics, as consumers seek eco-friendly options, creating new avenues for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Vehicles Real Estate Electronics Furniture Services Jobs Others |

| By End-User | Individual Consumers Small Businesses Corporations Government Entities |

| By Sales Channel | Direct Listings Auction Platforms Classified Ads Social Media |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas |

| By Price Range | Low-End Mid-Range High-End |

| By Listing Duration | Short-Term Listings Long-Term Listings |

| By Payment Method | Credit/Debit Cards Bank Transfers Cash on Delivery Digital Wallets |

| By Advertising Model | Free Listings Paid Listings Featured Listings Subscription-Based Listings |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Users of Online Classifieds | 120 | Frequent Buyers, Casual Sellers |

| Real Estate Listings | 60 | Real Estate Agents, Property Buyers |

| Automotive Sales | 50 | Car Dealers, Private Sellers |

| Consumer Electronics Market | 40 | Electronics Retailers, Tech Enthusiasts |

| Home Goods and Furniture | 40 | Homeowners, Interior Designers |

The Poland Online Classifieds Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and a shift in consumer behavior towards online shopping and selling.