Region:Asia

Author(s):Rebecca

Product Code:KRAB4137

Pages:96

Published On:October 2025

By Type:The online classifieds market can be segmented into various types, including Website Classifieds, Social Media Classifieds, Mobile App Classifieds, Search Engine Marketing Classifieds, and Vertical/Niche Classifieds. Each of these segments caters to different consumer preferences and behaviors, with some platforms focusing on specific niches while others offer broader categories.

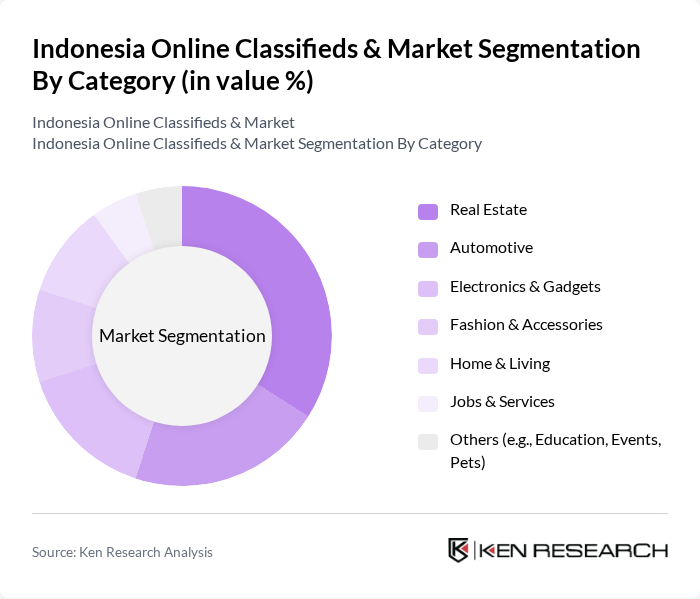

By Category:The market can also be segmented by category, including Real Estate, Automotive, Electronics & Gadgets, Fashion & Accessories, Home & Living, Jobs & Services, and Others. Each category reflects the diverse needs of consumers, with certain categories experiencing higher demand based on trends and economic conditions.

The Indonesia Online Classifieds & Market is characterized by a dynamic mix of regional and international players. Leading participants such as OLX Indonesia, Bukalapak, Tokopedia, Carousell Indonesia, Jualo, Kaskus, Blibli, Shopee Indonesia, Lazada Indonesia, Facebook Marketplace Indonesia, Instagram Shopping Indonesia, Bhinneka, FJB Kaskus, Rumah123, Lamudi.co.id contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's online classifieds market appears promising, driven by technological advancements and evolving consumer preferences. As internet penetration continues to rise, platforms are likely to enhance user experiences through AI-driven personalization and improved security measures. Additionally, the integration of social media for marketing and customer engagement will become increasingly vital. These trends suggest a dynamic landscape where adaptability and innovation will be crucial for success in the competitive market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Website Classifieds Social Media Classifieds Mobile App Classifieds Search Engine Marketing Classifieds Vertical/Niche Classifieds (e.g., Jobs, Real Estate, Automotive) |

| By Category | Real Estate Automotive Electronics & Gadgets Fashion & Accessories Home & Living Jobs & Services Others (e.g., Education, Events, Pets) |

| By End-User | Individual Consumers Small & Medium Enterprises (SMEs) Large Corporates |

| By Sales Channel | Direct Listings (C2C, B2C) Third-Party Aggregators Mobile Applications Social Media Platforms |

| By Product Condition | New Used Refurbished |

| By Payment Method | Cash on Delivery Credit/Debit Cards E-Wallets Bank Transfers |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Advertising Model | Pay-Per-Click (PPC) Subscription-Based Freemium Featured Listings/Promoted Ads Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Online Classifieds Users | 120 | Active users aged 18-45, diverse socio-economic backgrounds |

| Small Business Advertisers | 80 | Owners and managers of small to medium enterprises |

| Real Estate Listings | 60 | Real estate agents and property developers |

| Automotive Sellers | 50 | Individuals and dealers involved in vehicle sales |

| Consumer Electronics Buyers | 70 | Tech-savvy consumers interested in buying and selling electronics |

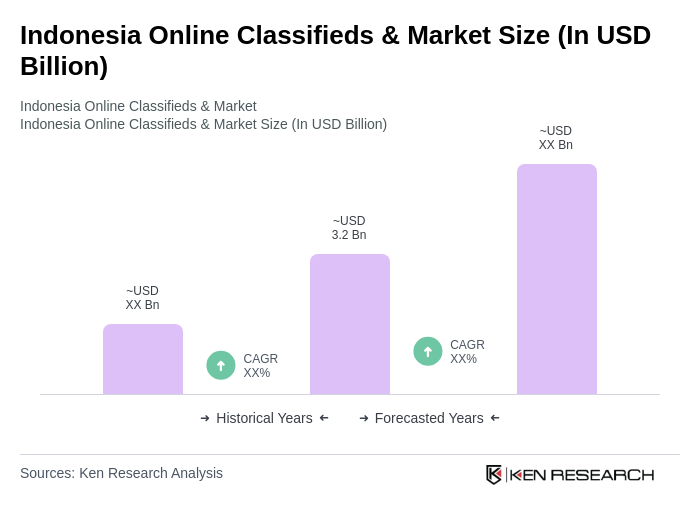

The Indonesia Online Classifieds Market is valued at approximately USD 3.2 billion, driven by increased internet penetration, mobile device usage, and a growing preference for online shopping among consumers.