Region:Europe

Author(s):Rebecca

Product Code:KRAB5353

Pages:85

Published On:October 2025

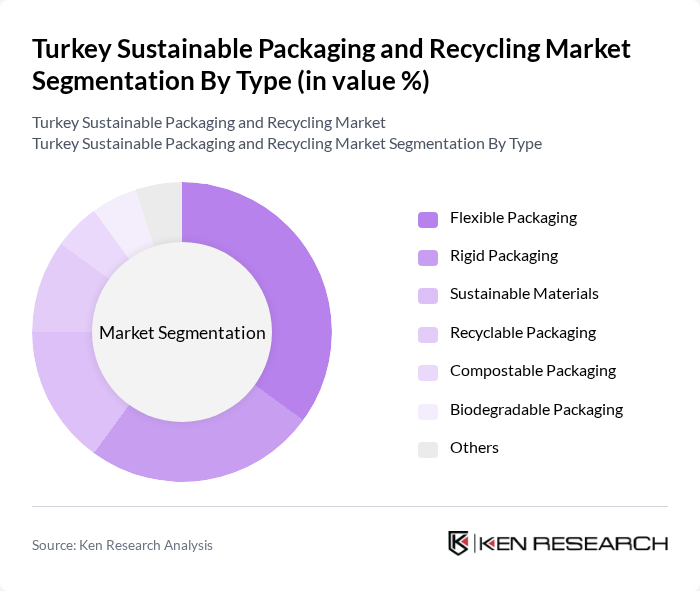

By Type:The market is segmented into various types of packaging solutions, including flexible packaging, rigid packaging, sustainable materials, recyclable packaging, compostable packaging, biodegradable packaging, and others. Among these, flexible packaging is gaining significant traction due to its lightweight nature and versatility, making it a preferred choice for many manufacturers. Rigid packaging also holds a substantial share, particularly in the food and beverage sector, where durability and protection are paramount. The increasing focus on sustainability is driving the demand for recyclable and compostable packaging options, as consumers and businesses alike seek to minimize their environmental impact.

By End-User:The end-user segmentation includes food and beverage, personal care, household products, industrial goods, healthcare, and others. The food and beverage sector is the largest consumer of sustainable packaging solutions, driven by the increasing demand for convenience and eco-friendly options. Personal care products are also seeing a rise in sustainable packaging adoption, as consumers become more environmentally conscious. The healthcare sector is gradually shifting towards sustainable practices, although it remains a smaller segment compared to food and beverage.

The Turkey Sustainable Packaging and Recycling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tetra Pak, Coca-Cola ?çecek A.?., P?nar Süt, Unilever Turkey, Nestlé Turkey, Eczac?ba?? Group, Anadolu Efes, PepsiCo Türkiye, Arçelik A.?., ?i?ecam, Korozo Ambalaj, Pakmaya, Çal?k Holding, Mavi Jeans, Tüpras contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sustainable packaging and recycling market in Turkey appears promising, driven by increasing consumer demand and supportive government policies. As awareness of environmental issues continues to grow, companies are likely to invest more in sustainable practices. Additionally, advancements in recycling technologies will enhance efficiency and reduce costs. The collaboration between businesses and local governments will be crucial in overcoming existing challenges, paving the way for a more sustainable future in packaging and waste management.

| Segment | Sub-Segments |

|---|---|

| By Type | Flexible Packaging Rigid Packaging Sustainable Materials Recyclable Packaging Compostable Packaging Biodegradable Packaging Others |

| By End-User | Food and Beverage Personal Care Household Products Industrial Goods Healthcare Others |

| By Distribution Channel | Online Retail Supermarkets and Hypermarkets Specialty Stores Direct Sales Others |

| By Material Type | Paper and Cardboard Plastics Glass Metals Others |

| By Application | Packaging for Food Products Packaging for Non-Food Products Packaging for Industrial Use Others |

| By Regulatory Compliance | EU Standards Compliance Local Government Regulations International Standards Compliance Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Manufacturers | 100 | Production Managers, Sustainability Officers |

| Retail Sector Stakeholders | 80 | Supply Chain Managers, Procurement Directors |

| Recycling Facilities | 70 | Operations Managers, Environmental Compliance Officers |

| Consumer Insights | 150 | General Consumers, Eco-conscious Shoppers |

| Government and Regulatory Bodies | 50 | Policy Makers, Environmental Analysts |

The Turkey Sustainable Packaging and Recycling Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by consumer awareness, government regulations, and the demand for eco-friendly packaging solutions across various industries.