Region:Middle East

Author(s):Rebecca

Product Code:KRAC1838

Pages:90

Published On:October 2025

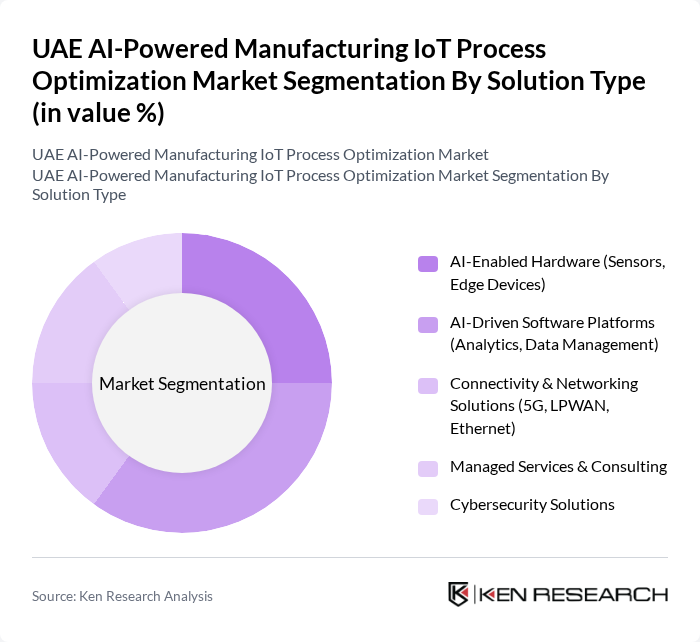

By Solution Type:

The solution type segmentation includes AI-Enabled Hardware (Sensors, Edge Devices), AI-Driven Software Platforms (Analytics, Data Management), Connectivity & Networking Solutions (5G, LPWAN, Ethernet), Managed Services & Consulting, and Cybersecurity Solutions. Among these, AI-Driven Software Platforms are leading the market due to the increasing demand for data analytics and management solutions that enhance decision-making processes. The growing need for predictive maintenance and real-time monitoring in manufacturing operations is driving the adoption of these platforms, making them essential for optimizing processes and improving efficiency.

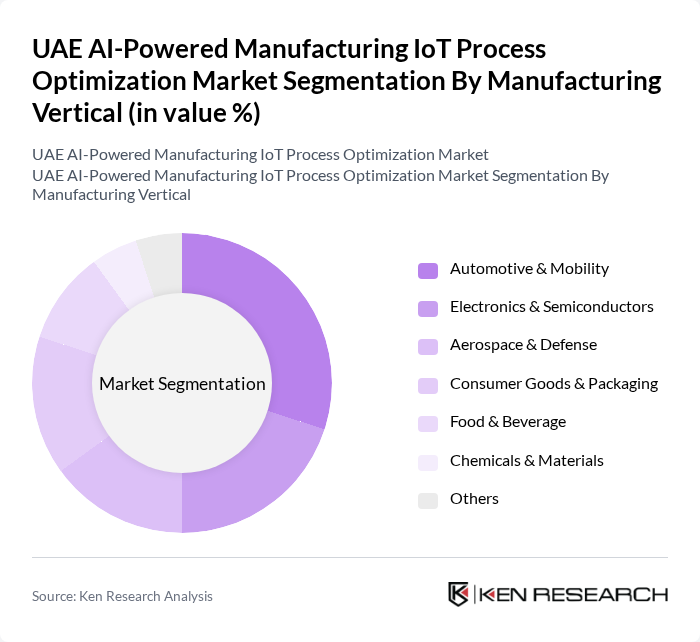

By Manufacturing Vertical:

This segmentation includes Automotive & Mobility, Electronics & Semiconductors, Aerospace & Defense, Consumer Goods & Packaging, Food & Beverage, Chemicals & Materials, and Others. The Automotive & Mobility sector is currently the dominant vertical, driven by the rapid advancements in smart manufacturing technologies and the increasing demand for automation in production lines. The push for electric vehicles and sustainable manufacturing practices is further propelling the adoption of AI-powered solutions in this sector, making it a key area for growth.

The UAE AI-Powered Manufacturing IoT Process Optimization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, General Electric Company, Honeywell International Inc., Rockwell Automation, Inc., ABB Ltd., Schneider Electric SE, Bosch Rexroth AG, Mitsubishi Electric Corporation, Emerson Electric Co., Yokogawa Electric Corporation, PTC Inc., Cisco Systems, Inc., IBM Corporation, Oracle Corporation, SAP SE, Microsoft Corporation, Etisalat Group (e&), Injazat Data Systems, du (Emirates Integrated Telecommunications Company), Aveva Group plc, Aspen Technology, Inc., Schneider Electric UAE, Honeywell Middle East, Strata Manufacturing PJSC, Innovent IoT Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE AI-powered manufacturing IoT process optimization market appears promising, driven by technological advancements and increasing government support. As manufacturers increasingly adopt AI and IoT technologies, operational efficiencies are expected to improve significantly. The focus on sustainability and energy efficiency will also shape future developments, with companies seeking innovative solutions to reduce their environmental impact while enhancing productivity and competitiveness in the global market.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | AI-Enabled Hardware (Sensors, Edge Devices) AI-Driven Software Platforms (Analytics, Data Management) Connectivity & Networking Solutions (5G, LPWAN, Ethernet) Managed Services & Consulting Cybersecurity Solutions |

| By Manufacturing Vertical | Automotive & Mobility Electronics & Semiconductors Aerospace & Defense Consumer Goods & Packaging Food & Beverage Chemicals & Materials Others |

| By Application Area | Predictive Maintenance & Asset Management Quality Assurance & Defect Detection Supply Chain & Inventory Optimization Production Scheduling & Workflow Automation Energy Management & Sustainability Safety & Compliance Monitoring Others |

| By Component | Sensors & Actuators AI Software Platforms Communication Modules Edge Computing Devices Cloud Infrastructure Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) Others |

| By Sales Channel | Direct Sales Distributors & System Integrators Online Sales Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing IoT Solutions | 65 | Production Managers, IT Directors |

| Electronics Manufacturing Process Optimization | 55 | Operations Managers, Quality Assurance Heads |

| Textile Industry AI Implementations | 50 | Supply Chain Managers, R&D Directors |

| Food and Beverage Manufacturing IoT Applications | 45 | Plant Managers, Process Engineers |

| Pharmaceutical Manufacturing AI Integration | 60 | Compliance Officers, Production Supervisors |

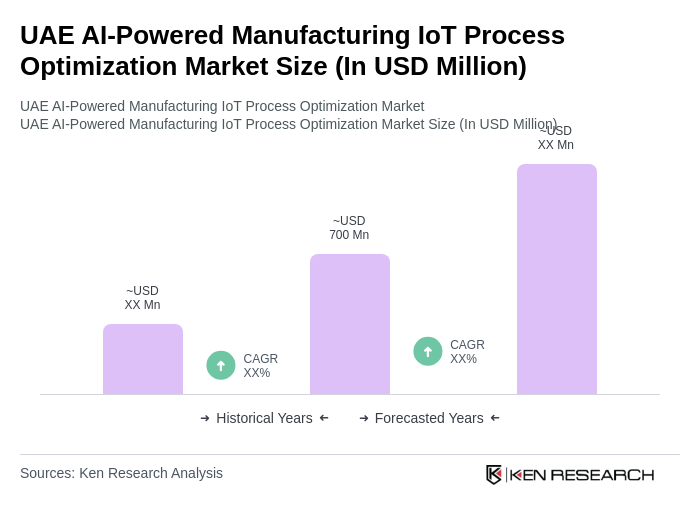

The UAE AI-Powered Manufacturing IoT Process Optimization Market is valued at approximately USD 700 million, reflecting significant growth driven by the adoption of AI technologies and IoT devices in manufacturing processes.