Region:Middle East

Author(s):Dev

Product Code:KRAD6435

Pages:97

Published On:December 2025

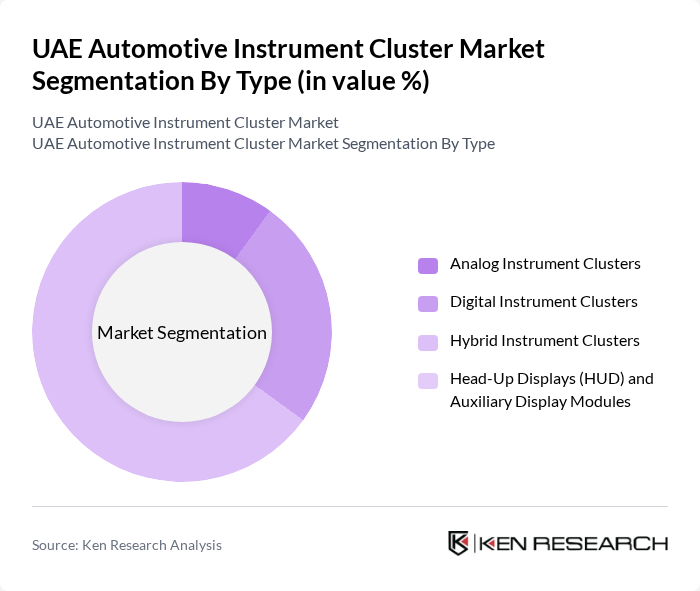

By Type:The market is segmented into various types of instrument clusters, including Analog Instrument Clusters, Digital Instrument Clusters, Hybrid Instrument Clusters, and Head-Up Displays (HUD) and Auxiliary Display Modules. Each type serves different consumer preferences and technological advancements.

The Hybrid Instrument Clusters segment is currently dominating the market due to the increasing consumer preference for high-tech features and enhanced user interfaces. These clusters provide real-time data, customizable displays, and connectivity options that appeal to tech-savvy consumers. The trend towards electric and autonomous vehicles further drives the demand for hybrid solutions, as they offer better integration with advanced vehicle systems. As a result, manufacturers are focusing on developing innovative hybrid clusters to meet market demands.

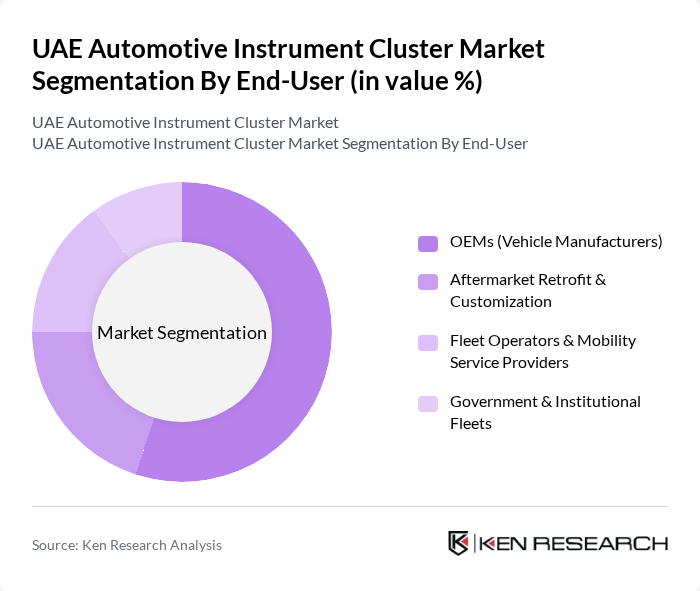

By End-User:The market is segmented based on end-users, including OEMs (Vehicle Manufacturers), Aftermarket Retrofit & Customization, Fleet Operators & Mobility Service Providers, and Government & Institutional Fleets. Each segment has unique requirements and growth potential.

The OEMs (Vehicle Manufacturers) segment leads the market, driven by the increasing integration of advanced instrument clusters in new vehicle models. As manufacturers strive to enhance vehicle safety, connectivity, and user experience, they are investing heavily in developing sophisticated instrument clusters. This trend is further supported by consumer demand for modern features, making OEMs a critical player in the automotive instrument cluster market.

The UAE Automotive Instrument Cluster Market is characterized by a dynamic mix of regional and international players. Leading participants such as Continental AG, Denso Corporation, Visteon Corporation, Robert Bosch GmbH, Nippon Seiki Co., Ltd., Yazaki Corporation, Marelli Holdings Co., Ltd., Aptiv PLC, Aisin Corporation, Panasonic Industry Co., Ltd., Harman International Industries, Inc., LG Electronics Inc., Samsung Electronics Co., Ltd., Forvia Faurecia, Alps Alpine Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE automotive instrument cluster market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As the demand for connected vehicles increases, manufacturers will focus on integrating IoT capabilities into instrument clusters, enhancing user experience. Additionally, sustainability will become a key priority, with manufacturers adopting eco-friendly materials and processes. The market is expected to witness a shift towards more personalized and interactive displays, aligning with the broader trends in the automotive industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Analog Instrument Clusters Digital Instrument Clusters Hybrid Instrument Clusters Head-Up Displays (HUD) and Auxiliary Display Modules |

| By End-User | OEMs (Vehicle Manufacturers) Aftermarket Retrofit & Customization Fleet Operators & Mobility Service Providers Government & Institutional Fleets |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCVs) Heavy Commercial Vehicles (HCVs & Buses) Two-Wheelers & Recreational Vehicles |

| By Display Technology | LCD Displays TFT-LCD Displays OLED & AMOLED Displays Projection & Other Emerging Technologies |

| By Region | Abu Dhabi Dubai Sharjah & Northern Emirates Free Zones & Special Economic Zones |

| By Functionality | Basic Analog & Entry-Level Clusters Connected & Telematics-Enabled Clusters ADAS-Integrated & Reconfigurable Clusters Luxury & Fully Digital Cockpit Solutions |

| By Price Range | Entry-Level / Low-End Clusters Mid-Range Clusters Premium / High-End Clusters Ultra-Luxury & Performance-Oriented Clusters |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Instrument Clusters | 120 | Product Managers, Design Engineers |

| Commercial Vehicle Instrument Clusters | 90 | Fleet Managers, Procurement Specialists |

| Electric Vehicle Instrument Clusters | 70 | R&D Engineers, Technology Officers |

| Aftermarket Instrument Cluster Solutions | 60 | Retail Managers, Automotive Technicians |

| Smart Instrument Cluster Technologies | 80 | Innovation Managers, UX Designers |

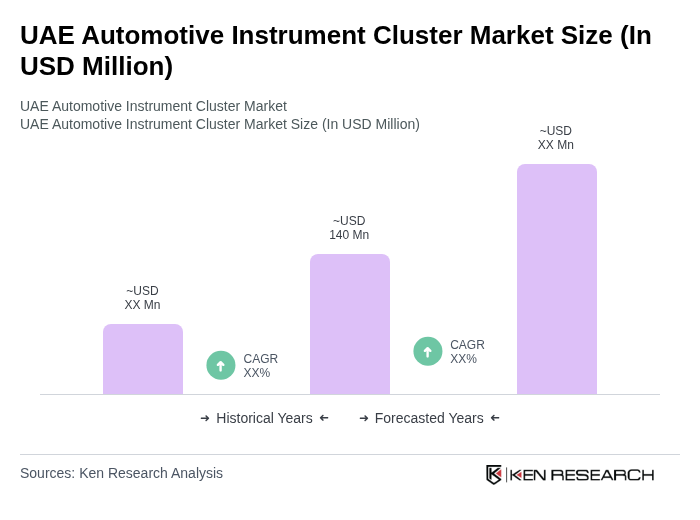

The UAE Automotive Instrument Cluster Market is valued at approximately USD 140 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for advanced vehicle technologies and the rise in vehicle production and sales in the region.