Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7001

Pages:99

Published On:October 2025

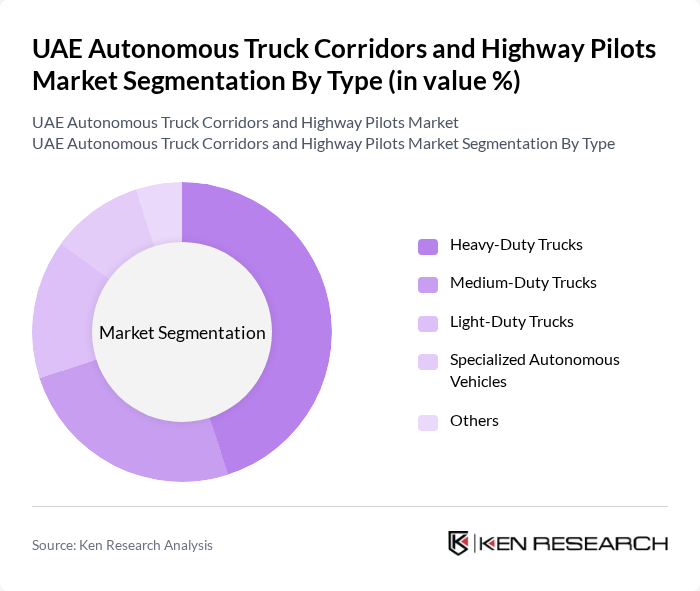

By Type:

The segmentation by type includes Heavy-Duty Trucks, Medium-Duty Trucks, Light-Duty Trucks, Specialized Autonomous Vehicles, and Others. Among these, Heavy-Duty Trucks are leading the market due to their extensive use in freight transportation and logistics. The demand for these trucks is driven by the need for efficient long-haul transportation solutions, which are increasingly being met by autonomous technology. Medium-Duty and Light-Duty Trucks are also gaining traction, particularly in urban delivery applications, while Specialized Autonomous Vehicles cater to niche markets such as construction and emergency services.

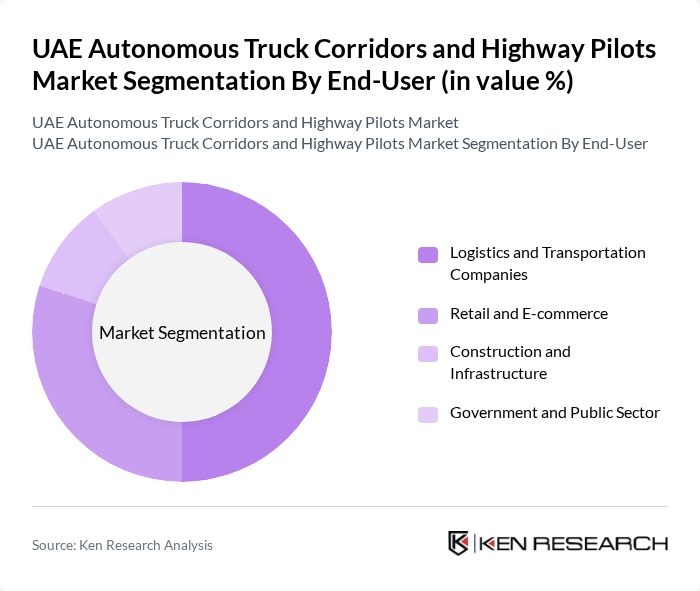

By End-User:

This segmentation includes Logistics and Transportation Companies, Retail and E-commerce, Construction and Infrastructure, and Government and Public Sector. Logistics and Transportation Companies dominate the market, driven by the increasing need for efficient supply chain solutions and the adoption of autonomous technology to reduce operational costs. Retail and E-commerce are also significant contributors, as they seek to enhance last-mile delivery efficiency. The Construction and Infrastructure sector is gradually adopting autonomous vehicles for material transport, while the Government and Public Sector are focusing on regulatory frameworks and pilot projects to support the integration of autonomous trucks.

The UAE Autonomous Truck Corridors and Highway Pilots Market is characterized by a dynamic mix of regional and international players. Leading participants such as DP World, Emirates Transport, Al-Futtaim Group, Al Naboodah Group, Al Jaber Group, Abu Dhabi Ports, Dubai Logistics City, GAC Group, Agility Logistics, Kuehne + Nagel, Aramex, FedEx, DHL, UPS, Maersk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE Autonomous Truck Corridors and Highway Pilots Market appears promising, driven by technological advancements and government support. As the logistics sector continues to expand, the integration of AI and machine learning will enhance operational efficiencies. Furthermore, the increasing focus on sustainability will push companies to adopt greener technologies, aligning with global trends. The collaboration between public and private sectors will be crucial in overcoming challenges and fostering innovation in autonomous transportation solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Heavy-Duty Trucks Medium-Duty Trucks Light-Duty Trucks Specialized Autonomous Vehicles Others |

| By End-User | Logistics and Transportation Companies Retail and E-commerce Construction and Infrastructure Government and Public Sector |

| By Application | Freight Transportation Last-Mile Delivery Inter-City Transport Urban Delivery Services |

| By Distribution Mode | Direct Sales Online Platforms Third-Party Logistics Providers |

| By Payload Capacity | Up to 5 Tons to 10 Tons to 20 Tons Above 20 Tons |

| By Fleet Ownership | Owned Fleets Leased Fleets Third-Party Fleets |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics and Freight Transport | 150 | Logistics Managers, Fleet Operators |

| Urban Mobility Solutions | 100 | Urban Planners, Transportation Engineers |

| Technology Providers for Autonomous Vehicles | 80 | Product Development Managers, R&D Heads |

| Regulatory Bodies and Government Agencies | 60 | Policy Makers, Regulatory Affairs Specialists |

| End-Users of Autonomous Trucking Solutions | 90 | Supply Chain Directors, Operations Managers |

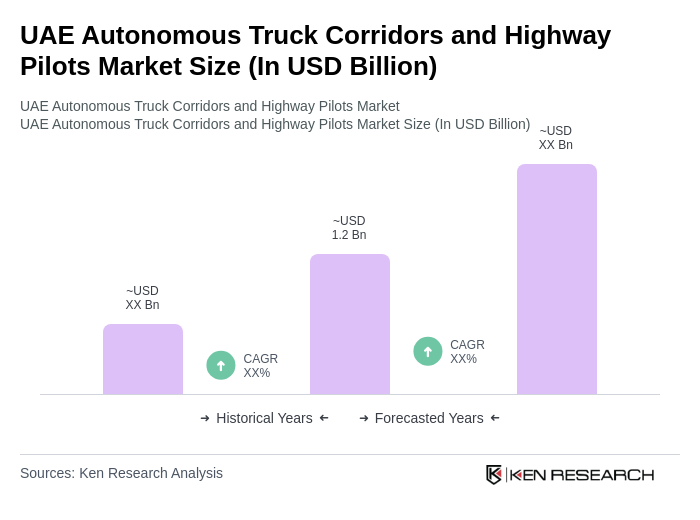

The UAE Autonomous Truck Corridors and Highway Pilots Market is valued at approximately USD 1.2 billion, driven by advancements in autonomous vehicle technology, increased demand for efficient logistics solutions, and supportive government initiatives aimed at enhancing transportation infrastructure.