Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4093

Pages:95

Published On:December 2025

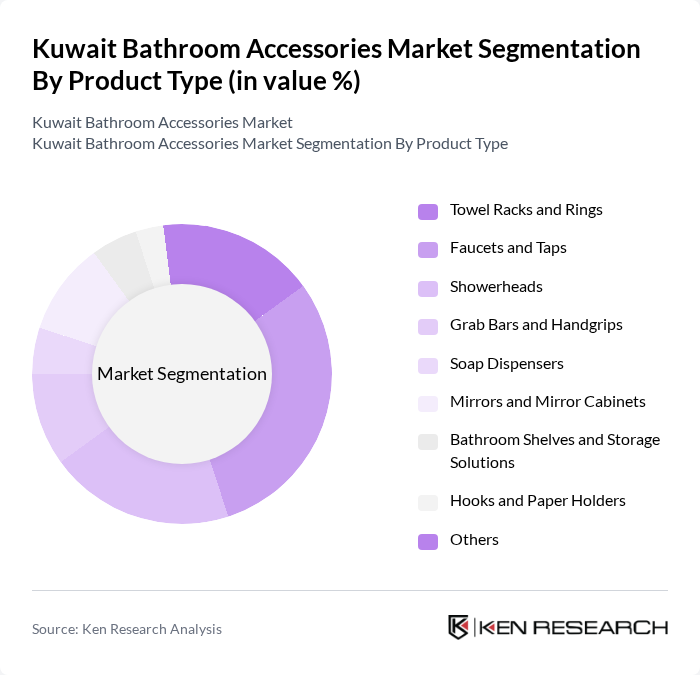

By Product Type:The product type segmentation includes various categories such as towel racks and rings, faucets and taps, showerheads, grab bars and handgrips, soap dispensers, mirrors and mirror cabinets, bathroom shelves and storage solutions, hooks and paper holders, and others. The relative weight of these categories in Kuwait broadly mirrors global and regional patterns, where towel racks/rings, faucets/taps, and shower accessories capture the bulk of demand, but robust Kuwait?specific percentage splits are not publicly disclosed. Within this mix, faucets and taps plausibly hold a leading position in value terms because they are essential for every basin, bidet, and some kitchen?adjacent wet areas, and because higher?end mixer faucets and designer finishes command premium prices in Kuwait’s upper?income market.

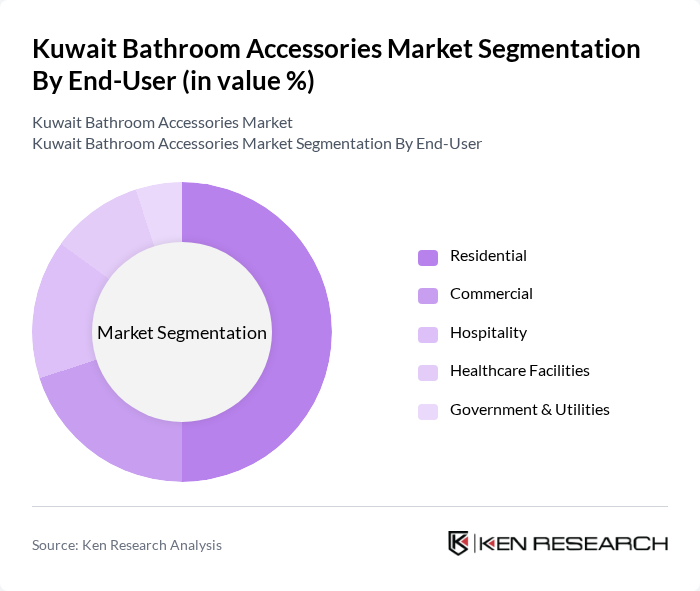

By End-User:The end-user segmentation encompasses residential, commercial, hospitality, healthcare facilities, and government & utilities. The residential segment is likely the largest contributor to the market, in line with global and regional bathroom accessories patterns where households account for a dominant share of installations, especially amid steady housing development and home renovation activity. In Kuwait, rising household incomes, demand for larger and better-equipped apartments and villas, and the influence of interior design trends have encouraged consumers to invest more in coordinated, higher?quality bathroom accessories to enhance convenience and aesthetics.

The Kuwait Bathroom Accessories Market is characterized by a dynamic mix of regional and international players. Large diversified groups such as Alghanim Industries and Al-Futtaim Group are active in home improvement, building materials, and retail, often acting as distributors or franchise partners for global sanitaryware and bathroom brands across Kuwait and the wider GCC. Local and regional engineering, contracting, and trading entities, including groups such as Al-Dhow Engineering and other Kuwaiti conglomerates, typically play key roles in supplying accessories for large construction projects, managing project specifications, and coordinating with architects and consultants.

The future of the Kuwait bathroom accessories market appears promising, driven by ongoing urbanization and rising disposable incomes. As consumers increasingly prioritize aesthetics and functionality, the demand for innovative and luxury products is expected to grow. Additionally, the integration of smart technologies in bathroom accessories will likely attract tech-savvy consumers. Companies that adapt to these trends and focus on sustainability will be well-positioned to capitalize on emerging opportunities in this evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Towel Racks and Rings Faucets and Taps Showerheads Grab Bars and Handgrips Soap Dispensers Mirrors and Mirror Cabinets Bathroom Shelves and Storage Solutions Hooks and Paper Holders Others |

| By End-User | Residential Commercial Hospitality Healthcare Facilities Government & Utilities |

| By Distribution Channel | Online Retail Offline Retail Wholesale and Distributor Networks Direct Sales Specialty Stores |

| By Material | Stainless Steel Plastic Glass Ceramic Brass and Copper Others |

| By Design Style | Modern Traditional Contemporary Vintage Minimalist |

| By Price Range | Budget Mid-range Premium Luxury |

| By Brand Origin | Local Kuwaiti Brands GCC Regional Brands International Brands Private Labels and Retailers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 120 | Store Managers, Retail Buyers |

| Consumer Preferences | 150 | Homeowners, Renters |

| Supplier Feedback | 90 | Manufacturers, Distributors |

| Market Trends Analysis | 80 | Industry Analysts, Market Researchers |

| Product Development Insights | 60 | Product Managers, Design Engineers |

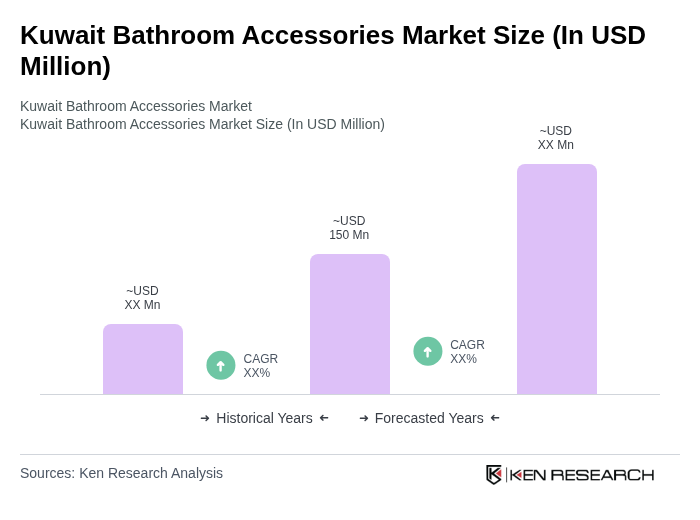

The Kuwait Bathroom Accessories Market is valued at approximately USD 150 million, reflecting the country's share in the broader Middle East and Africa bathroom accessories market, driven by urbanization and rising disposable incomes.