Region:Middle East

Author(s):Rebecca

Product Code:KRAA6946

Pages:97

Published On:September 2025

Market.png)

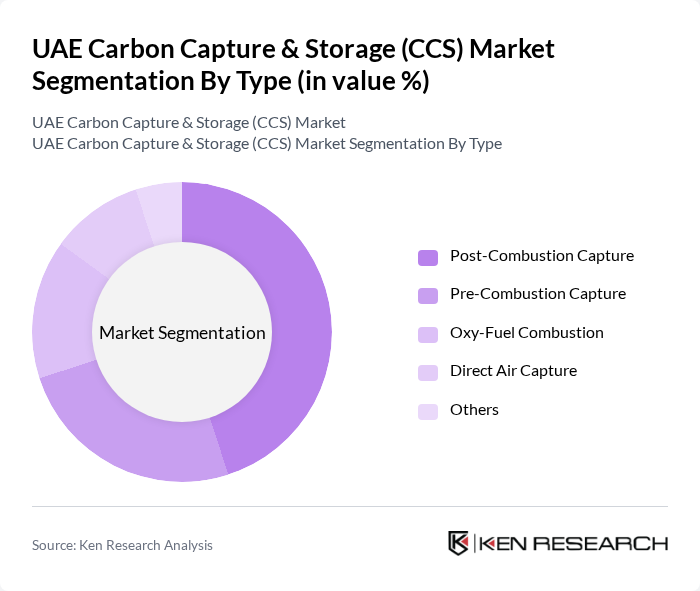

By Type:

The CCS market is segmented into various types, including Post-Combustion Capture, Pre-Combustion Capture, Oxy-Fuel Combustion, Direct Air Capture, and Others. Among these, Post-Combustion Capture is the leading sub-segment, primarily due to its applicability across existing power plants and industrial facilities. This technology allows for the retrofitting of current infrastructure, making it a preferred choice for many operators looking to reduce emissions without significant capital investment in new facilities. The growing emphasis on reducing carbon footprints in the oil and gas sector further solidifies its dominance.

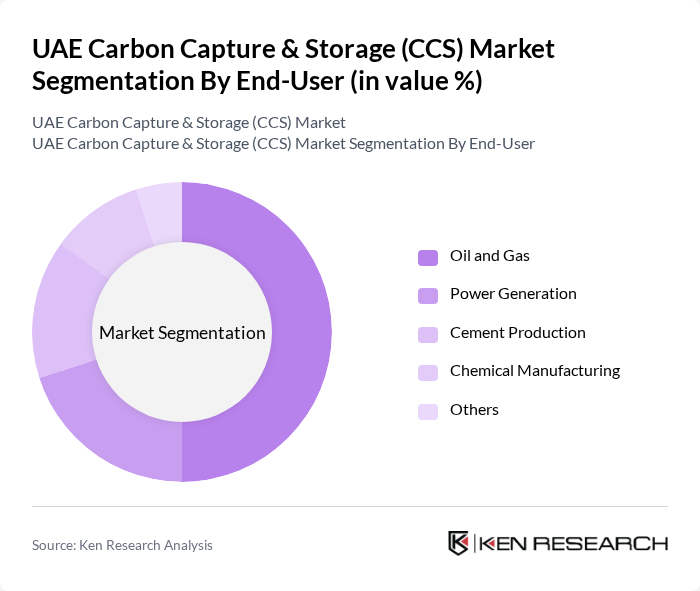

By End-User:

The end-user segmentation includes Oil and Gas, Power Generation, Cement Production, Chemical Manufacturing, and Others. The Oil and Gas sector is the dominant end-user, driven by the need for enhanced oil recovery and the industry's significant carbon emissions. Companies in this sector are increasingly adopting CCS technologies to meet regulatory requirements and improve sustainability practices. The growing demand for cleaner energy solutions and the integration of CCS in oil extraction processes further enhance its market leadership.

The UAE Carbon Capture & Storage (CCS) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi National Oil Company (ADNOC), Emirates Global Aluminium, Masdar, TotalEnergies, Shell, Siemens Energy, Carbon Clean Solutions, Linde, Occidental Petroleum, Air Products and Chemicals, Mitsubishi Heavy Industries, Baker Hughes, Aker Solutions, Fluor Corporation, CarbonCure Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE CCS market appears promising, driven by increasing investments in technology and a strong commitment to sustainability. As the government continues to enforce stringent emission reduction targets, the demand for CCS solutions is expected to rise. Additionally, the integration of CCS with hydrogen production is likely to create new avenues for growth, enhancing the overall energy transition. Collaborative efforts with international firms will further bolster innovation and market expansion, positioning the UAE as a leader in carbon management.

| Segment | Sub-Segments |

|---|---|

| By Type | Post-Combustion Capture Pre-Combustion Capture Oxy-Fuel Combustion Direct Air Capture Others |

| By End-User | Oil and Gas Power Generation Cement Production Chemical Manufacturing Others |

| By Application | Enhanced Oil Recovery Industrial Processes Geological Storage Carbon Utilization Others |

| By Investment Source | Government Funding Private Investments International Grants Public-Private Partnerships |

| By Policy Support | Tax Incentives Subsidies for CCS Projects Regulatory Frameworks Research Grants |

| By Technology | Chemical Absorption Physical Absorption Membrane Separation Others |

| By Market Maturity | Emerging Technologies Established Technologies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil and Gas Sector CCS Initiatives | 100 | Energy Executives, Environmental Managers |

| Power Generation CCS Projects | 80 | Plant Managers, Sustainability Officers |

| Industrial Process Emissions Reduction | 70 | Operations Directors, Compliance Officers |

| Research and Development in CCS Technologies | 60 | R&D Managers, Technology Innovators |

| Government Policy and Regulation on CCS | 50 | Policy Makers, Regulatory Affairs Specialists |

The UAE Carbon Capture & Storage (CCS) market is valued at approximately USD 1.5 billion, driven by the country's commitment to reducing carbon emissions and transitioning to sustainable energy solutions.