Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4042

Pages:96

Published On:December 2025

Market.png)

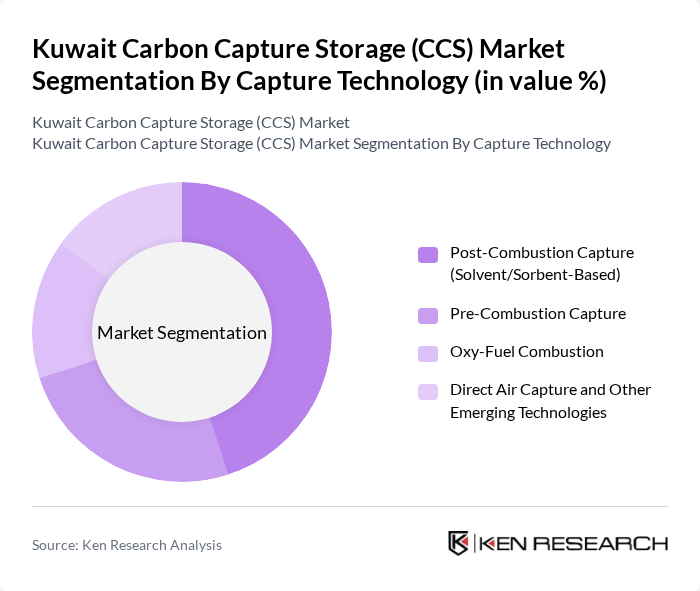

By Capture Technology:The capture technology segment includes various methods employed to capture carbon dioxide emissions from different sources. The primary subsegments are Post-Combustion Capture (Solvent/Sorbent-Based), Pre-Combustion Capture, Oxy-Fuel Combustion, and Direct Air Capture and Other Emerging Technologies. Among these, Post-Combustion Capture is currently leading the market due to its widespread applicability in existing power plants and industrial facilities, making it a preferred choice for many operators looking to reduce emissions effectively.

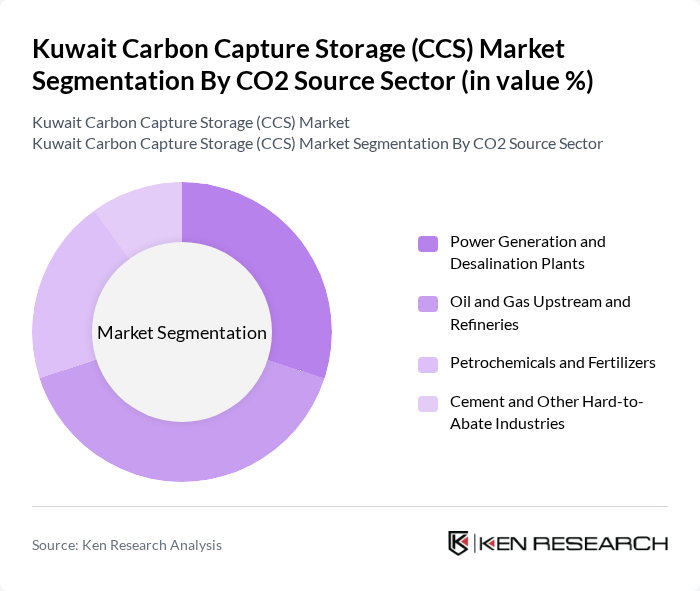

By CO2 Source Sector:This segment categorizes the sources of carbon dioxide emissions that are targeted for capture. The key subsegments include Power Generation and Desalination Plants, Oil and Gas Upstream and Refineries, Petrochemicals and Fertilizers, and Cement and Other Hard-to-Abate Industries. The Oil and Gas Upstream and Refineries subsegment is currently the most significant contributor to the market, driven by the high levels of CO2 emissions associated with these sectors and the urgent need for effective mitigation strategies.

The Kuwait Carbon Capture Storage (CCS) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Oil Company (KOC), Kuwait Integrated Petroleum Industries Company (KIPIC), Kuwait National Petroleum Company (KNPC), Kuwait Petroleum Corporation (KPC), Equinor ASA, Shell plc, TotalEnergies SE, BP plc, Mitsubishi Heavy Industries, Ltd., Aker Solutions ASA, Carbon Clean Solutions Limited, Linde plc, Siemens Energy AG, Baker Hughes Company, Schlumberger Limited (SLB) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait CCS market appears promising, driven by increasing environmental regulations and a strong governmental push towards sustainability. As the country aims to diversify its economy, the integration of CCS with renewable energy projects will likely enhance its viability. Furthermore, the collaboration between local and international firms is expected to accelerate technological advancements, making CCS more accessible and cost-effective. In future, these trends will create a conducive environment for CCS growth, positioning Kuwait as a regional leader in carbon management solutions.

| Segment | Sub-Segments |

|---|---|

| By Capture Technology | Post-Combustion Capture (Solvent/Sorbent-Based) Pre-Combustion Capture Oxy-Fuel Combustion Direct Air Capture and Other Emerging Technologies |

| By CO2 Source Sector | Power Generation and Desalination Plants Oil and Gas Upstream and Refineries Petrochemicals and Fertilizers Cement and Other Hard-to-Abate Industries |

| By CO2 Utilization and Storage | Enhanced Oil Recovery (EOR) in Mature Fields Long-Term Geological Storage (Saline Aquifers and Depleted Reservoirs) Carbon Utilization in Chemicals, Fuels, and Materials Other Pilot and R&D Demonstration Projects |

| By Project Stage | Feasibility and Concept Studies Pilot and Demonstration Projects Commercial-Scale Operational Projects Announced and Planned Projects |

| By Ownership and Financing Model | National Oil Company-Led Projects Joint Ventures and Public-Private Partnerships International Developer and Technology Provider-Led Projects Multilateral, Climate Fund, and Other Institutional Financing |

| By Policy and Regulatory Mechanism | Emissions Performance Standards and Carbon Intensity Targets Carbon Pricing, Taxes, and Offsets Investment Incentives, Grants, and Green Financing Voluntary Corporate Net-Zero and ESG Commitments |

| By Project Location in Kuwait | Northern Oil Fields and Gathering Centers Southern and West Kuwait Fields Refining and Petrochemical Complexes Power and Water Desalination Hubs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil and Gas Sector CCS Initiatives | 100 | Environmental Managers, Project Leads |

| Power Generation Companies | 80 | Operations Directors, Sustainability Officers |

| Industrial Process Emissions | 70 | Plant Managers, Compliance Officers |

| Government Regulatory Bodies | 50 | Policy Makers, Environmental Analysts |

| Research Institutions and Academia | 60 | Researchers, Professors in Environmental Science |

The Kuwait Carbon Capture Storage (CCS) Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the need to reduce greenhouse gas emissions and diversify energy sources in the region.