Region:Middle East

Author(s):Shubham

Product Code:KRAD6744

Pages:98

Published On:December 2025

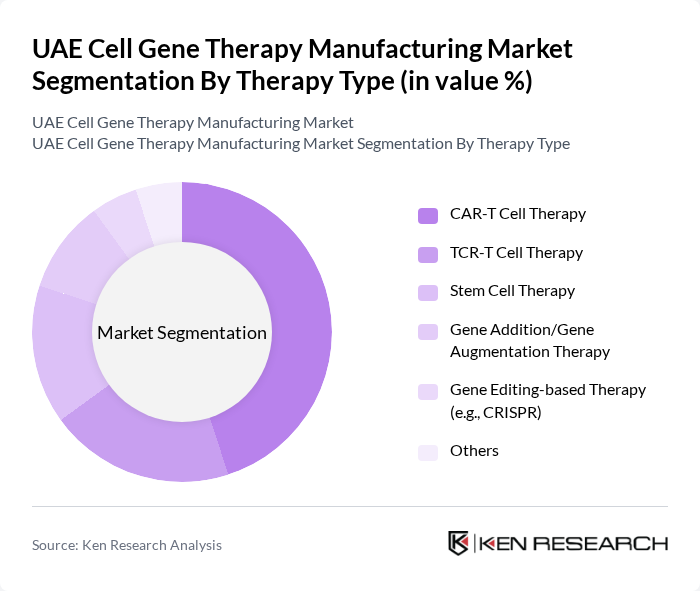

By Therapy Type:The market is segmented into various therapy types, including CAR-T Cell Therapy, TCR-T Cell Therapy, Stem Cell Therapy, Gene Addition/Gene Augmentation Therapy, Gene Editing-based Therapy (e.g., CRISPR), and Others. By therapy class, cell therapies (including stem cell and CAR-T modalities) currently account for the largest share of manufacturing activity in the UAE, with cell therapy identified as the largest segment in country-level manufacturing revenues. Within advanced oncology-focused approaches, CAR-T Cell Therapy is emerging as a leading clinical subsegment in the wider Middle East, driven by its effectiveness in treating certain types of cancers, particularly hematological malignancies. The increasing number of global approvals for CAR-T therapies, their successful clinical outcomes, and early patient access and referral programs with multinational biopharma have supported growing interest and adoption in the UAE, while stem cell and other regenerative therapies remain central to locally developed programs.

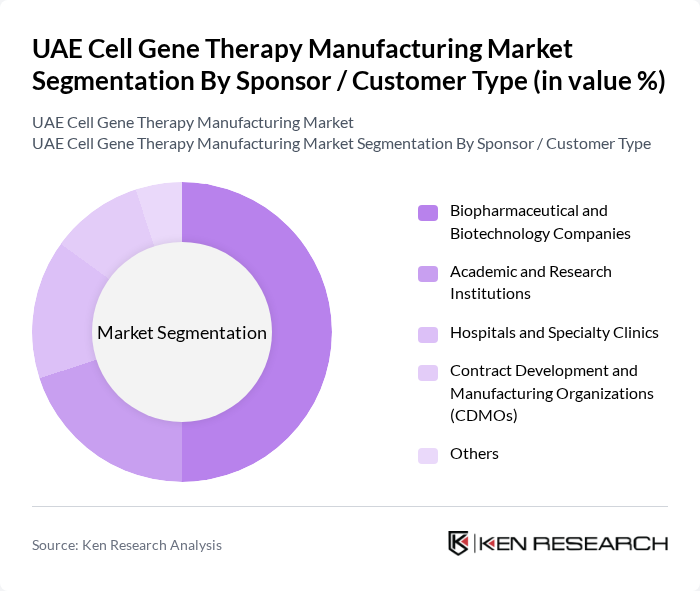

By Sponsor / Customer Type:The market is also segmented by sponsor or customer type, which includes Biopharmaceutical and Biotechnology Companies, Academic and Research Institutions, Hospitals and Specialty Clinics, Contract Development and Manufacturing Organizations (CDMOs), and Others. Biopharmaceutical and Biotechnology Companies dominate this segment due to their extensive resources and expertise in developing innovative therapies and their leading role in contracting specialized manufacturing services in cell and gene therapy globally and within the wider Middle East. Their strong focus on research and development, coupled with strategic collaborations with hospitals, research institutions, and technology providers, has positioned them as key drivers of pipeline expansion, technology transfer, and commercialization in the UAE cell and gene therapy landscape.

The UAE Cell Gene Therapy Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Stem Cells Center (ADSSC), Dubai Stem Cell Center, Sheikh Shakhbout Medical City (SSMC), Cleveland Clinic Abu Dhabi, Burjeel Medical City (Burjeel Holdings), Dubai Health (Dubai Academic Health Corporation), Mubadala Health / M42, G42 Healthcare (now M42), Dubai Healthcare City Authority, UAE University – Stem Cells and Regenerative Medicine Center, Novartis Pharma Services AG – UAE (Cell & Gene Therapy Division), Gilead Sciences / Kite Pharma – Middle East & UAE, NewBridge Pharmaceuticals FZ-LLC, Acrotech Biopharma / ACROBiosystems – GCC Presence, Pluristem Therapeutics Inc. – Abu Dhabi Collaboration contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE cell gene therapy manufacturing market appears promising, driven by ongoing advancements in biotechnology and increasing healthcare investments. As the prevalence of genetic disorders continues to rise, the demand for innovative therapies will likely grow. Additionally, collaborations between research institutions and healthcare providers will foster the development of novel therapies, enhancing patient access and treatment options. The integration of artificial intelligence in manufacturing processes will further streamline operations, improving efficiency and reducing costs.

| Segment | Sub-Segments |

|---|---|

| By Therapy Type | CAR-T Cell Therapy TCR-T Cell Therapy Stem Cell Therapy Gene Addition/Gene Augmentation Therapy Gene Editing-based Therapy (e.g., CRISPR) Others |

| By Sponsor / Customer Type | Biopharmaceutical and Biotechnology Companies Academic and Research Institutions Hospitals and Specialty Clinics Contract Development and Manufacturing Organizations (CDMOs) Others |

| By Therapeutic Area | Oncology Genetic and Rare Disorders Cardiovascular and Metabolic Diseases Neurological and Neuromuscular Diseases Autoimmune and Inflammatory Diseases Others |

| By Modality | Cell Therapy Manufacturing Gene Therapy Manufacturing Cell-based Gene Therapy Manufacturing Others |

| By Manufacturing Stage | Preclinical and Early-stage Clinical (Phase I/II) Late-stage Clinical (Phase III) Commercial-scale Manufacturing Others |

| By Technology / Platform | Viral Vector-based Manufacturing (AAV, Lentiviral, Others) Non-viral Vector and Plasmid-based Manufacturing Automated and Closed-system Cell Processing Others |

| By Emirate / Location | Abu Dhabi Dubai Sharjah Northern Emirates (Ajman, Ras Al Khaimah, Fujairah, Umm Al Quwain) Others |

| By Funding / Investment Source | Government and Sovereign Funds Private Equity and Venture Capital Corporate Strategic Investments International Collaborations and Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cell Gene Therapy Manufacturers | 60 | Production Managers, Quality Assurance Officers |

| Healthcare Providers Offering Gene Therapy | 50 | Oncologists, Genetic Counselors |

| Regulatory Bodies and Health Authorities | 40 | Regulatory Affairs Specialists, Policy Makers |

| Research Institutions and Universities | 50 | Research Scientists, Academic Professors |

| Investors and Venture Capitalists in Biotech | 40 | Investment Analysts, Portfolio Managers |

The UAE Cell Gene Therapy Manufacturing Market is valued at approximately USD 30 million, reflecting a five-year historical analysis of revenues and gene therapy activities within the country.