Region:Middle East

Author(s):Rebecca

Product Code:KRAD7485

Pages:90

Published On:December 2025

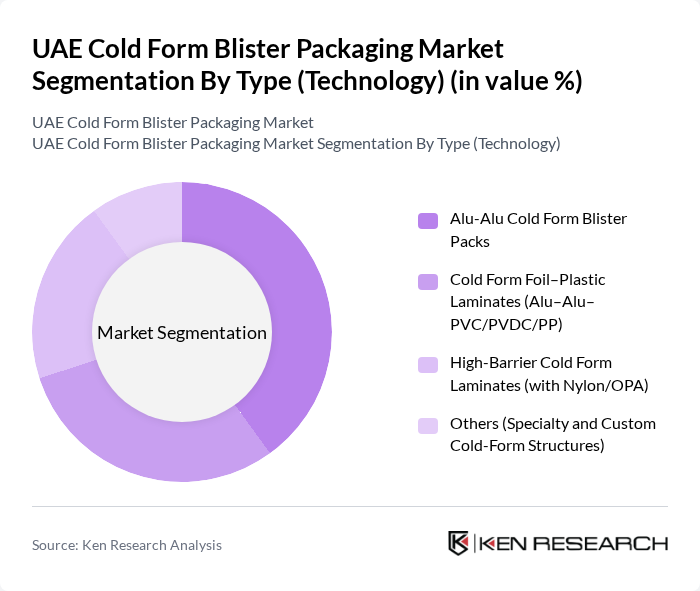

By Type (Technology):This segmentation includes various technologies used in cold form blister packaging, which are crucial for ensuring product safety and integrity. The subsegments are:

The Alu-Alu Cold Form Blister Packs segment is currently dominating the market due to its superior barrier properties, which provide excellent protection against moisture, oxygen, and light, essential for preserving the integrity of sensitive pharmaceutical products and high?value formulations. This technology is widely preferred for packaging solid oral dosage forms, such as tablets and capsules, as it enhances shelf life, supports stability in hot and humid climates, and ensures product safety throughout the supply chain. The increasing demand for high-quality, tamper?evident, and compliance?friendly packaging solutions in the pharmaceutical industry, along with growing use in specialty and chronic therapies, is driving the growth of this segment, making it a leader in the cold form blister packaging market.

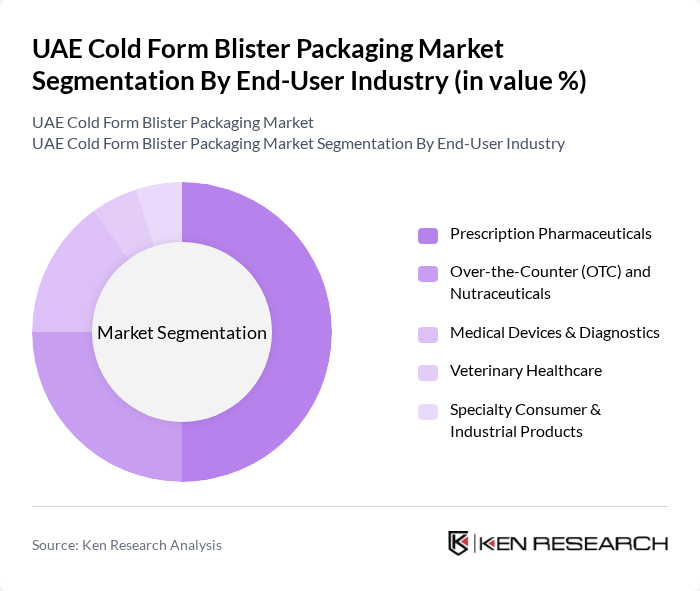

By End-User Industry:This segmentation focuses on the various industries utilizing cold form blister packaging, reflecting the diverse applications of this technology. The subsegments are:

The Prescription Pharmaceuticals segment is the largest end-user of cold form blister packaging, driven by the increasing demand for prescription medications in chronic disease management, oncology, cardiovascular, and central nervous system therapies, and the need for secure and reliable unit?dose packaging solutions. This segment benefits from the growing focus on patient safety and adherence, as well as the rising use of child?resistant and tamper?evident formats and traceability features such as serialized codes on blister packs. The stringent regulatory requirements for pharmaceutical packaging in the UAE and export markets, including stability, barrier performance, and labeling standards, further enhance the demand for cold form blister packs, solidifying its position as the leading segment in the market.

The UAE Cold Form Blister Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Constantia Flexibles, Bilcare Limited, ACG Group, UFlex Limited, TekniPlex, Inc., Honeywell International Inc. (Aclar Films), Huhtamaki Group, Mondi Group, Caprihans India Limited, Svam Packaging Industries, Inpac International LLC (UAE), Positive Packaging LLC (UAE), Arabian Packaging Co. LLC (UAE), Printpac Dubai LLC (UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE cold form blister packaging market appears promising, driven by ongoing innovations and a shift towards sustainable practices. As the healthcare sector continues to expand, the demand for efficient and safe packaging solutions will likely increase. Companies are expected to invest in eco-friendly materials and smart technologies, enhancing product safety and consumer engagement. This evolution will not only address current market challenges but also position the industry for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type (Technology) | Alu-Alu Cold Form Blister Packs Cold Form Foil–Plastic Laminates (Alu–Alu–PVC/PVDC/PP) High-Barrier Cold Form Laminates (with Nylon/OPA) Others (Specialty and Custom Cold-Form Structures) |

| By End-User Industry | Prescription Pharmaceuticals Over-the-Counter (OTC) and Nutraceuticals Medical Devices & Diagnostics Veterinary Healthcare Specialty Consumer & Industrial Products |

| By Material Structure | Aluminum-Based Cold Form Foil Oriented Polyamide (OPA/NY) Laminates PVC/PVDC-Based Laminates Polypropylene (PP) and Other Polymer Laminates |

| By Application | Solid Oral Dosage (Tablets & Capsules) Injectable & High-Sensitivity Drug Packaging Clinical Trial & Unit-Dose Packaging Others (Samples, Specialized Therapies) |

| By Customer Type | Originator & Multinational Pharma Companies Generic Drug Manufacturers Contract Packaging Organizations (CPOs)/CMOs Hospitals, Clinics & Government Procurement Others |

| By Region | Abu Dhabi Dubai Sharjah Northern Emirates (Ajman, Umm Al Quwain, Ras Al Khaimah) Fujairah |

| By Regulatory & Quality Compliance | cGMP & UAE Ministry of Health and Prevention (MOHAP) Requirements Gulf Health Council / GCC-DR Regulatory Alignment WHO Prequalification & International GMP (EU-GMP, US-FDA) Pharmacopoeia & Serialization / Track-and-Trace Compliance |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 120 | Production Managers, Quality Assurance Heads |

| Packaging Material Suppliers | 90 | Sales Directors, Product Development Managers |

| Regulatory Bodies | 40 | Compliance Officers, Regulatory Affairs Specialists |

| Healthcare Providers | 80 | Pharmacists, Hospital Procurement Managers |

| Research Institutions | 60 | Research Scientists, Industry Analysts |

The UAE Cold Form Blister Packaging Market is valued at approximately USD 40 million, driven by the increasing demand for pharmaceutical products and advancements in packaging technology that enhance product safety and shelf life.