Region:Middle East

Author(s):Dev

Product Code:KRAD4490

Pages:91

Published On:December 2025

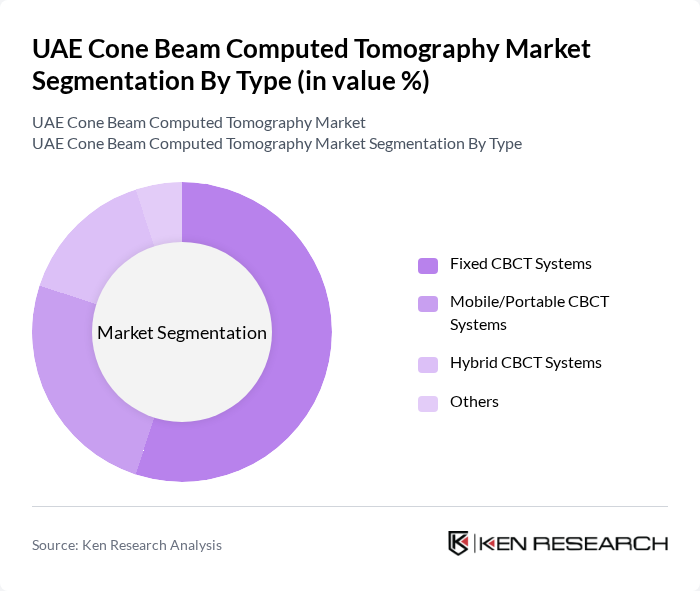

By Type:The market is segmented into Fixed CBCT Systems, Mobile/Portable CBCT Systems, Hybrid CBCT Systems, and Others. Fixed CBCT Systems dominate the market due to their high image quality, larger field-of-view options, and reliability, making them the preferred choice for hospitals, maxillofacial units, and high-volume dental clinics. Mobile/Portable CBCT Systems are gaining traction for their flexibility in outpatient, ambulatory, and multi-site dental group practices, while Hybrid Systems offer versatility for both dental and medical applications, including ENT and orthopedic imaging, where combined 2D/3D capability and adjustable FOV are required.

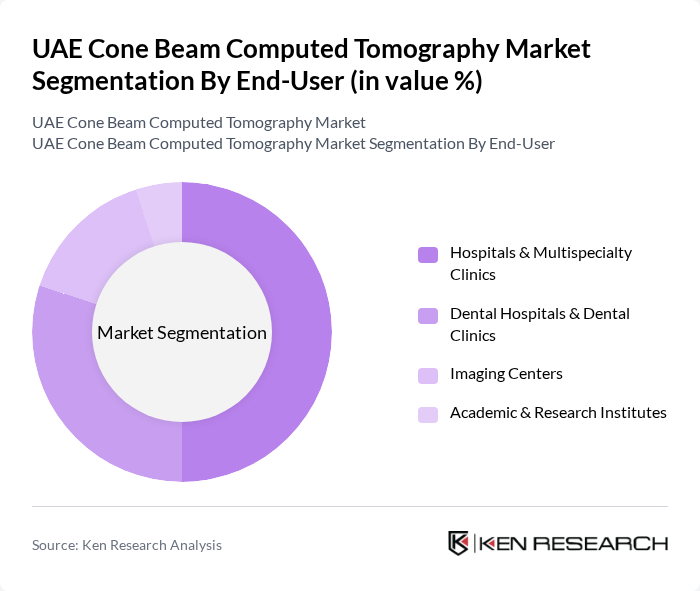

By End-User:The end-user segmentation includes Hospitals & Multispecialty Clinics, Dental Hospitals & Dental Clinics, Imaging Centers, and Academic & Research Institutes. Hospitals and multispecialty clinics are the leading end-users due to their comprehensive diagnostic services, emergency and trauma care needs, and ability to invest in high-end CBCT platforms integrated with broader radiology workflows. Dental hospitals and dental clinics are also significant users, driven by the increasing demand for implantology, orthodontic planning, and oral and maxillofacial imaging, as well as the shift toward chairside digital workflows. Imaging centers and academic institutions contribute to the market by adopting advanced imaging technologies for cross-referral diagnostics, clinical research, and training in dental and ENT specialties.

The UAE Cone Beam Computed Tomography Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carestream Dental LLC, Planmeca Oy, Dentsply Sirona Inc., Vatech Co., Ltd., MORITA Corporation (J. Morita), NewTom (Cefla S.C.), Kavo Dental GmbH, 3Shape A/S, FONA Dental, Asahi Roentgen Ind. Co., Ltd., Xoran Technologies LLC, CurveBeam AI Ltd., Carestream Health, Inc., Siemens Healthineers AG, GE HealthCare Technologies Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE Cone Beam Computed Tomography market appears promising, driven by ongoing advancements in technology and increasing healthcare investments. As the government allocates substantial funding towards healthcare infrastructure in future, the expansion of dental clinics and hospitals is anticipated. Additionally, the integration of telemedicine is expected to enhance access to dental imaging services, further propelling market growth. The focus on preventive healthcare will also encourage the adoption of advanced diagnostic tools, including CBCT systems.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed CBCT Systems Mobile/Portable CBCT Systems Hybrid CBCT Systems Others |

| By End-User | Hospitals & Multispecialty Clinics Dental Hospitals & Dental Clinics Imaging Centers Academic & Research Institutes |

| By Application | Dentistry Orthodontics Implantology Oral & Maxillofacial Surgery ENT Applications Orthopedic Conditions Others |

| By Technology / Detector Type | Flat-Panel Detector (FPD) CBCT Systems Image Intensifier Detector CBCT Systems D CBCT Systems Others |

| By Field of View (FOV) | Small FOV Systems Medium FOV Systems Large FOV Systems Others |

| By Region | Abu Dhabi Dubai Sharjah & Northern Emirates Others |

| By Distribution Channel | Direct Sales (OEM to End-User) Local Distributors / Importers Online / E-Procurement Platforms Others |

| By Pricing / Acquisition Model | Outright Capital Purchase Lease / Rental Model Pay-Per-Use / Volume-Based Contracts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 40 | Radiologists, Imaging Technologists |

| Dental Clinics Utilizing CBCT | 50 | Dentists, Clinic Managers |

| Medical Device Distributors | 40 | Sales Managers, Product Specialists |

| Healthcare Policy Makers | 30 | Health Administrators, Policy Analysts |

| Research Institutions | 25 | Research Scientists, Lab Managers |

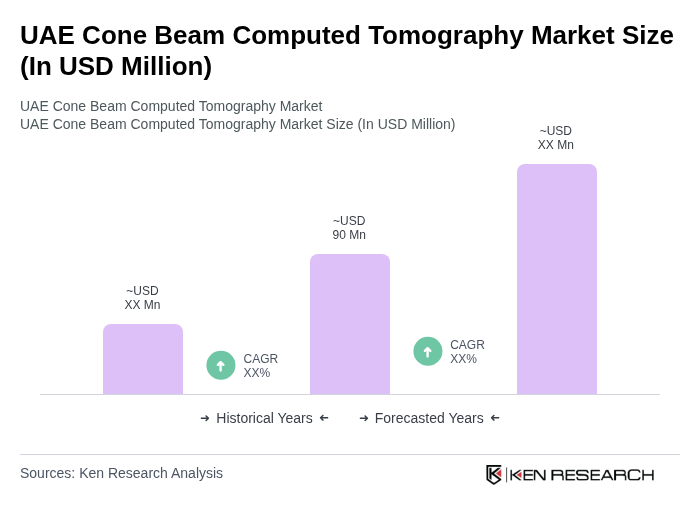

The UAE Cone Beam Computed Tomography (CBCT) market is valued at approximately USD 90 million, driven by advancements in imaging technology and increasing demand for dental and orthopedic imaging.