Region:Global

Author(s):Rebecca

Product Code:KRAE2747

Pages:93

Published On:February 2026

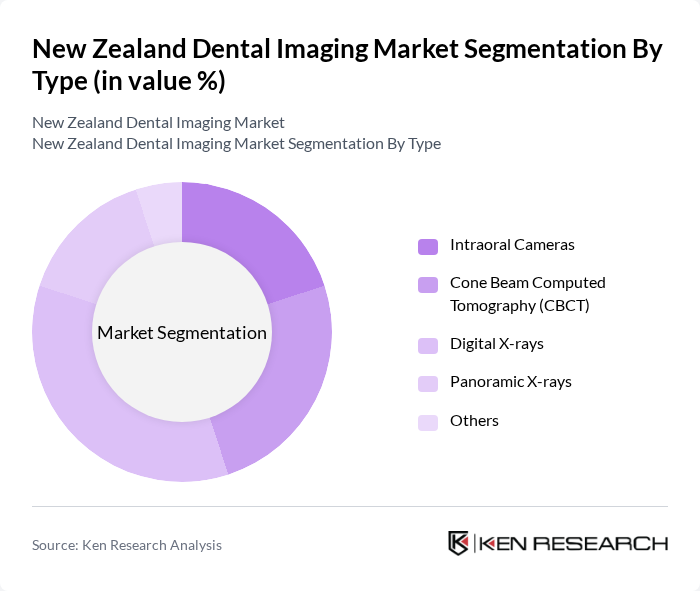

By Type:The market is segmented into various types of dental imaging technologies, including Intraoral Cameras, Cone Beam Computed Tomography (CBCT), Digital X-rays, Panoramic X-rays, and Others. Among these, Digital X-rays are currently the leading subsegment due to their efficiency, lower radiation exposure, and superior image quality. The increasing preference for non-invasive diagnostic methods has further propelled the adoption of Digital X-rays in dental practices.

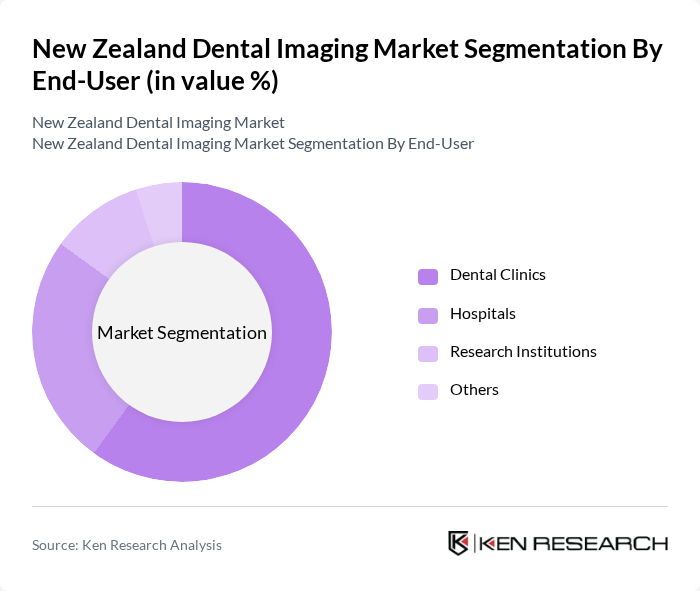

By End-User:The end-user segmentation includes Dental Clinics, Hospitals, Research Institutions, and Others. Dental Clinics dominate this segment as they are the primary providers of dental care and imaging services. The increasing number of dental practices and the growing trend of preventive dental care have led to a higher demand for imaging solutions in these settings.

The New Zealand Dental Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sirona Dental Systems, Carestream Dental, Planmeca, Dentsply Sirona, 3M Oral Care, Vatech, Gendex, KaVo Kerr, XDR Radiology, MyRay, Dental Wings, i-CAT, Carestream Health, Midmark Corporation, Owandy Radiology contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand dental imaging market appears promising, driven by ongoing technological advancements and a growing emphasis on preventive care. As the population ages, the demand for dental services is expected to rise, leading to increased adoption of advanced imaging technologies. Furthermore, the integration of tele-dentistry is likely to enhance access to dental care, particularly in rural areas, while AI-driven solutions will improve diagnostic accuracy and efficiency, shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Intraoral Cameras Cone Beam Computed Tomography (CBCT) Digital X-rays Panoramic X-rays Others |

| By End-User | Dental Clinics Hospitals Research Institutions Others |

| By Application | Diagnostic Imaging Treatment Planning Patient Monitoring Others |

| By Technology | D Imaging D Imaging Digital Imaging Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Region | North Island South Island Others |

| By Customer Type | Individual Patients Corporate Clients Insurance Providers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Dental Practices | 150 | Dentists, Practice Managers |

| Specialized Dental Clinics | 100 | Oral Surgeons, Orthodontists |

| Dental Imaging Equipment Suppliers | 80 | Sales Managers, Product Specialists |

| Dental Radiology Departments | 70 | Radiologists, Imaging Technicians |

| Dental Insurance Providers | 60 | Claims Managers, Underwriters |

The New Zealand Dental Imaging Market is valued at approximately USD 155 million, reflecting significant growth driven by advancements in dental technology and increasing demand for diagnostic imaging solutions among dental professionals.