UAE Cone Beam Computed Tomography (CBCT) Market Overview

- The UAE Cone Beam Computed Tomography (CBCT) market is valued at USD 80 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for advanced imaging technologies in dental and medical applications, coupled with a rise in healthcare expenditure and a growing population seeking diagnostic services. The expansion of medical tourism and government incentives supporting advanced imaging infrastructure are further accelerating market growth .

- Dubai and Abu Dhabi dominate the UAE CBCT market due to their advanced healthcare infrastructure, high concentration of dental and medical facilities, and a significant influx of medical tourists. These cities are also home to numerous specialized imaging centers that leverage cutting-edge technology to provide high-quality diagnostic services. The region accounts for the majority of CBCT installations in the UAE, with over 720 systems operational in dental care hubs across Dubai and Abu Dhabi .

- In 2023, the UAE government implemented the Federal Law No. 4 of 2023 on Healthcare Regulation, which mandates the use of advanced imaging technologies in healthcare facilities to enhance diagnostic accuracy and patient safety. This regulation aims to standardize imaging practices across the country, ensuring that healthcare providers utilize the latest technologies, including CBCT, to improve patient outcomes and align with international safety standards .

Market.png)

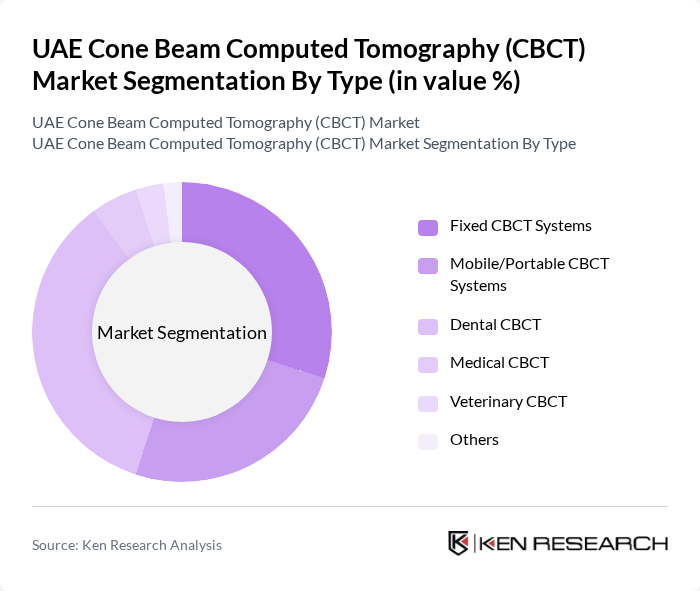

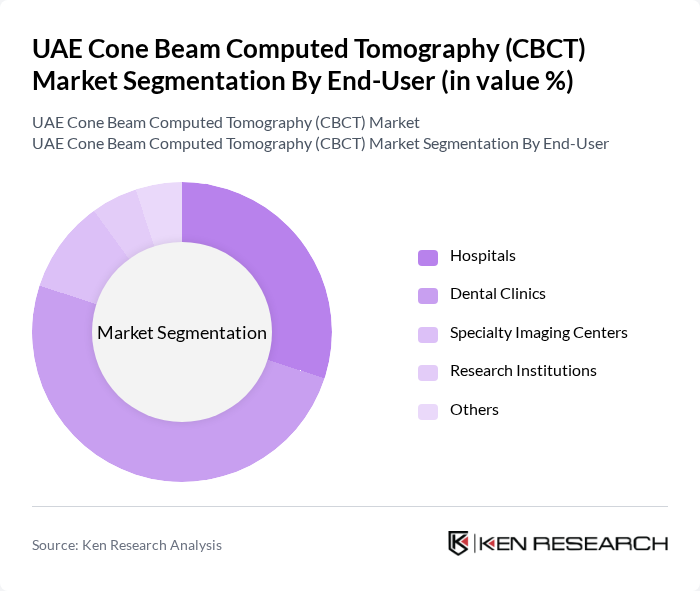

UAE Cone Beam Computed Tomography (CBCT) Market Segmentation

By Type:The market is segmented into various types, including Fixed CBCT Systems, Mobile/Portable CBCT Systems, Dental CBCT, Medical CBCT, Veterinary CBCT, and Others. Among these, Dental CBCT is the leading sub-segment, driven by the increasing prevalence of dental disorders and the growing demand for precise imaging in orthodontics and implantology. The convenience and efficiency of Mobile/Portable CBCT Systems are also gaining traction, particularly in outpatient settings.

By End-User:The end-user segmentation includes Hospitals, Dental Clinics, Specialty Imaging Centers, Research Institutions, and Others. Dental Clinics are the dominant segment, as they increasingly adopt CBCT technology for enhanced diagnostic capabilities in dental procedures. Hospitals also represent a significant portion of the market, utilizing CBCT for various medical imaging applications, including orthopedics and ENT.

UAE Cone Beam Computed Tomography (CBCT) Market Competitive Landscape

The UAE Cone Beam Computed Tomography (CBCT) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carestream Health, Planmeca Oy, Dentsply Sirona, Vatech Co., Ltd., 3Shape A/S, Fujifilm Holdings Corporation, GE HealthCare, Siemens Healthineers AG, Canon Medical Systems Corporation, Hitachi Medical Systems (Hitachi, Ltd.), Xoran Technologies LLC, Imaging Sciences International (subsidiary of Dentsply Sirona), PreXion, Inc., J. Morita Corporation, NewTom (Cefla Group) contribute to innovation, geographic expansion, and service delivery in this space.

UAE Cone Beam Computed Tomography (CBCT) Market Industry Analysis

Growth Drivers

- Increasing Demand for Dental Imaging:The UAE's dental imaging market is projected to grow significantly, driven by a population of approximately 9.5 million people, with a notable increase in dental visits. In future, the number of dental procedures is expected to reach 5.2 million, reflecting a growing demand for advanced imaging technologies. This surge is attributed to rising awareness of oral health, leading to more patients seeking diagnostic imaging for accurate treatment planning.

- Technological Advancements in Imaging Systems:The UAE is witnessing rapid technological advancements in CBCT systems, with over 35% of dental clinics adopting 3D imaging solutions in future. Innovations such as improved image resolution and reduced radiation exposure are enhancing diagnostic capabilities. The integration of AI in imaging systems is expected to streamline workflows, making these advanced technologies more accessible to practitioners and patients alike, thereby driving market growth.

- Rising Prevalence of Dental Disorders:The prevalence of dental disorders in the UAE is increasing, with approximately 65% of the population experiencing dental issues in future. This rise is linked to lifestyle changes and dietary habits. As a result, there is a growing need for effective diagnostic tools like CBCT to facilitate early detection and treatment. The increasing burden of dental diseases is propelling the demand for advanced imaging solutions in the healthcare sector.

Market Challenges

- High Initial Investment Costs:The high initial investment required for CBCT systems poses a significant challenge for dental practices in the UAE. The average cost of a CBCT machine ranges from AED 220,000 to AED 520,000, which can deter smaller clinics from adopting this technology. This financial barrier limits the widespread implementation of advanced imaging solutions, hindering market growth despite the increasing demand for dental imaging.

- Limited Reimbursement Policies:The lack of comprehensive reimbursement policies for CBCT imaging in the UAE presents a challenge for dental practitioners. Currently, only 45% of dental procedures involving CBCT are covered by insurance, which affects patient access to these advanced diagnostic tools. This limitation can lead to reduced utilization of CBCT technology, impacting overall market growth and adoption rates among dental professionals.

UAE Cone Beam Computed Tomography (CBCT) Market Future Outlook

The future of the UAE CBCT market appears promising, driven by ongoing advancements in imaging technology and increasing awareness of dental health. As the healthcare sector continues to evolve, the integration of AI and cloud-based solutions is expected to enhance diagnostic accuracy and efficiency. Additionally, the expansion of dental clinics and the rise in medical tourism will further stimulate demand for CBCT systems, positioning the UAE as a regional hub for advanced dental imaging services.

Market Opportunities

- Expansion of Dental Clinics and Hospitals:The UAE is experiencing a rapid expansion of dental clinics, with over 250 new facilities projected to open in future. This growth presents a significant opportunity for CBCT manufacturers to penetrate the market, as new clinics will require advanced imaging technologies to meet patient demands and enhance service offerings.

- Increasing Adoption of CBCT in Orthodontics:The orthodontics sector in the UAE is expected to grow, with an estimated 20% increase in orthodontic treatments in future. This trend creates an opportunity for CBCT systems, as orthodontists increasingly rely on 3D imaging for treatment planning and monitoring, thereby driving demand for advanced imaging solutions in this specialty.

Market.png)