Region:Middle East

Author(s):Rebecca

Product Code:KRAD8248

Pages:92

Published On:December 2025

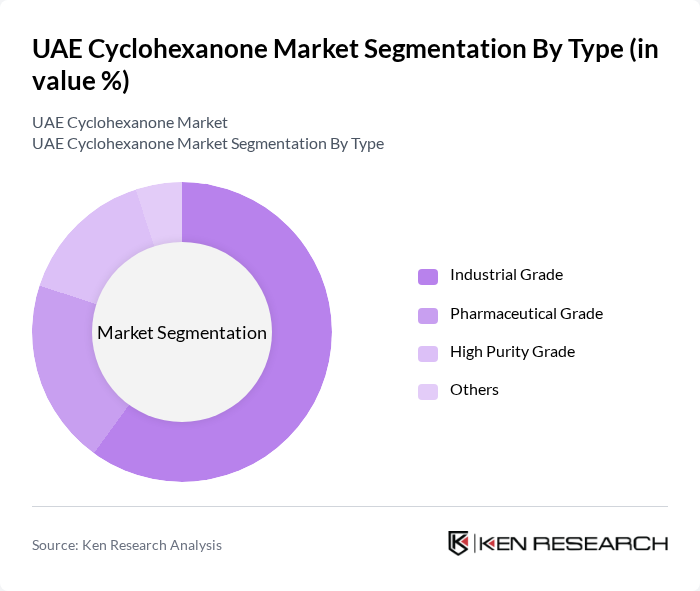

By Type:

The cyclohexanone market is segmented into four types: Industrial Grade, Pharmaceutical Grade, High Purity Grade, and Others. Among these, the Industrial Grade segment is the most dominant due to its extensive use in the production of nylon and other synthetic fibers. The demand for industrial-grade cyclohexanone is driven by the growth of the textile and automotive industries, which require high volumes of this chemical for manufacturing processes. The Pharmaceutical Grade segment, while smaller, is growing steadily as the pharmaceutical industry expands its use of cyclohexanone in drug formulation and synthesis.

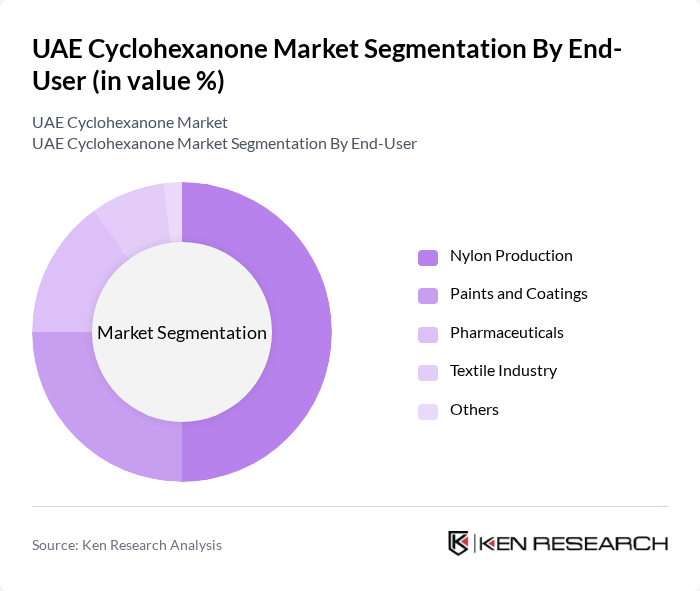

By End-User:

The end-user segmentation includes Nylon Production, Paints and Coatings, Pharmaceuticals, Textile Industry, and Others. The Nylon Production segment leads the market, driven by the increasing demand for nylon in various applications, including textiles and automotive components. The Paints and Coatings segment also holds a significant share, as cyclohexanone is widely used as a solvent in paint formulations. The Pharmaceuticals segment is growing, reflecting the rising use of cyclohexanone in drug manufacturing processes.

The UAE Cyclohexanone Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Solvay S.A., SABIC, ExxonMobil Chemical, Shell Chemicals, Mitsubishi Chemical Corporation, Covestro AG, INEOS Group, LyondellBasell Industries, Dow Chemical Company, Sinopec Limited, Reliance Industries Limited, Formosa Plastics Corporation, LG Chem, and PTT Global Chemical contribute to innovation, geographic expansion, and service delivery in this space.

The UAE cyclohexanone market is poised for significant growth, driven by increasing demand from key sectors such as automotive, pharmaceuticals, and paints. As manufacturers adapt to stringent environmental regulations, there will be a notable shift towards sustainable production methods. Additionally, technological advancements in production processes are expected to enhance efficiency and reduce costs. The focus on high-purity cyclohexanone will also shape market dynamics, ensuring that manufacturers meet evolving quality standards and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade Pharmaceutical Grade High Purity Grade Others |

| By End-User | Nylon Production Paints and Coatings Pharmaceuticals Textile Industry Others |

| By Application | Solvent Intermediate in Chemical Synthesis Adhesives Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | Abu Dhabi Dubai Sharjah Others |

| By Packaging Type | Drums IBCs Bulk Others |

| By Supply Chain Model | Manufacturer to Distributor Manufacturer to Retailer Manufacturer to End-User Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cyclohexanone in Paints and Coatings | 45 | Product Managers, Technical Directors |

| Cyclohexanone in Adhesives | 40 | Procurement Managers, R&D Specialists |

| Cyclohexanone in Pharmaceuticals | 35 | Quality Assurance Managers, Regulatory Affairs Officers |

| Cyclohexanone in Industrial Applications | 40 | Operations Managers, Supply Chain Analysts |

| Cyclohexanone Market Trends | 45 | Market Analysts, Industry Consultants |

The UAE Cyclohexanone market is valued at approximately USD 2 million, driven by increasing demand in the production of nylon and other chemical intermediates, as well as growth in the automotive and textile industries.