Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3710

Pages:88

Published On:November 2025

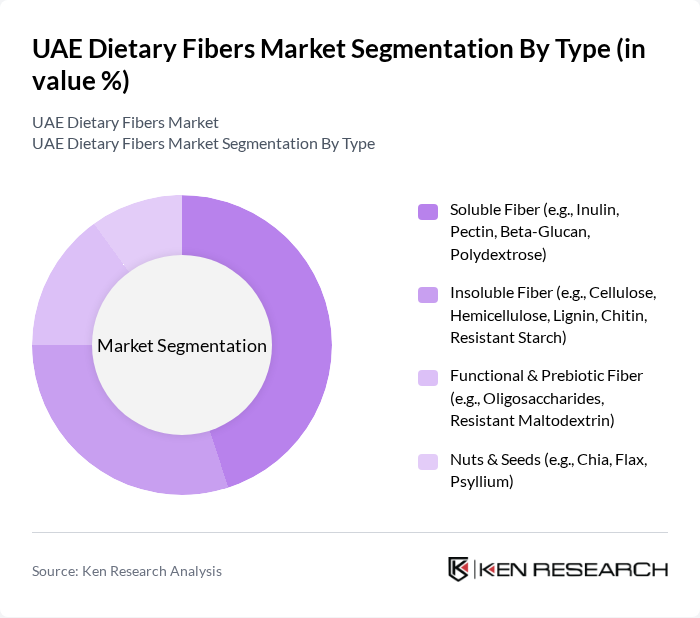

By Type:The dietary fibers market can be segmented into various types, including soluble fiber, insoluble fiber, functional & prebiotic fiber, and nuts & seeds. Among these, soluble fiber—such as inulin, pectin, and beta-glucan—is gaining traction due to its health benefits, including improved digestion, blood sugar control, and cholesterol reduction. The increasing consumer awareness regarding gut health and the role of soluble fibers in managing weight and cholesterol levels is driving its demand. Insoluble fibers, while also important for digestive health, are often overshadowed by the growing popularity of soluble fibers in health-focused products. The demand for clean label and natural sources of fiber is also influencing product innovation and market growth .

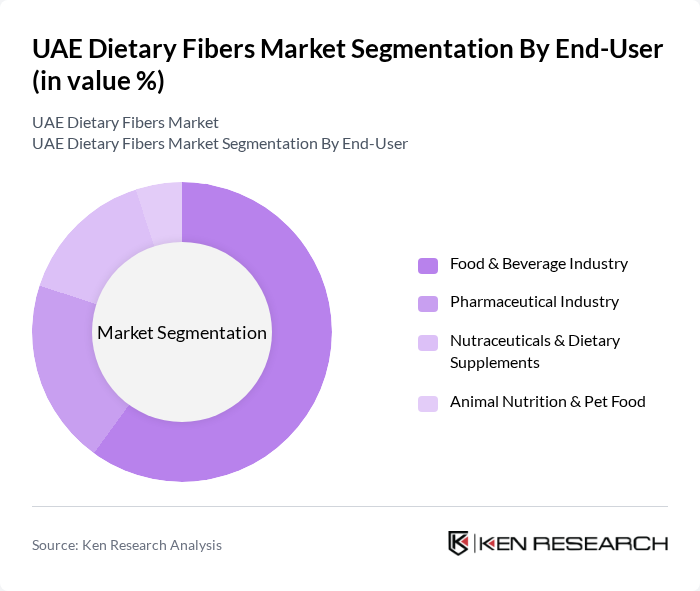

By End-User:The dietary fibers market is segmented by end-user into the food & beverage industry, pharmaceutical industry, nutraceuticals & dietary supplements, and animal nutrition & pet food. The food & beverage industry is the leading segment, driven by the increasing incorporation of dietary fibers in various food products, including snacks, cereals, bakery, and beverages. The growing trend of health-conscious eating among consumers is pushing manufacturers to innovate and include more fiber-rich options in their offerings. The pharmaceutical and nutraceutical sectors are also witnessing growth, as consumers seek dietary supplements that promote digestive health and overall well-being. Animal nutrition and pet food applications are expanding due to increased recognition of fiber's importance in animal health .

The UAE Dietary Fibers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill Middle East DMCC, Archer Daniels Midland Company (ADM), DuPont Nutrition & Biosciences (E.I. du Pont de Nemours), Südzucker AG (BENEO GmbH), Ingredion Incorporated, Roquette Frères, Tate & Lyle PLC, Kerry Group, Frutarom Industries Ltd. (IFF), Royal Cosun (Sensus), DSM Nutritional Products, Herbalife Nutrition Ltd., Naturex (Givaudan), Emsland Group, Sunfiber (Taiyo International) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE dietary fibers market appears promising, driven by increasing health awareness and government support for healthy eating. Innovations in product development, particularly in plant-based fibers, are expected to attract health-conscious consumers. Additionally, the rise of e-commerce platforms will facilitate greater access to dietary fiber products, enhancing market penetration. As sustainability becomes a priority, companies focusing on eco-friendly sourcing will likely gain a competitive edge, further shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Soluble Fiber (e.g., Inulin, Pectin, Beta-Glucan, Polydextrose) Insoluble Fiber (e.g., Cellulose, Hemicellulose, Lignin, Chitin, Resistant Starch) Functional & Prebiotic Fiber (e.g., Oligosaccharides, Resistant Maltodextrin) Nuts & Seeds (e.g., Chia, Flax, Psyllium) |

| By End-User | Food & Beverage Industry Pharmaceutical Industry Nutraceuticals & Dietary Supplements Animal Nutrition & Pet Food |

| By Source | Cereals & Grains (e.g., Wheat, Oats, Barley, Rice Bran) Fruits (e.g., Apples, Citrus, Bananas) Vegetables (e.g., Carrots, Potatoes, Legumes) Others (e.g., Chicory Root, Tubers) |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Health Food Stores B2B (Industrial/Institutional Sales) |

| By Application | Functional Foods & Beverages Dietary Supplements Animal Feed & Pet Food Pharmaceuticals & Medical Nutrition |

| By Region | Abu Dhabi Dubai Sharjah Northern Emirates & Others |

| By Consumer Demographics | Age Group Gender Income Level Lifestyle & Health Status |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Dietary Fiber Preferences | 100 | Health-conscious Consumers, Nutrition Enthusiasts |

| Food Manufacturer Insights | 60 | Product Development Managers, Quality Assurance Officers |

| Retail Sector Dietary Fiber Sales | 50 | Store Managers, Category Buyers |

| Healthcare Professional Perspectives | 40 | Dietitians, Nutritionists, Health Coaches |

| Market Trends and Innovations | 40 | Food Scientists, R&D Managers |

The UAE Dietary Fibers Market is valued at approximately USD 55 million, reflecting a significant growth trend driven by increasing health awareness, lifestyle-related diseases, and a rising demand for functional foods among consumers.