Region:Middle East

Author(s):Rebecca

Product Code:KRAC1086

Pages:92

Published On:October 2025

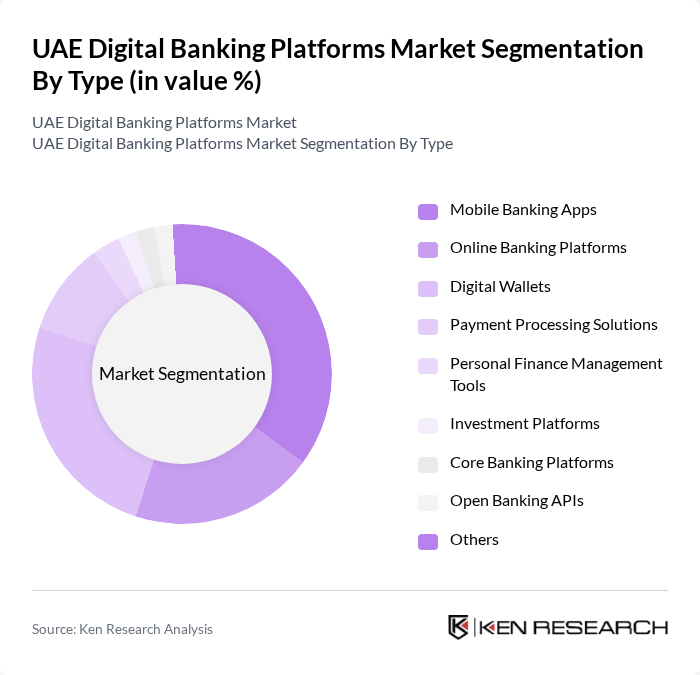

By Type:The market is segmented into various types, including Mobile Banking Apps, Online Banking Platforms, Digital Wallets, Payment Processing Solutions, Personal Finance Management Tools, Investment Platforms, Core Banking Platforms, Open Banking APIs, and Others. Among these,Mobile Banking AppsandDigital Walletsare particularly prominent due to their convenience and user-friendly interfaces, catering to the growing demand for on-the-go banking solutions. The UAE’s digital banking ecosystem is also witnessing rapid adoption of open banking APIs and payment processing solutions, driven by regulatory support and the shift towards a cashless economy .

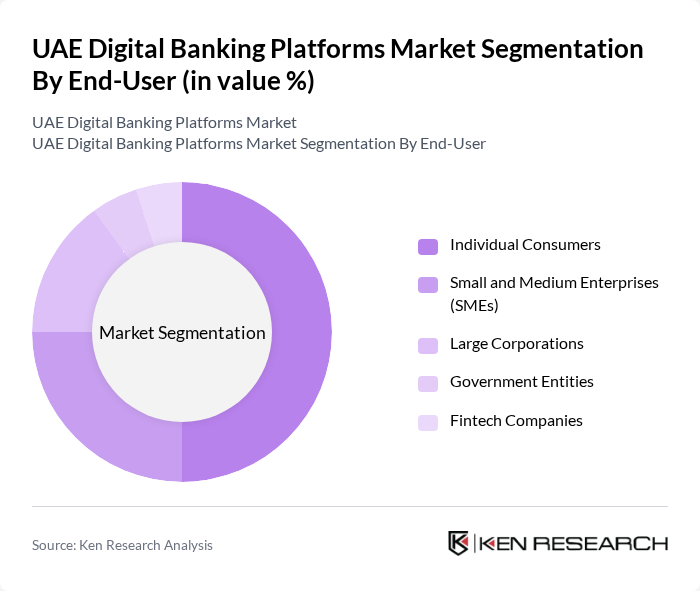

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Government Entities, and Fintech Companies.Individual Consumersdominate the market, driven by the increasing preference for digital banking solutions that offer convenience and accessibility. SMEs are also significant users, leveraging digital platforms for efficient financial management and transactions. The adoption of digital banking by government entities and fintech companies is supported by regulatory initiatives and the UAE’s ambition to become a regional digital economy leader .

The UAE Digital Banking Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD, Abu Dhabi Commercial Bank (ADCB), First Abu Dhabi Bank (FAB), Dubai Islamic Bank, Mashreq Bank, RAKBANK (National Bank of Ras Al Khaimah), Liv. (by Emirates NBD), Mashreq Neo, Al Hilal Digital (Al Hilal Bank), YAP, Zand Bank, Wio Bank, Emirates Islamic, Sharjah Islamic Bank, Bank of Sharjah, Commercial Bank of Dubai (CBD), Abu Dhabi Islamic Bank (ADIB), Tabby, Yalla Compare contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE digital banking platforms market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance customer service and operational efficiency. Additionally, the shift towards open banking will foster collaboration between traditional banks and fintechs, creating innovative financial solutions. As sustainability becomes a priority, banks are likely to adopt eco-friendly practices, aligning with global trends and consumer expectations for responsible banking.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Banking Apps Online Banking Platforms Digital Wallets Payment Processing Solutions Personal Finance Management Tools Investment Platforms Core Banking Platforms Open Banking APIs Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities Fintech Companies |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Retailers Affiliate Marketing Bank Branch Integration |

| By Customer Segment | Retail Customers Corporate Clients High Net-Worth Individuals (HNWIs) Millennials and Gen Z |

| By Service Type | Savings Accounts Loans and Credit Facilities Investment Services Insurance Products Buy Now Pay Later (BNPL) |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Payments Cryptocurrency Transactions QR Code Payments |

| By Geographic Reach | Local Market Regional Market International Market Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customers | 120 | Individual Account Holders, Retail Banking Managers |

| Small Business Digital Banking Users | 60 | Small Business Owners, Financial Advisors |

| Fintech Innovators | 40 | Product Managers, Technology Officers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Investment Banking Clients | 50 | Investment Managers, Wealth Advisors |

The UAE Digital Banking Platforms Market is valued at approximately USD 3.2 billion, reflecting significant growth driven by increased adoption of digital banking solutions and a preference for cashless transactions among consumers.