Region:Middle East

Author(s):Dev

Product Code:KRAC1256

Pages:100

Published On:October 2025

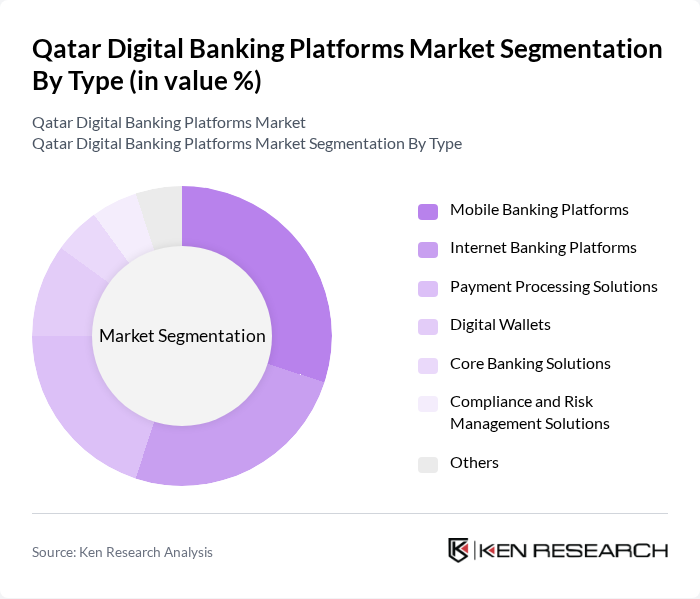

By Type:The market is segmented into various types, including Mobile Banking Platforms, Internet Banking Platforms, Payment Processing Solutions, Digital Wallets, Core Banking Solutions, Compliance and Risk Management Solutions, and Others. Each of these segments plays a crucial role in shaping the overall market landscape. The rapid adoption of mobile and internet banking is driven by high smartphone penetration and consumer demand for convenience, while payment processing and digital wallets benefit from the expansion of e-commerce and contactless transactions. Core banking and compliance solutions are increasingly integrated with advanced analytics and security features to meet regulatory requirements and enhance operational efficiency.

The Mobile Banking Platforms segment is currently leading the market due to the increasing preference for on-the-go banking solutions among consumers. The convenience of accessing banking services via smartphones has significantly influenced consumer behavior, leading to a surge in mobile app downloads and usage. Additionally, the integration of advanced features such as biometric authentication, instant payments, and personalized financial management tools has further enhanced user experience, driving the growth of this segment.

By End-User:The market is segmented by end-users, including Retail Banks, Credit Unions, Fintech Startups, Non-Banking Financial Companies (NBFCs), Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Each segment has unique needs and contributes to the overall market dynamics. Retail banks and fintech startups are the primary drivers of digital banking adoption, leveraging technology to deliver innovative services and reach a broader customer base. SMEs and large corporations are increasingly adopting digital platforms for efficient cash management and streamlined operations, while government entities use digital banking for public service delivery and financial inclusion initiatives.

Retail Banks dominate the market as they are the primary providers of digital banking services, catering to a vast customer base. The increasing demand for digital solutions among consumers has prompted these banks to invest heavily in technology and innovation. Additionally, the competitive landscape encourages retail banks to enhance their digital offerings, resulting in improved customer satisfaction and loyalty. Fintech startups are also rapidly gaining market share by introducing agile, customer-centric solutions that complement traditional banking services.

The Qatar Digital Banking Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar National Bank (QNB), Doha Bank, Commercial Bank of Qatar (CBQ), Masraf Al Rayan, Qatar Islamic Bank (QIB), Al Khalij Commercial Bank (al khaliji), Qatar Development Bank (QDB), Ahli Bank QPSC, Dukhan Bank, Arab Bank Qatar, Bank of Beirut and the Arab Countries (BBAC) Qatar, Abu Dhabi Commercial Bank (ADCB) Qatar, Emirates NBD Qatar, Standard Chartered Bank Qatar, HSBC Bank Middle East Limited (Qatar), QNB Finansbank, Fintech Galaxy, CWallet Services, SkipCash, and Qatar FinTech Hub contribute to innovation, geographic expansion, and service delivery in this space.

The future of Qatar's digital banking platforms is poised for significant evolution, driven by technological advancements and changing consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance customer service and operational efficiency. Additionally, the trend towards open banking will facilitate collaboration between traditional banks and fintech companies, fostering innovation. As digital literacy improves, more consumers will embrace these platforms, leading to increased transaction volumes and a more competitive landscape in the banking sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Banking Platforms Internet Banking Platforms Payment Processing Solutions Digital Wallets Core Banking Solutions Compliance and Risk Management Solutions Others |

| By End-User | Retail Banks Credit Unions Fintech Startups Non-Banking Financial Companies (NBFCs) Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Financial Institutions |

| By Service Model | Software as a Service (SaaS) Platform as a Service (PaaS) Infrastructure as a Service (IaaS) Public Cloud Private Cloud Hybrid Cloud |

| By Customer Segment | Individual Customers Small and Medium Enterprises (SMEs) Large Enterprises |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Payments QR Code Payments |

| By Regulatory Compliance | Sharia-compliant Solutions International Compliance Standards Local Regulatory Standards |

| By Application | Personal Banking Business Banking Investment Banking Wealth Management Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customers | 120 | Individual Account Holders, Retail Banking Managers |

| Small and Medium Enterprises (SMEs) | 100 | Business Owners, Financial Officers |

| Fintech Startups | 80 | Founders, Product Development Leads |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Investment Analysts | 70 | Financial Analysts, Market Researchers |

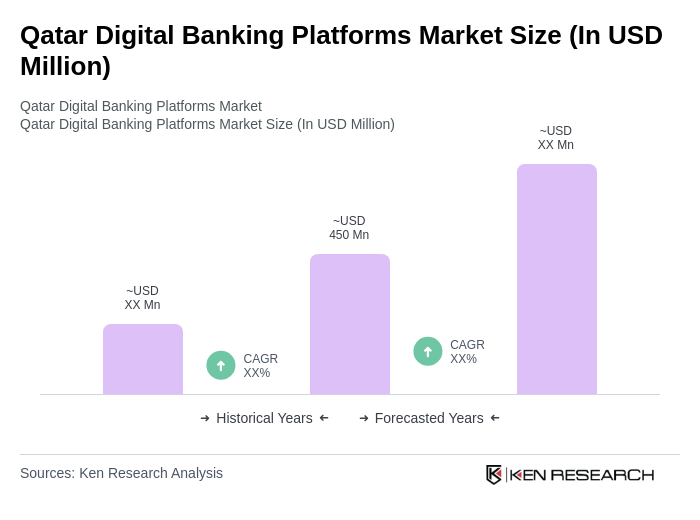

The Qatar Digital Banking Platforms Market is valued at approximately USD 450 million, reflecting significant growth driven by the increasing adoption of digital banking solutions and a strong preference for online financial services among consumers.