Region:Middle East

Author(s):Rebecca

Product Code:KRAC1105

Pages:96

Published On:October 2025

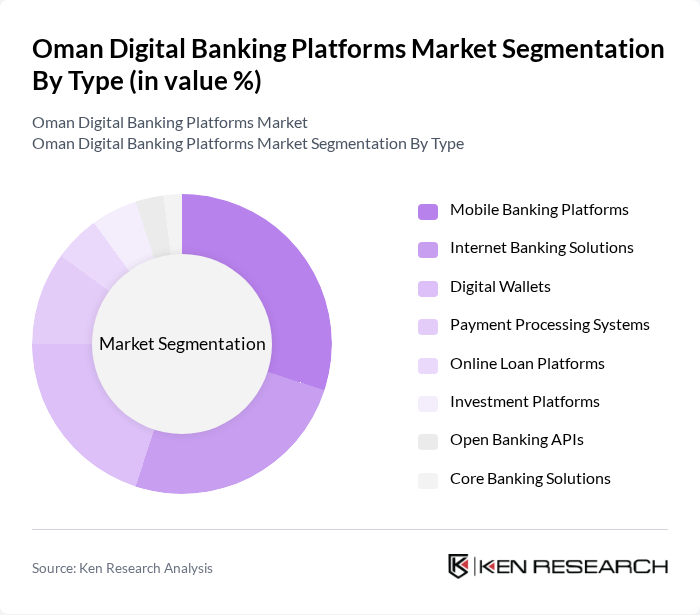

By Type:The market can be segmented into various types of digital banking platforms, including Mobile Banking Platforms, Internet Banking Solutions, Digital Wallets, Payment Processing Systems, Online Loan Platforms, Investment Platforms, Open Banking APIs, and Core Banking Solutions. Mobile Banking Platforms have emerged as the leading segment, driven by innovations such as NFC-enabled payment solutions, integration with Apple Pay and Samsung Pay, and enhanced mobile app security features including biometric authentication and SIM-based verification. Each of these sub-segments plays a crucial role in catering to the diverse needs of consumers and businesses.

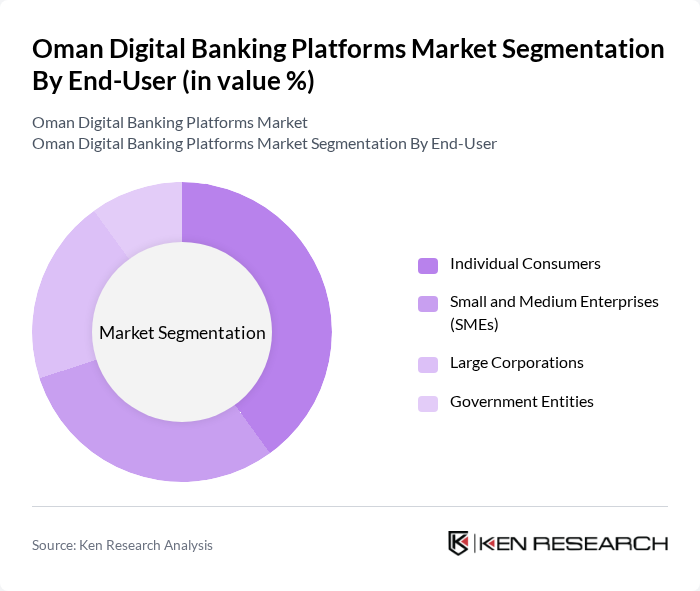

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Consumers represent the largest segment, benefiting from seamless digital onboarding experiences with remote KYC verification, doorstep card delivery, and real-time transaction notifications. SMEs have experienced significant growth through purpose-built digital banking platforms supporting self-registration, secure wage payments, bulk salary uploads, and business-specific card services. Each segment has unique requirements and preferences, influencing the types of digital banking solutions they adopt.

The Oman Digital Banking Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bank Muscat, Oman Arab Bank, National Bank of Oman, Sohar International Bank, Bank Dhofar, Alizz Islamic Bank, Oman Investment and Finance Co. SAOG, Muscat Finance, Oman United Insurance Company, Oman Housing Bank, Bank of Beirut and the Arab Countries (Oman Branch), Qatar National Bank (Oman Branch), HSBC Bank Oman, Standard Chartered Bank Oman, Abu Dhabi Commercial Bank (Oman Branch), Maliyat (Oman's first digital-only bank), Meethaq Islamic Banking (Bank Muscat's Islamic window), Bank Nizwa contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman digital banking platforms market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance personalized banking experiences, while the rise of neobanks will challenge traditional banking models. Additionally, the focus on sustainability in banking practices will likely shape the industry's direction, encouraging financial institutions to adopt eco-friendly initiatives and technologies that resonate with environmentally conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Banking Platforms Internet Banking Solutions Digital Wallets Payment Processing Systems Online Loan Platforms Investment Platforms Open Banking APIs Core Banking Solutions |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Application | Personal Banking Business Banking Investment Banking Wealth Management Islamic Banking |

| By Distribution Channel | Direct Sales Online Platforms Mobile Applications Third-Party Fintech Partnerships |

| By Customer Segment | Retail Customers Corporate Clients High Net Worth Individuals (HNWI) |

| By Payment Method | Credit/Debit Cards Bank Transfers E-wallets QR Code Payments |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Digital Transformation Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customers | 120 | Individual Account Holders, Retail Banking Managers |

| Corporate Banking Clients | 80 | Corporate Account Managers, CFOs of SMEs |

| Fintech Users | 60 | Tech-savvy Consumers, Fintech Product Managers |

| Regulatory Bodies | 40 | Policy Makers, Financial Regulators |

| Banking Technology Providers | 60 | IT Managers, Solutions Architects |

The Oman Digital Banking Platforms Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by increased adoption of digital banking solutions and enhanced internet penetration among consumers.