Region:Middle East

Author(s):Geetanshi

Product Code:KRAB4626

Pages:82

Published On:October 2025

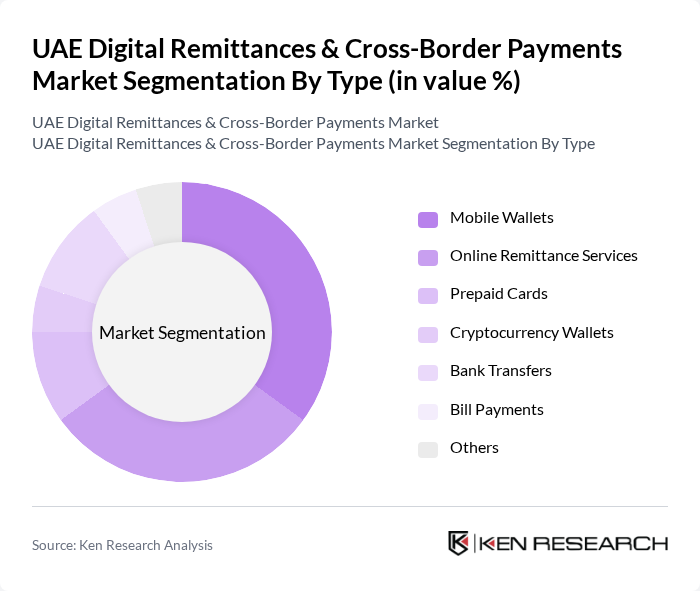

By Type:The segmentation by type includes various methods of digital remittances and cross-border payments. The subsegments are Mobile Wallets, Online Remittance Services, Prepaid Cards, Cryptocurrency Wallets, Bank Transfers, Bill Payments, and Others. Among these, Mobile Wallets and Online Remittance Services are particularly popular due to their convenience and user-friendly interfaces, catering to the tech-savvy population in the UAE. The increasing use of smartphones and the proliferation of fintech solutions have accelerated the adoption of these segments, especially among expatriates and younger consumers .

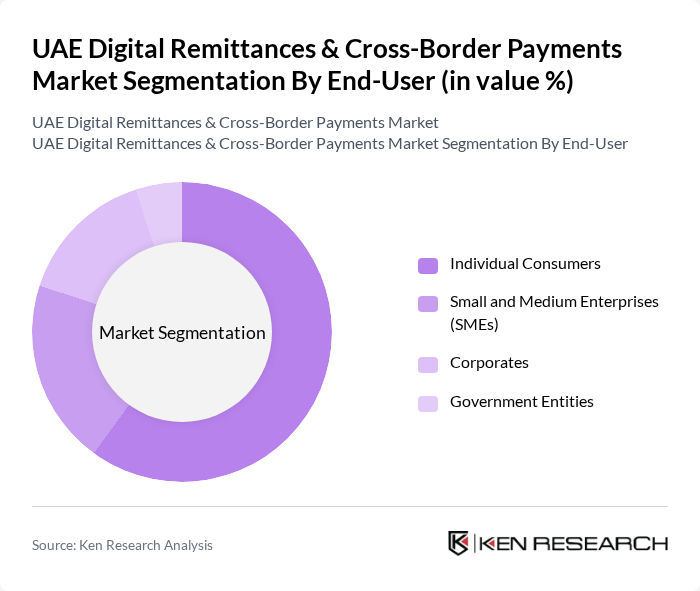

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, and Government Entities. Individual Consumers dominate the market as they frequently engage in remittances to support families back home. SMEs also represent a significant portion of the market, utilizing digital payment solutions for cross-border transactions and supplier payments. The growing trend of e-commerce and the increasing adoption of digital payment platforms among businesses further support the expansion of these end-user segments .

The UAE Digital Remittances & Cross-Border Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, Wise (formerly TransferWise), PayPal, Remitly, Xoom, Ria Money Transfer, Al Ansari Exchange, UAE Exchange, Lulu Exchange, Fawry, Payoneer, Skrill, Azimo, WorldRemit, Alipay, Revolut, N26, Venmo, Cash App, Zelle contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE digital remittances and cross-border payments market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance fraud detection and customer service. Additionally, the rise of digital wallets and mobile payment solutions will likely facilitate faster and more secure transactions, catering to the growing demand for efficiency. As regulatory frameworks evolve, they will also support innovation and competition in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Wallets Online Remittance Services Prepaid Cards Cryptocurrency Wallets Bank Transfers Bill Payments Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Corporates Government Entities |

| By Payment Method | Bank Transfers Credit/Debit Cards Cash Deposits Mobile Payments |

| By Transaction Type | Domestic Transactions International Transactions Remittances Bill Payments |

| By User Demographics | Age Group Income Level Nationality |

| By Distribution Channel | Online Platforms Mobile Applications Physical Outlets |

| By Regulatory Compliance | Licensed Providers Unlicensed Providers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Expatriate Remittance Behavior | 120 | Expatriates from South Asia, Africa, and the Philippines |

| Digital Payment Adoption | 90 | Fintech Users, Digital Wallet Customers |

| Regulatory Impact Assessment | 60 | Compliance Officers, Financial Regulators |

| Service Provider Insights | 50 | Executives from Remittance Companies, Banks |

| Consumer Preferences in Cross-Border Payments | 70 | General Consumers, Small Business Owners |

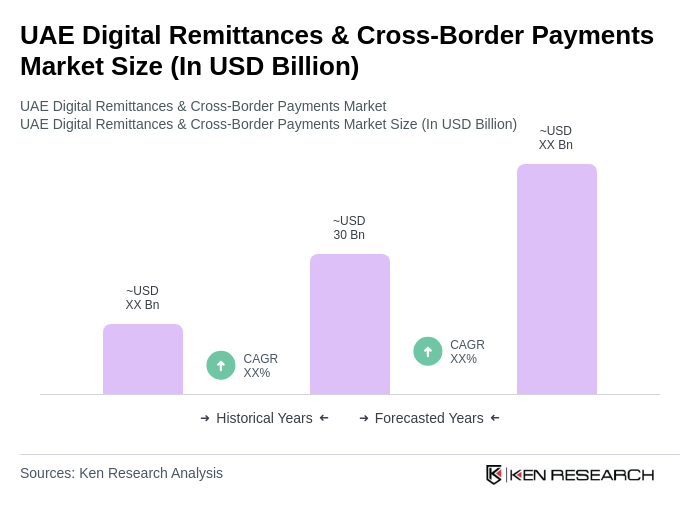

The UAE Digital Remittances & Cross-Border Payments Market is valued at approximately USD 30 billion, driven by a growing expatriate population and increasing demand for efficient remittance solutions.