Region:Middle East

Author(s):Dev

Product Code:KRAD1647

Pages:80

Published On:November 2025

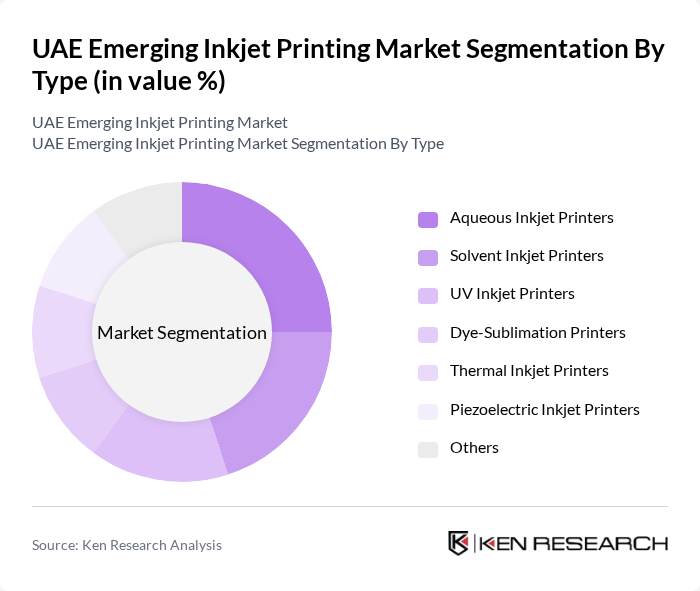

By Type:The market is segmented into various types of inkjet printers, including Aqueous Inkjet Printers, Solvent Inkjet Printers, UV Inkjet Printers, Dye-Sublimation Printers, Thermal Inkjet Printers, Piezoelectric Inkjet Printers, and Others. Each type serves different applications and industries, catering to specific customer needs. Multifunctional and large format printers are particularly prominent in commercial and industrial applications, while desktop and thermal inkjet printers are widely used in office and home environments. UV and solvent inkjet printers are favored for signage, packaging, and textile printing due to their durability and versatility .

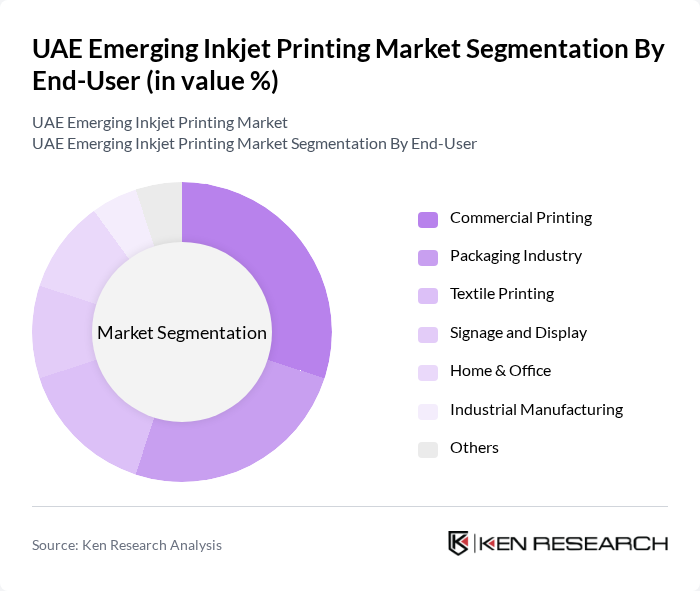

By End-User:The end-user segmentation includes Commercial Printing, Packaging Industry, Textile Printing, Signage and Display, Home & Office, Industrial Manufacturing, and Others. Each segment reflects the diverse applications of inkjet printing technology across various industries. Commercial printing and packaging remain the largest end-user segments, driven by the growth of retail, e-commerce, and branding activities. Textile printing is also expanding due to demand for customized fabrics and apparel. The signage and display segment benefits from increasing investments in advertising and retail environments .

The UAE Emerging Inkjet Printing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canon Middle East, Epson Middle East, HP Middle East, Ricoh Middle East, Brother International (Gulf) FZE, Mimaki Engineering Co., Ltd., Roland DG Corporation, Durst Phototechnik AG, Agfa Graphics NV, Xerox Emirates LLC, Konica Minolta Business Solutions Middle East, Fujifilm Middle East FZE, SATO Holdings Corporation, Zünd Systemtechnik AG, A B Graphic International Ltd., Domino Printing Sciences PLC, Videojet Technologies Inc., Lexmark International Middle East, Kyocera Document Solutions Middle East, Sharp Middle East FZE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE inkjet printing market appears promising, driven by ongoing technological advancements and a growing emphasis on sustainability. As businesses increasingly prioritize eco-friendly practices, the demand for sustainable printing solutions is expected to rise. Additionally, the integration of automation and IoT technologies will enhance operational efficiency, allowing companies to streamline their printing processes. These trends indicate a dynamic market landscape, with significant potential for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Aqueous Inkjet Printers Solvent Inkjet Printers UV Inkjet Printers Dye-Sublimation Printers Thermal Inkjet Printers Piezoelectric Inkjet Printers Others |

| By End-User | Commercial Printing Packaging Industry Textile Printing Signage and Display Home & Office Industrial Manufacturing Others |

| By Application | Label Printing Direct-to-Object Printing Photo Printing Industrial Printing Security Printing Transactional Printing Others |

| By Material | Paper Plastic Metal Fabric Glass Ceramics Others |

| By Technology | Continuous Inkjet Technology Drop-on-Demand Technology Piezoelectric Inkjet Technology Thermal Inkjet Technology Hybrid Technology Others |

| By Distribution Channel | Direct Sales Online Sales Retail Sales Distributors Value-Added Resellers (VARs) Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Printing Sector | 100 | Print Shop Owners, Production Managers |

| Packaging Industry | 80 | Packaging Designers, Operations Directors |

| Textile Printing Applications | 60 | Textile Manufacturers, R&D Managers |

| Advertising and Marketing Firms | 50 | Creative Directors, Marketing Managers |

| Industrial Inkjet Solutions | 70 | Manufacturing Engineers, Product Development Managers |

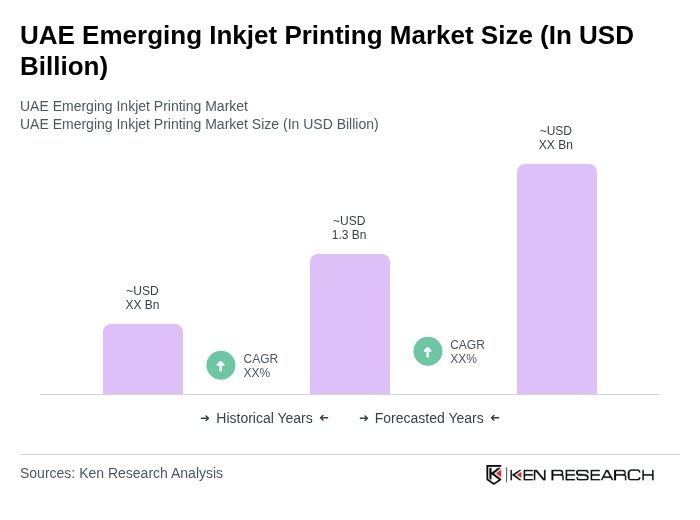

The UAE Emerging Inkjet Printing Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by the demand for high-quality printing solutions across various sectors, including commercial printing, packaging, and textiles.