Region:Middle East

Author(s):Geetanshi

Product Code:KRAA2088

Pages:90

Published On:August 2025

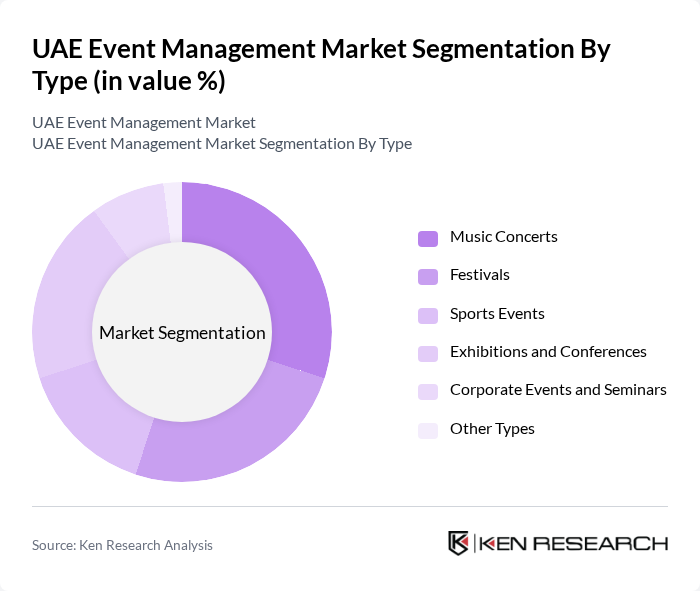

By Type:The segmentation by type includes various categories such as music concerts, festivals, sports events, exhibitions and conferences, corporate events and seminars, and other types. Each of these subsegments caters to different audience preferences and market demands. Music concerts and festivals often lead in popularity, driven by their entertainment value, cultural significance, and the UAE’s positioning as a global entertainment destination. Sports events and exhibitions also attract substantial participation due to the country’s focus on international sporting and business gatherings .

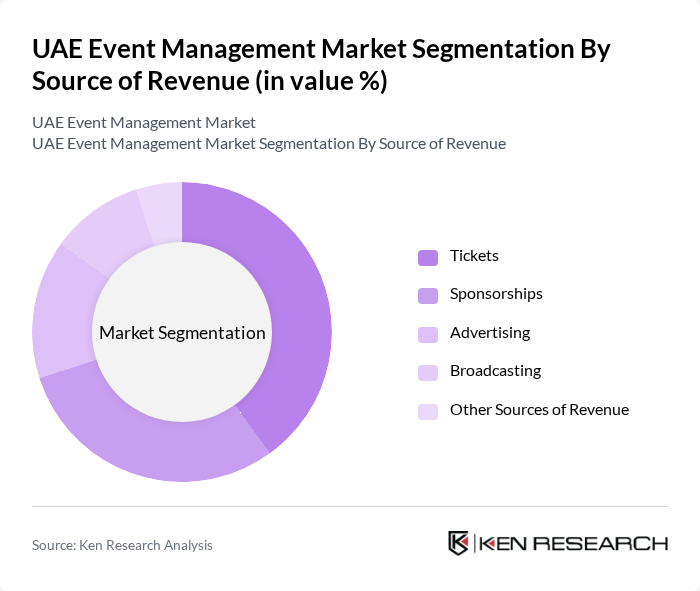

By Source of Revenue:The revenue sources in the event management market are diverse, including ticket sales, sponsorships, advertising, broadcasting, and other sources of revenue. Ticket sales remain the largest revenue generator, especially for concerts and festivals, while sponsorships are crucial for funding larger events and enhancing visibility. Advertising and broadcasting revenues are also significant, particularly for high-profile and televised events .

The UAE Event Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as TEC (The Event Company), SkyHigh Events, Done Events, HQ Worldwide Shows, Invent Creative Event Solutions, Event Lab, SLS Events, Memories Events Management, Plan b Group, Purple Honey Group, 360 Event Management, Eclipse Staging Services, Viva Events, Oplus Events, Max Events Dubai contribute to innovation, geographic expansion, and service delivery in this space .

The UAE event management market is poised for dynamic growth, driven by technological advancements and evolving consumer preferences. The integration of virtual and hybrid events is expected to reshape the landscape, allowing for broader audience engagement. Additionally, sustainability practices are becoming increasingly important, with event organizers focusing on eco-friendly solutions. As the market adapts to these trends, innovative strategies will be essential for capturing emerging opportunities and enhancing overall event experiences in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Music Concerts Festivals Sports Events Exhibitions and Conferences Corporate Events and Seminars Other Types |

| By Source of Revenue | Tickets Sponsorships Advertising Broadcasting Other Sources of Revenue |

| By End-User | Corporate Individual Public |

| By Venue Type | Indoor Venues Outdoor Venues Hybrid Venues |

| By Service Type | Event Planning Event Marketing Event Logistics Event Technology |

| By Geographic Focus | Local Events Regional Events International Events |

| By Duration | One-Day Events Multi-Day Events |

| By Budget Range | Low Budget Mid-Range Budget High Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Event Management | 100 | Event Managers, Corporate Executives |

| Wedding Planning Services | 60 | Wedding Planners, Couples Planning Weddings |

| Exhibition and Trade Shows | 50 | Exhibition Coordinators, Venue Managers |

| Conferences and Seminars | 40 | Conference Organizers, Speakers, Attendees |

| Event Technology Solutions | 40 | Tech Providers, Event Technologists |

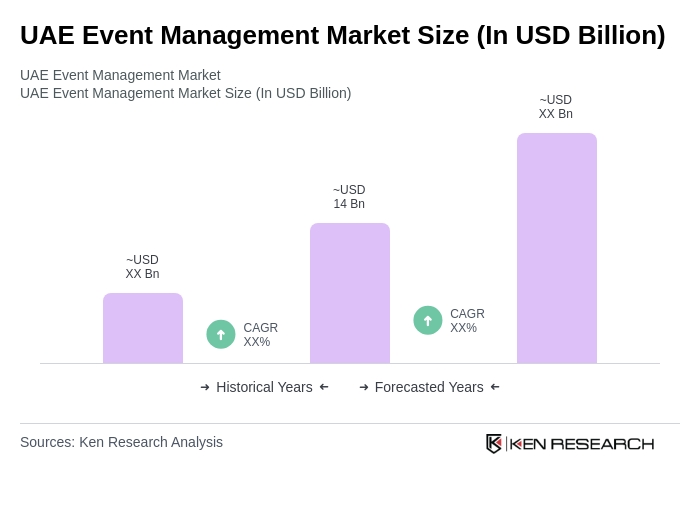

The UAE Event Management Market is valued at approximately USD 14 billion, driven by a surge in international events, corporate gatherings, and cultural festivals, alongside a thriving tourism sector that attracts global audiences.