Region:North America

Author(s):Geetanshi

Product Code:KRAC3815

Pages:86

Published On:October 2025

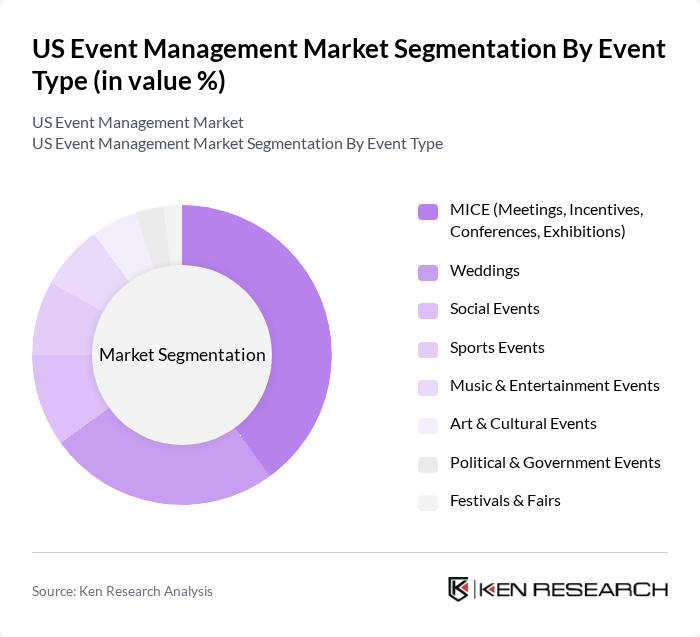

By Event Type:The event type segmentation includes various categories such as MICE (Meetings, Incentives, Conferences, Exhibitions), Weddings, Social Events, Sports Events, Music & Entertainment Events, Art & Cultural Events, Political & Government Events, and Festivals & Fairs. Among these, MICE events are currently dominating the market due to the increasing number of corporate meetings and conferences, which are essential for business networking and knowledge sharing. The demand for professional gatherings has surged, particularly in urban centers, as companies recognize the value of face-to-face interactions in building relationships and driving business growth. Corporate events lead the event type category, reflecting the high volume of business activities and professional gatherings in the US market.

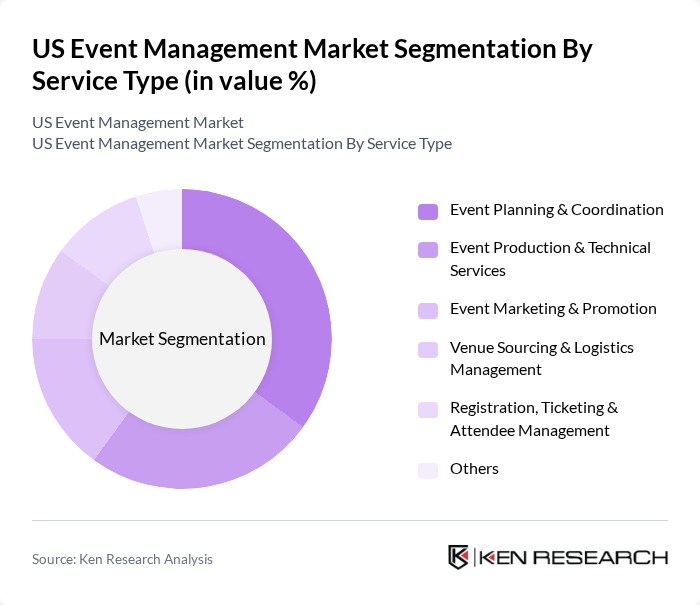

By Service Type:The service type segmentation encompasses Event Planning & Coordination, Event Production & Technical Services, Event Marketing & Promotion, Venue Sourcing & Logistics Management, Registration, Ticketing & Attendee Management, and Others. Event Planning & Coordination is the leading sub-segment, as it involves comprehensive management of all aspects of an event, from conceptualization to execution. The increasing complexity of events and the need for professional expertise in logistics and coordination have made this service essential for successful event outcomes. Event planning dominates the service type segment, reflecting its critical role in event execution.

The US Event Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Eventbrite, Cvent, Freeman, Informa, Reed Exhibitions, Live Nation Entertainment, Bizzabo, Social Tables, Splash, Whova, Gather, Certain, Aventri, MeetingPlay, MKG Productions, LLC, Maritz Holdings Inc., EA Collective, LLC, BCD Meetings & Events, EGG Events, George P. Johnson Company, Event Solutions, TeamOut, AMP Event Group contribute to innovation, geographic expansion, and service delivery in this space.

The US event management market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As hybrid events gain traction, combining in-person and virtual experiences, organizers will need to adapt their strategies to meet diverse audience needs. Additionally, the focus on sustainability will shape event planning, with more companies seeking eco-friendly solutions. The integration of data analytics will further enhance event personalization, ensuring that experiences are tailored to individual preferences and expectations.

| Segment | Sub-Segments |

|---|---|

| By Event Type | MICE (Meetings, Incentives, Conferences, Exhibitions) Weddings Social Events Sports Events Music & Entertainment Events Art & Cultural Events Political & Government Events Festivals & Fairs |

| By Service Type | Event Planning & Coordination Event Production & Technical Services Event Marketing & Promotion Venue Sourcing & Logistics Management Registration, Ticketing & Attendee Management Others |

| By Delivery Mode | In-Person Virtual Hybrid |

| By End-User | Corporations Non-Profit Organizations Government Agencies Educational Institutions Individuals Others |

| By Event Size | Small Events Medium Events Large Events |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas |

| By Technology Utilization | Event Management Software Mobile Applications Virtual Reality Tools |

| By Pricing Model | Fixed Pricing Tiered Pricing Pay-Per-Event Pricing Subscription-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Event Planning | 120 | Event Managers, Corporate Executives |

| Wedding and Social Events | 90 | Wedding Planners, Venue Coordinators |

| Trade Shows and Expos | 80 | Exhibition Managers, Marketing Directors |

| Virtual and Hybrid Events | 70 | Technology Providers, Event Producers |

| Entertainment and Festivals | 90 | Festival Organizers, Sponsorship Managers |

The US Event Management Market is valued at approximately USD 400 billion, reflecting strong demand for various events, including corporate gatherings, weddings, and social events, particularly as in-person events have surged post-pandemic.