Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3099

Pages:86

Published On:October 2025

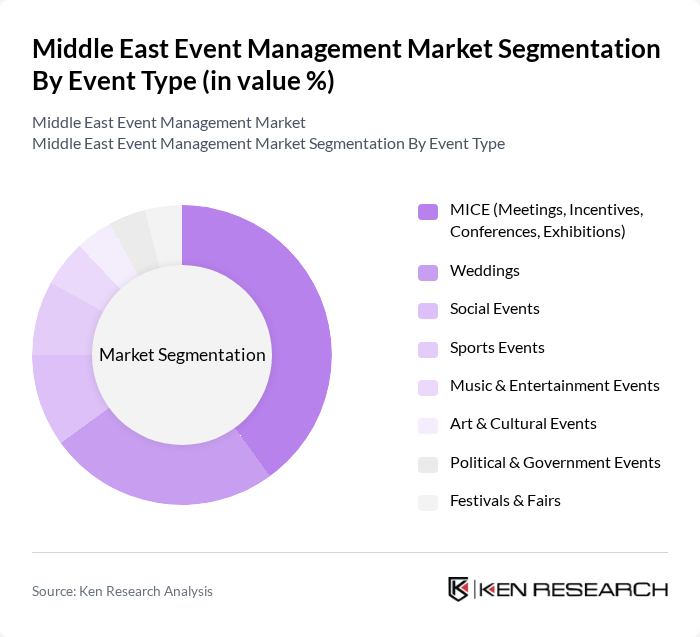

By Event Type:The event type segmentation includes various categories such as MICE (Meetings, Incentives, Conferences, Exhibitions), Weddings, Social Events, Sports Events, Music & Entertainment Events, Art & Cultural Events, Political & Government Events, and Festivals & Fairs. Among these, MICE is the leading segment due to the increasing number of international conferences and exhibitions hosted in the region. The demand for corporate meetings and incentive travel is also on the rise, driven by the growing business landscape and the need for networking opportunities. The weddings segment is also significant, reflecting cultural traditions and the increasing trend of destination weddings in luxurious venues.

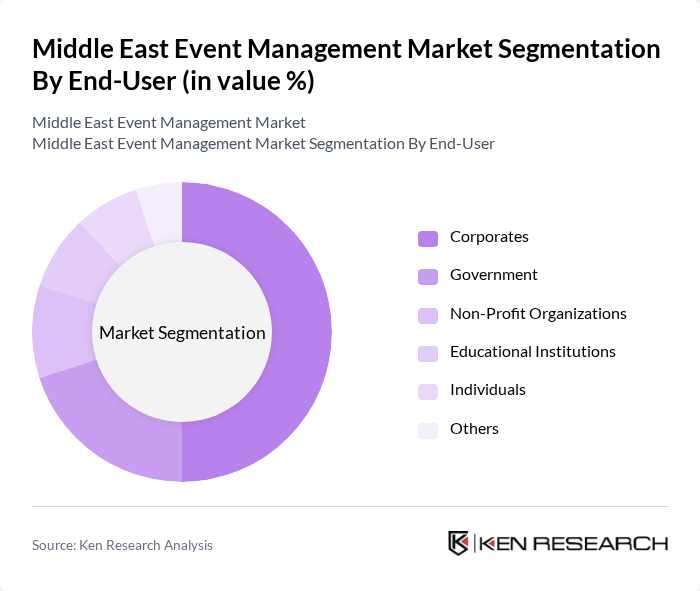

By End-User:The end-user segmentation encompasses Corporates, Government, Non-Profit Organizations, Educational Institutions, Individuals, and Others. The corporate sector is the dominant end-user, driven by the need for business meetings, conferences, and incentive travel. Corporates are increasingly investing in event management services to enhance employee engagement and client relationships. Government events also play a significant role, particularly in promoting tourism and cultural initiatives, while educational institutions are leveraging events for outreach and engagement.

The Middle East Event Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Informa PLC, MCI Group, GES (Global Experience Specialists), Freeman Company, Dubai World Trade Centre (DWTC), Abu Dhabi National Exhibitions Company (ADNEC), Qatar National Convention Centre (QNCC), Sela Sport, Flash Entertainment, Event Lab, HQ Worldwide Shows (HQWS), Prisme International, Cvent, Eventbrite, AEG Ogden contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East event management market appears promising, driven by a growing emphasis on sustainability and technological integration. As businesses increasingly prioritize eco-friendly practices, the demand for sustainable event solutions is expected to rise. Additionally, the continued evolution of hybrid and virtual events will likely reshape the landscape, allowing for broader participation and engagement. This shift presents opportunities for innovative event formats and enhanced attendee experiences, positioning the region as a leader in modern event management.

| Segment | Sub-Segments |

|---|---|

| By Event Type | MICE (Meetings, Incentives, Conferences, Exhibitions) Weddings Social Events Sports Events Music & Entertainment Events Art & Cultural Events Political & Government Events Festivals & Fairs |

| By End-User | Corporates Government Non-Profit Organizations Educational Institutions Individuals Others |

| By Event Size | Small Scale Events Medium Scale Events Large Scale Events |

| By Service Type | Event Planning & Coordination Event Production & Technical Services Event Marketing & Promotion Venue Sourcing & Logistic Management Registration, Ticketing & Attendee Management Others |

| By Delivery Mode | In-person Virtual Hybrid |

| By Geographic Location | UAE Saudi Arabia Qatar Kuwait Bahrain Oman Others |

| By Technology Used | Event Management Software Mobile Applications Virtual Reality Tools Live Streaming Services Others |

| By Budget Range | Low Budget Events Mid-Range Budget Events High Budget Events |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Event Management | 120 | Event Managers, Corporate Executives |

| Social Event Planning | 90 | Wedding Planners, Event Coordinators |

| Cultural and Festival Events | 80 | Festival Organizers, Cultural Affairs Directors |

| Exhibitions and Trade Shows | 70 | Exhibition Managers, Marketing Directors |

| Venue Management | 60 | Venue Owners, Operations Managers |

The Middle East Event Management Market is valued at approximately USD 34.5 billion, reflecting significant growth driven by increasing demand for corporate events, exhibitions, and social gatherings, alongside rising disposable incomes and investments in infrastructure and technology.