Region:Middle East

Author(s):Shubham

Product Code:KRAB7443

Pages:88

Published On:October 2025

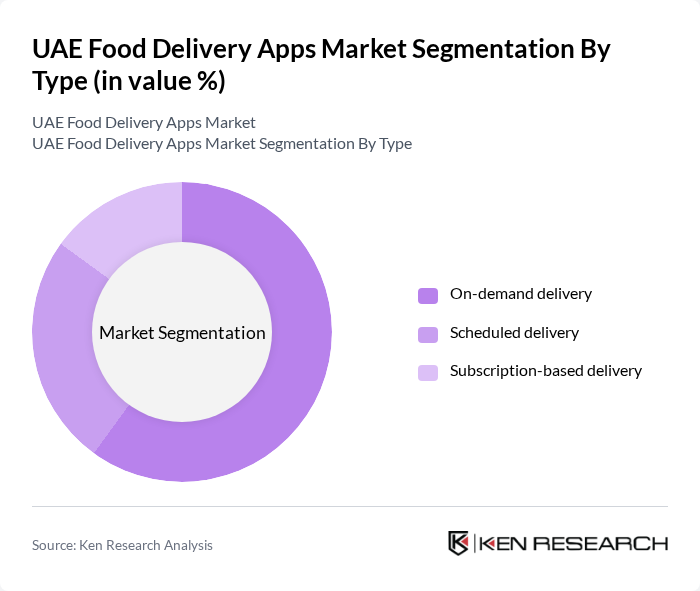

By Type:The market is segmented into three main types: on-demand delivery, scheduled delivery, and subscription-based delivery. On-demand delivery is the most popular segment, driven by consumer preference for immediate service. Scheduled delivery allows consumers to plan their meals in advance, while subscription-based delivery offers convenience for regular users. The on-demand delivery segment is expected to dominate due to its alignment with the fast-paced lifestyle of consumers.

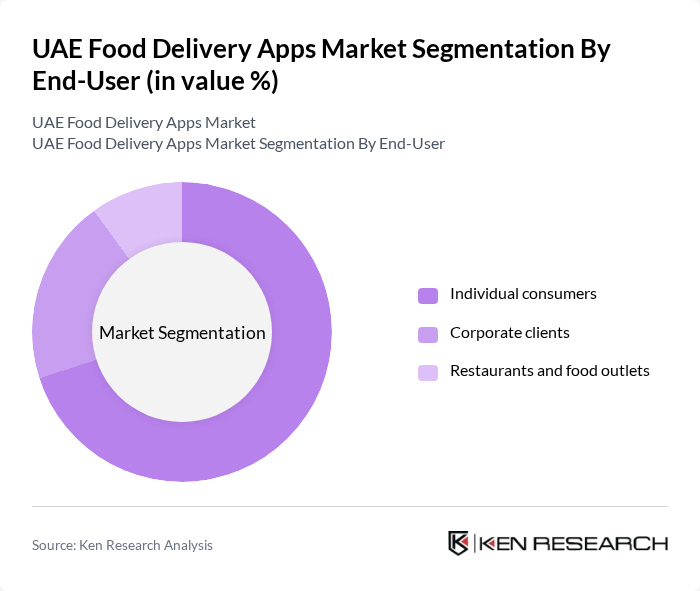

By End-User:The end-user segmentation includes individual consumers, corporate clients, and restaurants and food outlets. Individual consumers represent the largest segment, driven by the growing trend of online food ordering among households. Corporate clients utilize food delivery services for business meetings and events, while restaurants and food outlets leverage these platforms to expand their reach. The individual consumer segment leads the market due to the increasing number of people opting for convenience in their dining choices.

The UAE Food Delivery Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Talabat, Deliveroo, Zomato, Uber Eats, Noon Food, Foodonclick, Carriage, Eat App, Fatafeat, Just Eat, GoFood, Munchbox, Food Delivery UAE, Crave, ChefXChange contribute to innovation, geographic expansion, and service delivery in this space.

The UAE food delivery apps market is poised for continued evolution, driven by technological advancements and changing consumer preferences. As urbanization increases, the demand for efficient and diverse food delivery options will likely rise. Companies are expected to invest in AI and data analytics to enhance customer experiences and streamline operations. Furthermore, sustainability initiatives will play a crucial role in shaping the market, as consumers increasingly favor eco-friendly practices in food delivery services.

| Segment | Sub-Segments |

|---|---|

| By Type | On-demand delivery Scheduled delivery Subscription-based delivery |

| By End-User | Individual consumers Corporate clients Restaurants and food outlets |

| By Cuisine Type | Fast food Asian cuisine Middle Eastern cuisine Vegetarian and vegan options |

| By Delivery Method | In-house delivery Third-party delivery |

| By Payment Method | Credit/debit cards Digital wallets Cash on delivery |

| By Customer Demographics | Age groups Income levels Urban vs rural |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Food Delivery | 150 | Regular Users of Food Delivery Apps, Occasional Users |

| Restaurant Partnerships and Collaborations | 100 | Restaurant Owners, Managers, and Franchise Operators |

| Logistics and Delivery Operations | 80 | Logistics Managers, Delivery Coordinators |

| Market Trends and Innovations | 70 | Industry Analysts, Market Researchers |

| Consumer Satisfaction and Feedback | 120 | Frequent Users, First-time Users |

The UAE Food Delivery Apps Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by smartphone adoption, e-commerce expansion, and changing consumer preferences for convenience, particularly during the pandemic.