Region:Middle East

Author(s):Geetanshi

Product Code:KRAB6634

Pages:95

Published On:October 2025

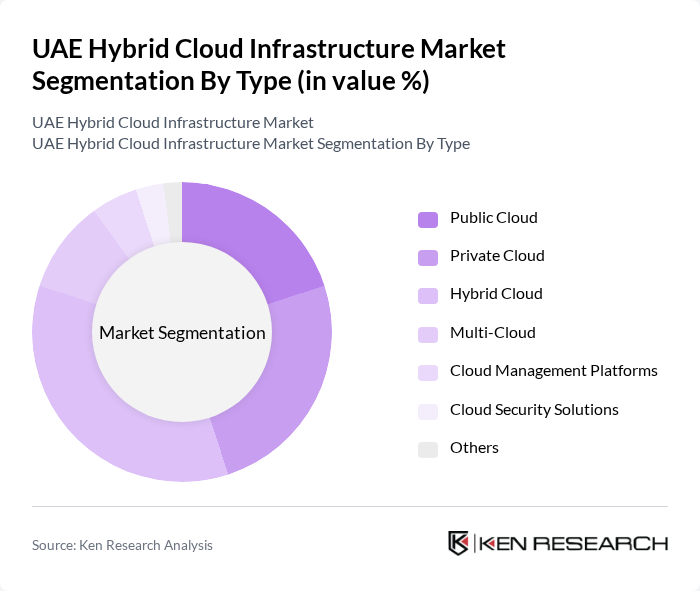

By Type:The market is segmented into various types, including Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud, Cloud Management Platforms, Cloud Security Solutions, and Others. Among these, the Hybrid Cloud segment is gaining significant traction due to its ability to combine the benefits of both public and private clouds, allowing organizations to maintain control over sensitive data while leveraging the scalability of public cloud services.

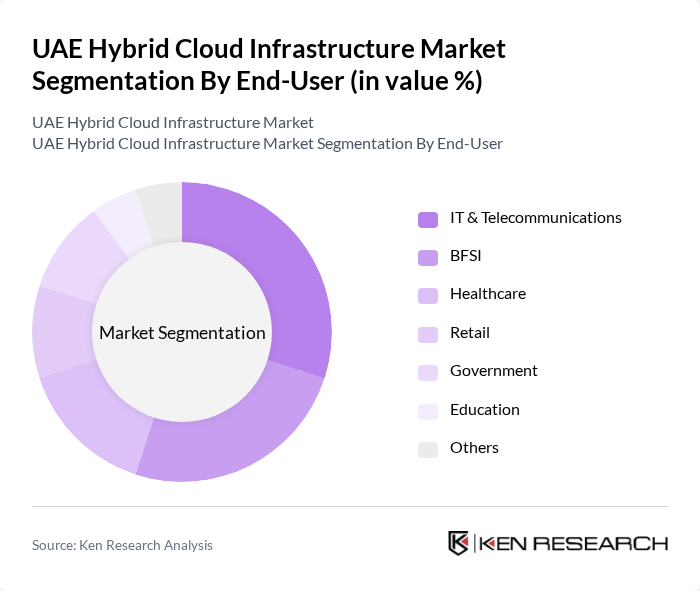

By End-User:The end-user segmentation includes IT & Telecommunications, BFSI, Healthcare, Retail, Government, Education, and Others. The IT & Telecommunications sector is the leading end-user, driven by the need for robust infrastructure to support digital services and applications. The increasing reliance on cloud solutions for data storage, processing, and analytics is propelling this sector's growth.

The UAE Hybrid Cloud Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Web Services, Microsoft Corporation, Google Cloud Platform, IBM Corporation, Oracle Corporation, Alibaba Cloud, VMware, Inc., Dell Technologies, Cisco Systems, Inc., HPE (Hewlett Packard Enterprise), Rackspace Technology, DigitalOcean, LLC, Nutanix, Inc., Red Hat, Inc., Fujitsu Limited contribute to innovation, geographic expansion, and service delivery in this space.

The UAE hybrid cloud infrastructure market is poised for significant growth, driven by technological advancements and increasing digitalization across sectors. As organizations prioritize agility and scalability, the adoption of hybrid cloud solutions will likely accelerate. Furthermore, the integration of AI and machine learning into cloud services will enhance operational efficiencies. The focus on sustainability will also shape future investments, as businesses seek eco-friendly cloud solutions to meet regulatory and consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud Cloud Management Platforms Cloud Security Solutions Others |

| By End-User | IT & Telecommunications BFSI Healthcare Retail Government Education Others |

| By Deployment Model | On-Premises Off-Premises Hybrid Deployment Managed Services Others |

| By Industry Vertical | Manufacturing Energy & Utilities Transportation & Logistics Media & Entertainment Others |

| By Service Type | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Disaster Recovery as a Service (DRaaS) Others |

| By Geographic Presence | UAE GCC Region Middle East & North Africa Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 150 | IT Managers, CTOs, CIOs |

| SME Hybrid Cloud Solutions | 100 | Business Owners, IT Directors |

| Public Sector Cloud Initiatives | 80 | Government IT Officials, Policy Makers |

| Cloud Security and Compliance | 70 | Security Officers, Compliance Managers |

| Data Center Operations | 90 | Data Center Managers, Operations Directors |

The UAE Hybrid Cloud Infrastructure Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the demand for flexible and scalable IT solutions, as well as the rise in digital transformation initiatives across various sectors.