Region:Middle East

Author(s):Rebecca

Product Code:KRAC3967

Pages:96

Published On:October 2025

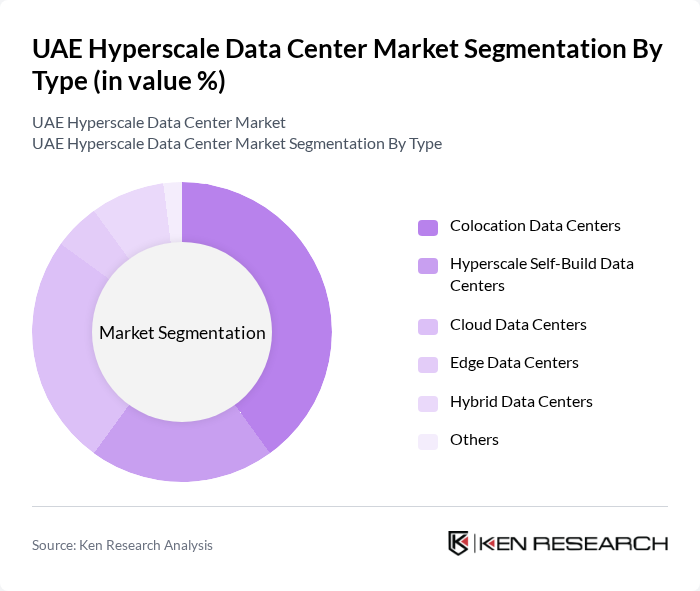

By Type:The market is segmented into various types, including Colocation Data Centers, Hyperscale Self-Build Data Centers, Cloud Data Centers, Edge Data Centers, Hybrid Data Centers, and Others. Among these, Hyperscale Self-Build Data Centers are increasingly gaining prominence, with enterprises and hyperscale operators preferring to construct dedicated facilities to maintain complete control over infrastructure and operations. The demand for Cloud Data Centers is also rising significantly, driven by the increasing adoption of cloud computing solutions across industries and the region's strategic positioning as a cloud service hub. Edge Data Centers are emerging as a growing segment, supported by the expansion of 5G networks and IoT deployments that require low-latency processing capabilities.

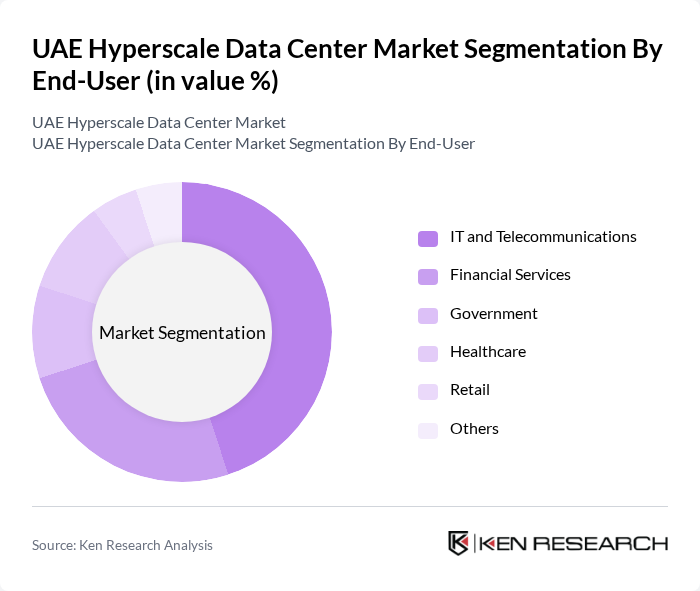

By End-User:The end-user segmentation includes IT and Telecommunications, Financial Services, Government, Healthcare, Retail, and Others. The IT and Telecommunications sector is the dominant end-user, driven by the increasing demand for data processing and storage solutions to support cloud providers, connectivity services, and digital infrastructure expansion. Financial services are also significant contributors, as they require robust data centers for secure transactions, real-time processing, and compliance with stringent regulatory standards. The government sector is experiencing notable growth as national digitalization programs and smart city initiatives drive demand for sovereign data hosting and secure infrastructure. The retail and e-commerce segments are expanding their data center requirements to support digital payment systems, customer analytics, and omnichannel operations.

The UAE Hyperscale Data Center Market is characterized by a dynamic mix of regional and international players. Leading participants such as Etisalat, du (Emirates Integrated Telecommunications Company), Gulf Data Hub, Khazna Data Centers, NTT Communications, Equinix, Digital Realty, Alibaba Cloud, Microsoft Azure, Amazon Web Services (AWS), Ooredoo, Interxion, Rackspace Technology, IBM Cloud, Oracle Cloud contribute to innovation, geographic expansion, and service delivery in this space.

The UAE hyperscale data center market is poised for significant growth, driven by advancements in technology and increasing digitalization across sectors. As businesses continue to embrace cloud computing and digital transformation, the demand for robust data infrastructure will rise. Additionally, the government's commitment to enhancing technology frameworks and promoting sustainability will further shape the market landscape. The integration of AI and edge computing will also play a pivotal role in optimizing data center operations and meeting evolving consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Colocation Data Centers Hyperscale Self-Build Data Centers Cloud Data Centers Edge Data Centers Hybrid Data Centers Others |

| By End-User | IT and Telecommunications Financial Services Government Healthcare Retail Others |

| By Application | Data Storage and Backup Disaster Recovery Big Data Analytics Application Hosting Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants Others |

| By Policy Support | Tax Incentives Subsidies for Renewable Energy Regulatory Support for Infrastructure Development Others |

| By Location | Urban Areas Suburban Areas Rural Areas Others |

| By Service Model | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Data Center Utilization | 120 | IT Managers, CTOs, Infrastructure Directors |

| Cloud Service Adoption Trends | 85 | Cloud Architects, IT Strategists |

| Regulatory Compliance in Data Centers | 65 | Compliance Officers, Legal Advisors |

| Energy Efficiency Practices | 60 | Facility Managers, Sustainability Officers |

| Future Investment Plans in Data Centers | 75 | Investment Analysts, Business Development Managers |

The UAE Hyperscale Data Center Market is valued at approximately USD 3.7 billion, driven by the increasing demand for cloud services, data storage, and digital transformation initiatives across various sectors.