Region:Global

Author(s):Shubham

Product Code:KRAC5246

Pages:95

Published On:January 2026

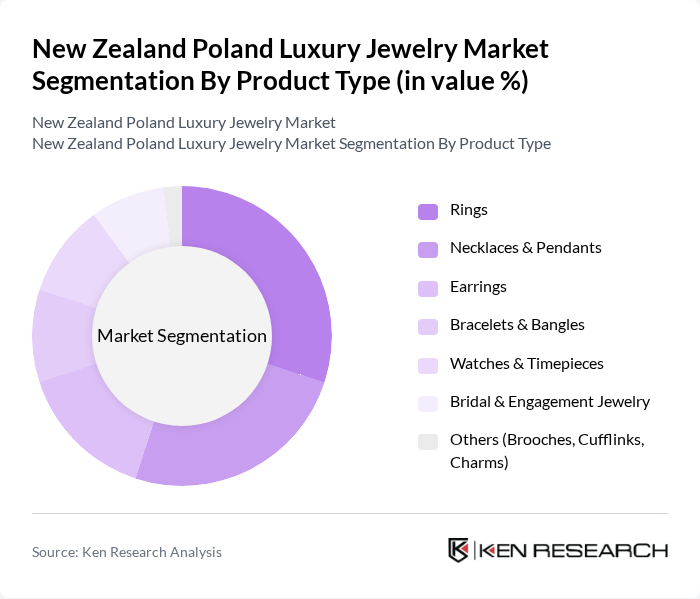

By Product Type:The luxury jewelry market is segmented into various product types, including rings, necklaces & pendants, earrings, bracelets & bangles, watches & timepieces, bridal & engagement jewelry, and others such as brooches, cufflinks, and charms. Among these, rings and necklaces are particularly popular, driven by consumer preferences for personal adornment and gifting. The bridal & engagement jewelry segment also sees significant demand, especially during wedding seasons, reflecting cultural trends and consumer behavior.

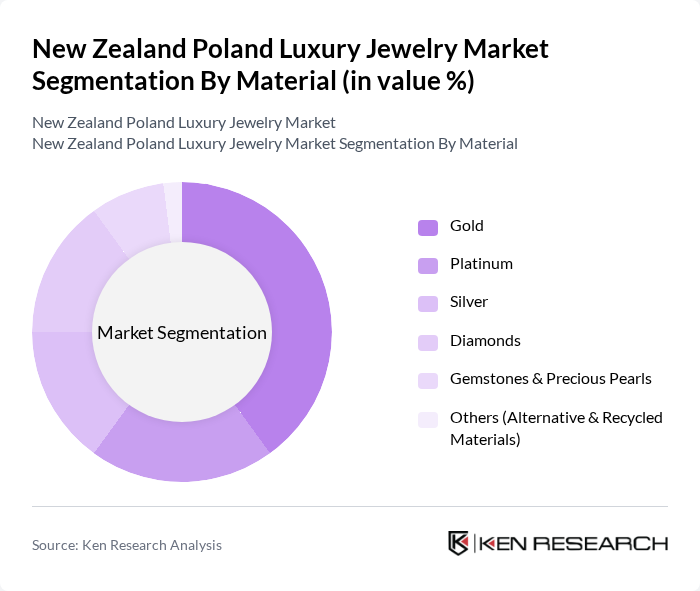

By Material:The luxury jewelry market is also categorized by material, including gold, platinum, silver, diamonds, gemstones & precious pearls, and others such as alternative and recycled materials. Gold remains the most sought-after material due to its timeless appeal and investment value. Diamonds and gemstones are also highly favored, particularly in engagement and bridal jewelry, reflecting consumer trends towards unique and personalized pieces.

The New Zealand Poland Luxury Jewelry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Michael Hill International, Walker & Hall, Partridge Jewellers, Stewart Dawsons, Pascoes The Jewellers, Prouds The Jewellers, Goldmark, Pandora Jewelry, Apart, W.KRUK, YES Bi?uteria, Swarovski, Tiffany & Co., Cartier, Bvlgari, Chopard contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand Poland luxury jewelry market is poised for dynamic growth, driven by increasing disposable incomes and a shift towards personalized and sustainable products. As e-commerce continues to expand, luxury brands will need to enhance their online presence to capture a broader audience. Additionally, the influence of social media and digital marketing will play a crucial role in shaping consumer preferences. Brands that adapt to these trends while maintaining quality and exclusivity are likely to thrive in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Rings Necklaces & Pendants Earrings Bracelets & Bangles Watches & Timepieces Bridal & Engagement Jewelry Others (Brooches, Cufflinks, Charms) |

| By Material | Gold Platinum Silver Diamonds Gemstones & Precious Pearls Others (Alternative & Recycled Materials) |

| By Application / Consumer Type | Women Men Unisex / Gender-Fluid Children & Teens |

| By Occasion | Everyday / Self-Purchase Weddings & Engagements Anniversaries Gifting (Festive & Corporate) Others (Cultural & Religious Events) |

| By Distribution Channel | Mono-Brand Boutiques Multi-Brand Jewelry Retailers Department & Duty-Free Stores Online Brand Stores Online Marketplaces Others (Pop-Up & Concept Stores) |

| By Price Band | Core Luxury (Entry-Level) High Luxury Ultra-High-Net-Worth / High Jewelry |

| By Consumer Demographics | Age Groups Gender Income Levels / Wealth Tier Urban vs Non-Urban Consumers Tourist vs Resident Buyers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Jewelry Retailers | 60 | Store Managers, Brand Representatives |

| Affluent Consumers | 120 | High Net-Worth Individuals, Luxury Shoppers |

| Jewelry Designers and Artisans | 50 | Independent Designers, Workshop Owners |

| Market Analysts and Experts | 40 | Industry Analysts, Economic Consultants |

| Luxury Brand Marketing Professionals | 40 | Marketing Directors, Brand Strategists |

The New Zealand Poland luxury jewelry market is valued at approximately USD 1.0 billion, reflecting a robust growth trend driven by increasing disposable incomes and a rising demand for luxury goods among affluent consumers in both regions.