Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3261

Pages:84

Published On:September 2025

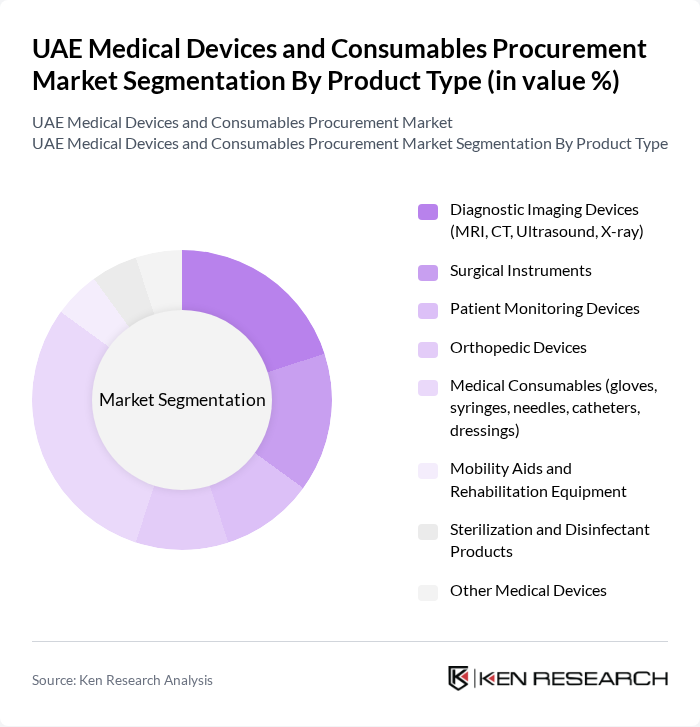

By Product Type:The product type segmentation includes various categories such as Diagnostic Imaging Devices, Surgical Instruments, Patient Monitoring Devices, Orthopedic Devices, Medical Consumables, Mobility Aids, Sterilization Products, and Other Medical Devices. Among these,Medical Consumablesare currently dominating the market due to their essential role in daily healthcare operations and the increasing volume of medical procedures. The demand for consumables like gloves, syringes, and catheters remains consistently high, driven by the growing number of healthcare facilities, ongoing expansion of hospital networks, and heightened awareness of hygiene and infection control standards. The UAE’s import-dependent market structure further supports the dominance of consumables, as most disposable products are sourced internationally to meet daily operational needs .

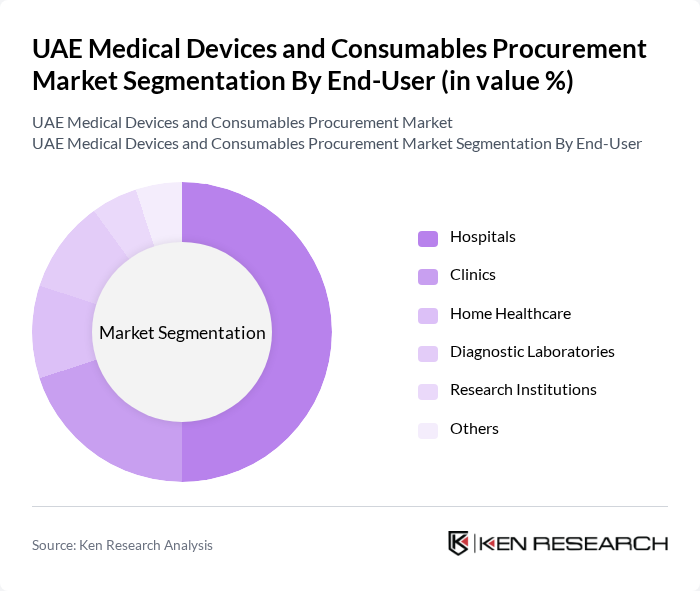

By End-User:The end-user segmentation encompasses Hospitals, Clinics, Home Healthcare, Diagnostic Laboratories, Research Institutions, and Others.Hospitalsare the leading end-user segment, primarily due to their extensive need for a wide range of medical devices and consumables to support various medical procedures. The increasing number of hospitals, expansion of healthcare services, and government investment in hospital infrastructure are driving the demand for medical devices in this segment. Clinics and diagnostic laboratories also contribute significantly, reflecting the UAE’s focus on expanding healthcare access and specialized medical services .

The UAE Medical Devices and Consumables Procurement Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE Healthcare, Philips Medical Systems, Medtronic, Abbott Laboratories, Johnson & Johnson (Ethicon, DePuy Synthes), B. Braun Melsungen AG, Stryker Corporation, Boston Scientific, Terumo Corporation, Smith & Nephew, Cardinal Health, Zimmer Biomet, Hologic, Inc., 3M Health Care, Fresenius Medical Care, Hillrom (now part of Baxter International), Al Zahrawi Medical Supplies LLC, Pure Health, Gulf & World Traders, Pharma Trade contribute to innovation, geographic expansion, and service delivery in this space. The competitive landscape is highly fragmented, with international companies distributing through authorized local distributors and a strong emphasis on product portfolio breadth, distribution network coverage, and after-sales support .

The future of the UAE medical devices and consumables procurement market appears promising, driven by ongoing investments in healthcare infrastructure and technology. As the government continues to prioritize healthcare improvements, the integration of advanced technologies such as AI and IoT in medical devices will likely enhance procurement efficiency. Additionally, the expansion of telemedicine and home healthcare solutions will create new avenues for growth, enabling healthcare providers to adapt to evolving patient needs and preferences effectively.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Diagnostic Imaging Devices (MRI, CT, Ultrasound, X-ray) Surgical Instruments Patient Monitoring Devices Orthopedic Devices Medical Consumables (gloves, syringes, needles, catheters, dressings) Mobility Aids and Rehabilitation Equipment Sterilization and Disinfectant Products Other Medical Devices |

| By End-User | Hospitals Clinics Home Healthcare Diagnostic Laboratories Research Institutions Others |

| By Distribution Channel | Direct Sales Authorized Distributors Online Sales Retail Pharmacies Others |

| By Application | Cardiovascular Orthopedics Neurology Oncology General Surgery Others |

| By Price Range | Low-End Devices Mid-Range Devices High-End Devices |

| By Brand Recognition | Established Brands Emerging Brands Private Labels |

| By Regulatory Compliance | CE Marked Products FDA Approved Products ISO Certified Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Coordinators |

| Medical Device Manufacturers | 60 | Sales Directors, Product Managers |

| Healthcare Facility Administrators | 50 | Facility Managers, Operations Directors |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Healthcare Professionals | 80 | Doctors, Nurses, Medical Technologists |

The UAE Medical Devices and Consumables Procurement Market is valued at approximately USD 3.8 billion, driven by increasing demand for advanced healthcare solutions, technological advancements, and rising healthcare expenditure.