Region:Middle East

Author(s):Rebecca

Product Code:KRAD4382

Pages:91

Published On:December 2025

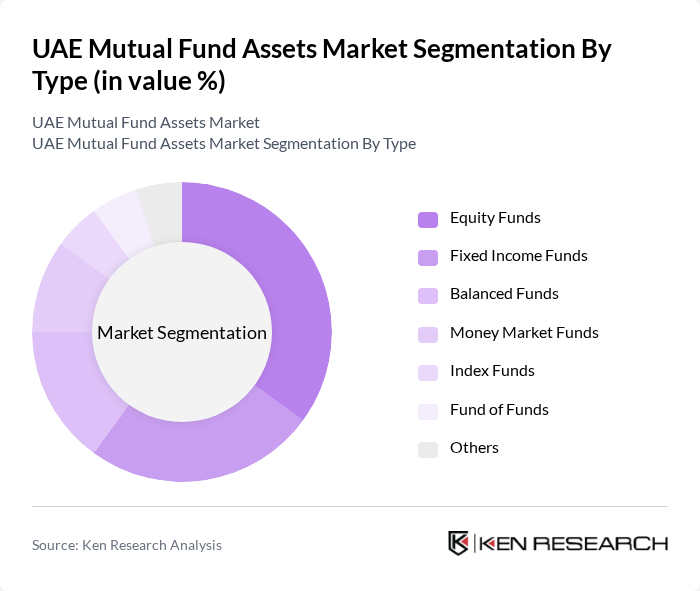

By Type:The mutual fund assets market can be segmented into various types, including equity funds, fixed income funds, balanced funds, money market funds, index funds, fund of funds, and others. Each of these sub-segments caters to different investor preferences and risk appetites. Equity funds have gained significant traction due to their potential for high returns, while fixed income funds appeal to conservative investors seeking stability. Balanced funds offer a mix of both, attracting a diverse range of investors.

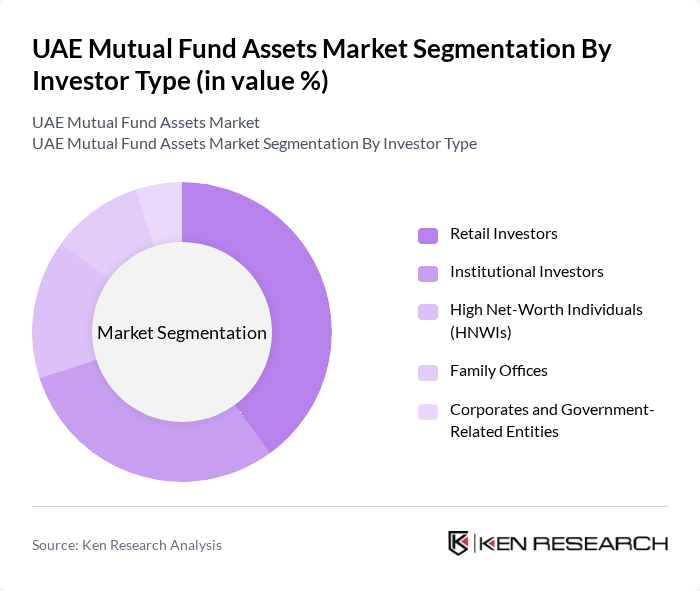

By Investor Type:The investor type segmentation includes retail investors, institutional investors, high net-worth individuals (HNWIs), family offices, and corporates and government-related entities. Retail investors have increasingly participated in the mutual fund market, driven by the availability of digital platforms and financial literacy initiatives. Institutional investors, including pension funds and insurance companies, play a crucial role in providing stability and liquidity to the market.

The UAE Mutual Fund Assets Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD Asset Management, ADCB Asset Management (Abu Dhabi Commercial Bank), FAB Investment Management (First Abu Dhabi Bank), HSBC Global Asset Management (UAE), Mashreq Capital (Mashreq Bank), ENBD REIT and related fund platforms, Shuaa Capital, NBK Capital (UAE operations), Emirates Islamic (Wealth and Asset Management), Dubai Islamic Bank – Investment and Funds, Abu Dhabi Investment Company (Invest AD), Abu Dhabi Investment Authority (ADIA – mutual fund-related mandates), Al Mal Capital, Al Hilal Global Sukuk and Fund Platform, Sharjah Asset Management and related investment vehicles contribute to innovation, geographic expansion, and service delivery in this space.

The UAE mutual fund market is poised for significant transformation in the coming years, driven by technological advancements and evolving investor preferences. The integration of digital platforms is expected to streamline investment processes, making mutual funds more accessible to a broader audience. Additionally, the increasing focus on sustainable investing will likely lead to the development of innovative fund products that cater to environmentally conscious investors, further enhancing market growth and diversification opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Funds Fixed Income Funds Balanced Funds Money Market Funds Index Funds Fund of Funds Others |

| By Investor Type | Retail Investors Institutional Investors High Net-Worth Individuals (HNWIs) Family Offices Corporates and Government-Related Entities |

| By Fund Size | Small Funds (below USD 50 million) Medium Funds (USD 50 million – USD 250 million) Large Funds (above USD 250 million) Others |

| By Investment Strategy | Active Management Passive Management (including ETFs) Shariah-compliant Strategies Thematic and ESG Strategies |

| By Distribution Channel | Direct Sales Bank Branch and Private Banking Networks Independent Financial Advisors Digital and Online Platforms Others |

| By Risk Profile | Capital Preservation / Low Risk Moderate Risk (Balanced) High Risk (Equity and Thematic) Alternative and Absolute Return |

| By Geographic Focus | Domestic (UAE-focused) Funds GCC and MENA-focused Funds Global and International Funds Emerging and Frontier Market Funds |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Insights | 150 | Individual Investors, Financial Advisors |

| Institutional Fund Management | 100 | Portfolio Managers, Institutional Investors |

| Regulatory Impact Assessment | 80 | Regulatory Officials, Compliance Officers |

| Market Trends and Sentiment | 120 | Market Analysts, Economic Researchers |

| Investment Strategy Evaluation | 90 | Wealth Managers, Investment Consultants |

The UAE Mutual Fund Assets Market is valued at approximately USD 5 billion, reflecting a robust growth trajectory driven by increased investor confidence and a diverse range of investment options available to both retail and institutional investors.