Region:Middle East

Author(s):Geetanshi

Product Code:KRAE2907

Pages:94

Published On:December 2025

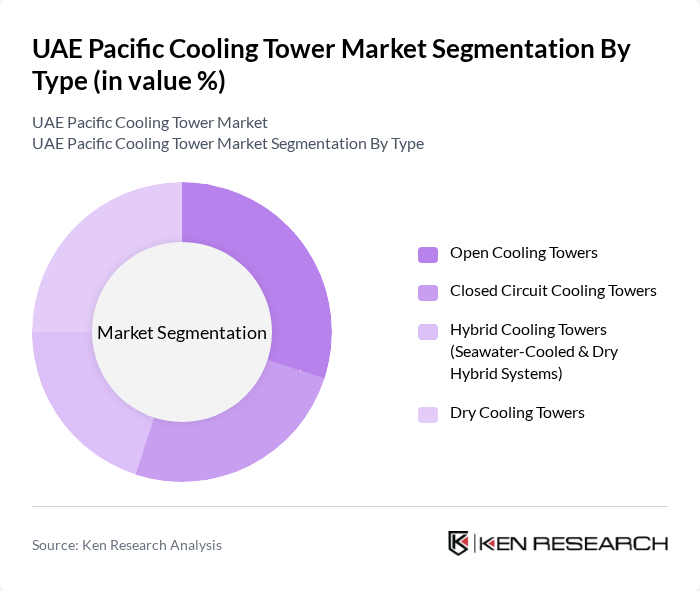

By Type:The market is segmented into various types of cooling towers, including Open Cooling Towers, Closed Circuit Cooling Towers, Hybrid Cooling Towers (Seawater-Cooled & Dry Hybrid Systems), and Dry Cooling Towers. Each type serves different applications and industries, catering to specific cooling needs.

The Open Cooling Towers segment is currently dominating the market due to their widespread use in large-scale industrial applications and power generation facilities. Their efficiency in heat exchange and lower operational costs make them a preferred choice among industries. Additionally, the increasing focus on energy conservation and sustainability is driving the adoption of open cooling systems, which are known for their effectiveness in high-temperature environments.

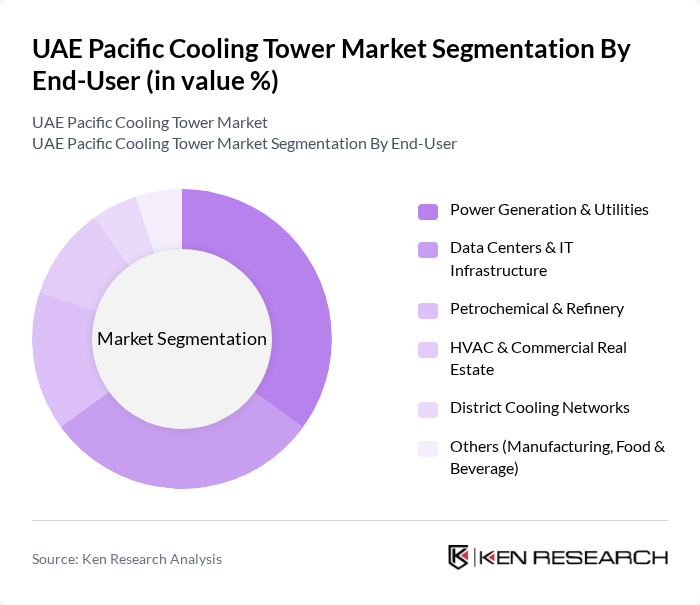

By End-User:The market is categorized based on end-users, including Power Generation & Utilities, Data Centers & IT Infrastructure, Petrochemical & Refinery, HVAC & Commercial Real Estate, District Cooling Networks, and Others (Manufacturing, Food & Beverage). Each end-user segment has unique requirements and contributes differently to the overall market dynamics.

The Power Generation & Utilities segment leads the market due to the high demand for efficient cooling solutions in power plants and utility services. The need for reliable cooling systems to maintain optimal operational temperatures in energy production facilities drives significant investments in cooling tower technologies. Additionally, the growing emphasis on renewable energy sources and sustainable practices further enhances the demand for advanced cooling solutions in this sector.

The UAE Pacific Cooling Tower Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Engineering (UAE-based), Trane Technologies, Carrier Global Corporation, Johnson Controls International, Daikin Industries Ltd., Mitsubishi Electric Corporation, GEA Group AG, SPX Cooling Technologies, Baltimore Air Coil Company (BAC), Evapco, Inc., Babcock & Wilcox Enterprises, Inc., Paharpur Cooling Towers Ltd., Airedale International Air Conditioning Ltd., Thermal Care, Inc., Hamon Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE Pacific cooling tower market appears promising, driven by increasing urbanization and a strong governmental push towards sustainability. As the population grows and infrastructure projects expand, the demand for efficient cooling solutions will likely rise. Additionally, advancements in technology, such as IoT integration, will enhance system performance and user experience. The market is expected to evolve, focusing on innovative solutions that align with environmental goals and energy efficiency standards, creating a robust landscape for growth and development.

| Segment | Sub-Segments |

|---|---|

| By Type | Open Cooling Towers Closed Circuit Cooling Towers Hybrid Cooling Towers (Seawater-Cooled & Dry Hybrid Systems) Dry Cooling Towers |

| By End-User | Power Generation & Utilities Data Centers & IT Infrastructure Petrochemical & Refinery HVAC & Commercial Real Estate District Cooling Networks Others (Manufacturing, Food & Beverage) |

| By Application | HVAC Systems Power Generation & Thermal Plants Process Cooling (Industrial) Data Center Cooling District Cooling Applications |

| By Material | FRP (Fiberglass Reinforced Plastic) Steel Concrete Composite Materials |

| By Capacity Range | Small (< 5 MW) Medium (5–20 MW) Large (> 20 MW) |

| By Cooling Method | Evaporative Cooling Non-Evaporative Cooling Hybrid Evaporative-Dry Systems |

| By Region | Abu Dhabi Dubai Sharjah & Northern Emirates Ras Al Khaimah & Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Cooling Systems | 100 | Facility Managers, Building Engineers |

| Industrial Cooling Applications | 80 | Operations Managers, Plant Engineers |

| Hospitality Sector Cooling Solutions | 70 | Hotel Operations Directors, Maintenance Supervisors |

| Government and Infrastructure Projects | 60 | Project Managers, Procurement Officers |

| Energy Efficiency Initiatives | 90 | Sustainability Managers, Energy Consultants |

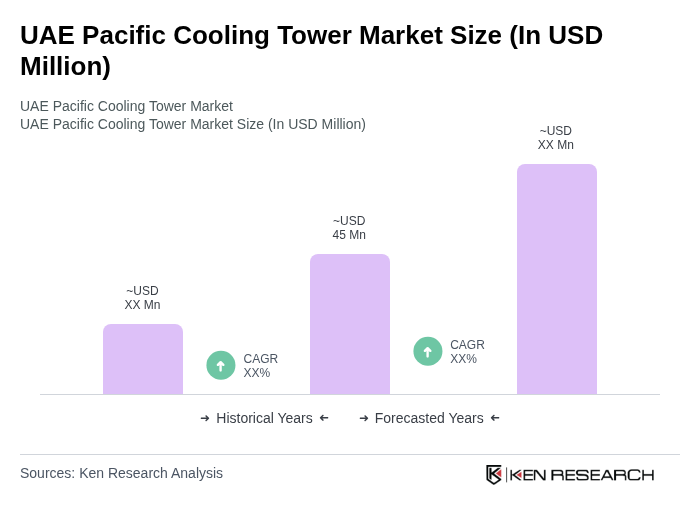

The UAE Pacific Cooling Tower Market is valued at approximately USD 45 million, driven by urbanization, energy-efficient cooling demands, and industrial sector expansion, particularly in power generation and data centers.