Region:Middle East

Author(s):Dev

Product Code:KRAA8354

Pages:99

Published On:November 2025

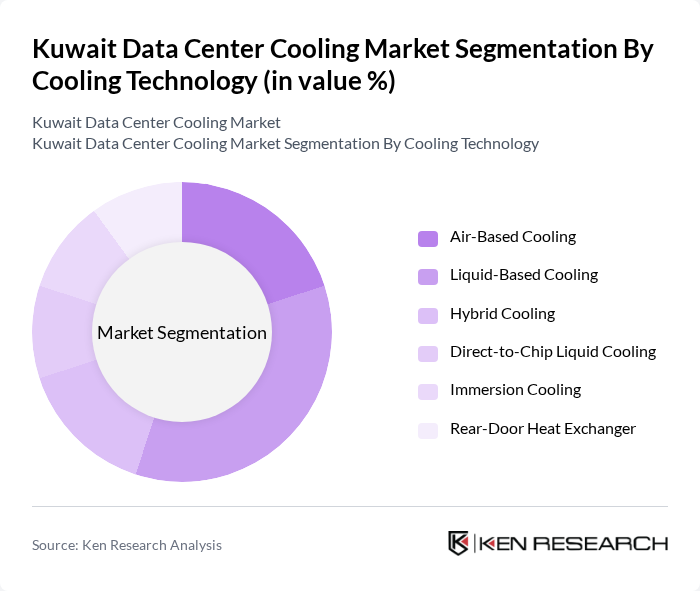

By Cooling Technology:The cooling technology segment comprises various methods used to maintain optimal temperatures in data centers. Subsegments include Air-Based Cooling, Liquid-Based Cooling, Hybrid Cooling, Direct-to-Chip Liquid Cooling, Immersion Cooling, and Rear-Door Heat Exchanger. Liquid-Based Cooling is increasingly favored for its superior efficiency in heat removal and energy savings, especially in high-density and AI-driven environments. Direct-to-Chip and Immersion Cooling are gaining traction for their ability to manage thermal loads in hyperscale and high-performance computing facilities.

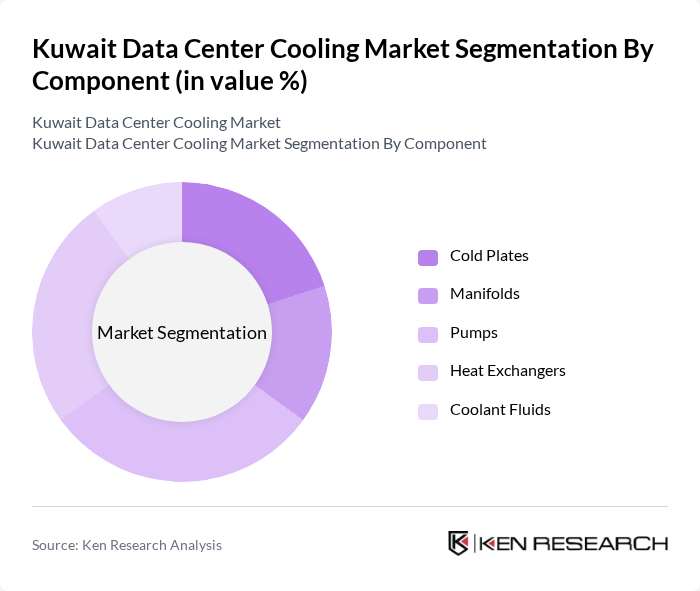

By Component:This segment covers the key components of data center cooling systems, including Cold Plates, Manifolds, Pumps, Heat Exchangers, and Coolant Fluids. Pumps are particularly significant as they enable the circulation of coolant in liquid cooling systems, which are increasingly adopted for their effectiveness in managing heat in high-density and AI-intensive environments. The adoption of advanced heat exchangers and cold plates is also rising, driven by the need for efficient thermal management and operational reliability.

The Kuwait Data Center Cooling Market features a dynamic mix of regional and international players. Leading participants such as Gulf Data Hub, Zain Group, KEMS (Kuwait Electronic Messaging Services), Equinix, STC (Saudi Telecom Company), Ooredoo Kuwait, KIPCO (Kuwait Projects Company Holding K.S.C.P.), Zajil Telecom, KNET (Kuwait National Electronic Technology), Agility Public Warehousing Company, Huawei Technologies Kuwait, Schneider Electric Kuwait, Modine (Airedale by Modine), Johnson Controls International Kuwait, and Vertiv Group Corp. are instrumental in driving innovation, expanding geographic reach, and enhancing service delivery in this sector.

The future of the Kuwait data center cooling market appears promising, driven by technological advancements and increasing awareness of sustainability. As companies prioritize energy efficiency, the adoption of liquid cooling solutions is expected to rise significantly. Furthermore, the integration of artificial intelligence in cooling management systems will enhance operational efficiency, allowing for real-time monitoring and optimization. These trends indicate a shift towards more sustainable and efficient cooling practices, positioning Kuwait as a leader in the regional data center landscape.

| Segment | Sub-Segments |

|---|---|

| By Cooling Technology | Air-Based Cooling Liquid-Based Cooling Hybrid Cooling Direct-to-Chip Liquid Cooling Immersion Cooling Rear-Door Heat Exchanger |

| By Component | Cold Plates Manifolds Pumps Heat Exchangers Coolant Fluids |

| By End-User | Hyperscale Data Centers Colocation Providers Enterprise Data Centers High-Performance Computing (HPC) Facilities |

| By Application | Server Cooling Storage Cooling Networking Equipment Cooling |

| By Industry Vertical | IT & Telecom Healthcare Financial Services Government Retail Media & Entertainment |

| By Sales Channel | Direct Sales Distributors/Resellers System Integrators |

| By Price Range | Entry-Level Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Data Centers | 100 | IT Managers, Data Center Operations Heads |

| Colocation Facilities | 80 | Facility Managers, Sales Directors |

| Cloud Service Providers | 70 | Technical Architects, Infrastructure Managers |

| Cooling Technology Suppliers | 60 | Product Managers, Sales Engineers |

| Energy Efficiency Consultants | 50 | Energy Auditors, Sustainability Officers |

The Kuwait Data Center Cooling Market is valued at approximately USD 55 million, reflecting a significant growth driven by the expansion of data center infrastructure, increased cloud computing adoption, and advancements in cooling technologies.