Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3950

Pages:100

Published On:November 2025

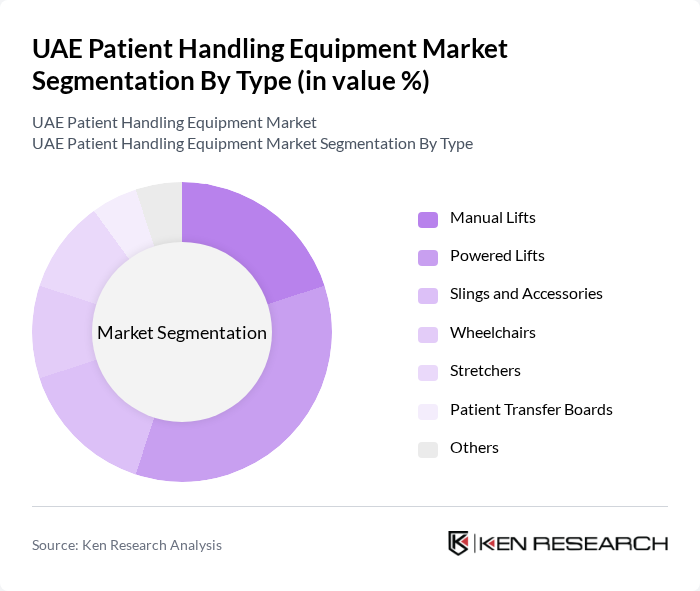

By Type:The market is segmented into various types of patient handling equipment, including Manual Lifts, Powered Lifts, Slings and Accessories, Wheelchairs, Stretchers, Patient Transfer Boards, and Others. Among these, powered lifts are gaining significant traction due to their ease of use and ability to reduce the physical strain on caregivers. The increasing focus on patient safety and comfort is driving the demand for advanced powered lifting solutions.

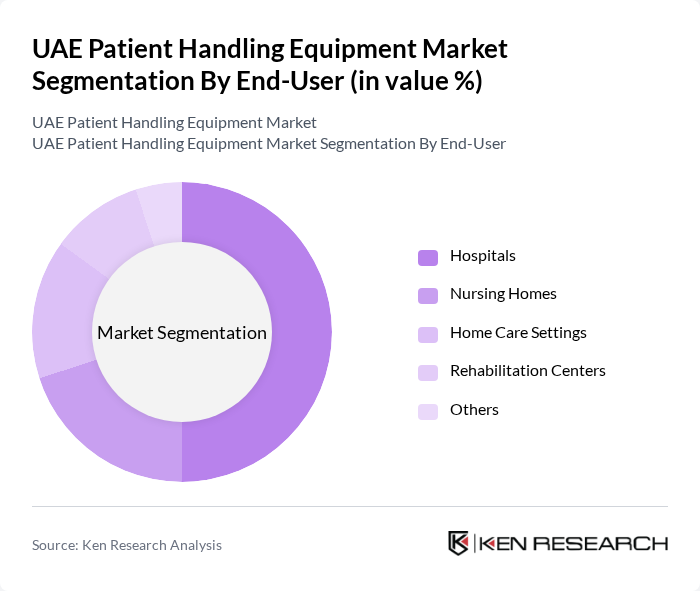

By End-User:The end-user segmentation includes Hospitals, Nursing Homes, Home Care Settings, Rehabilitation Centers, and Others. Hospitals are the leading end-users of patient handling equipment, driven by the need for efficient patient transfer and mobility solutions. The increasing number of surgical procedures and hospital admissions further propels the demand for advanced patient handling solutions in these facilities.

The UAE Patient Handling Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arjo Medical, Invacare Corporation, Hill-Rom Holdings, Inc., Stryker Corporation, Guldmann A/S, Drive DeVilbiss Healthcare, Medline Industries, Inc., Sunrise Medical, K Care Healthcare Solutions, Handicare Group, Joerns Healthcare, Liko, Carex Health Brands, Medtronic, Permobil contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE patient handling equipment market appears promising, driven by ongoing technological advancements and a growing emphasis on patient safety. As healthcare facilities increasingly adopt automated solutions, the demand for innovative equipment is expected to rise. Additionally, the government's commitment to enhancing healthcare infrastructure will likely facilitate the expansion of patient handling solutions, ensuring that facilities are better equipped to meet the needs of an aging population and those with chronic illnesses.

| Segment | Sub-Segments |

|---|---|

| By Type | Manual Lifts Powered Lifts Slings and Accessories Wheelchairs Stretchers Patient Transfer Boards Others |

| By End-User | Hospitals Nursing Homes Home Care Settings Rehabilitation Centers Others |

| By Application | Mobility Assistance Patient Transfer Rehabilitation Emergency Response Others |

| By Material | Steel Aluminum Plastic Composite Materials Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Outlets Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Healthcare Facilities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Directors |

| Rehabilitation Centers | 75 | Physical Therapists, Facility Managers |

| Long-term Care Facilities | 60 | Care Coordinators, Nursing Home Administrators |

| Home Healthcare Providers | 50 | Home Care Managers, Occupational Therapists |

| Medical Equipment Distributors | 80 | Sales Managers, Product Specialists |

The UAE Patient Handling Equipment Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by factors such as an aging population, increased healthcare expenditure, and advancements in medical technology.