Region:Middle East

Author(s):Rebecca

Product Code:KRAD7492

Pages:87

Published On:December 2025

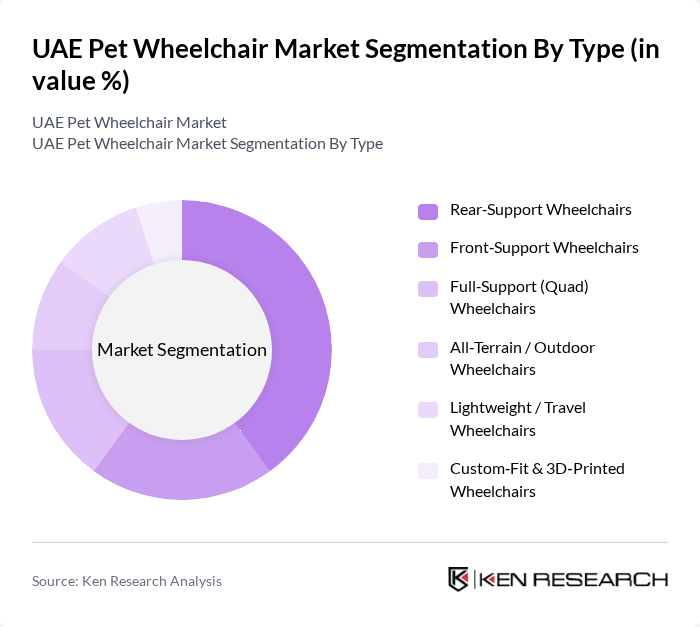

By Type:The market is segmented into various types of pet wheelchairs, including Rear-Support Wheelchairs, Front-Support Wheelchairs, Full-Support (Quad) Wheelchairs, All-Terrain / Outdoor Wheelchairs, Lightweight / Travel Wheelchairs, and Custom-Fit & 3D-Printed Wheelchairs. Among these, Rear-Support Wheelchairs are the most popular due to their ease of use and effectiveness for pets with hind leg mobility issues, consistent with global demand patterns where rear-wheel designs dominate usage. The demand for Custom-Fit & 3D-Printed Wheelchairs is also rising as pet owners seek personalized solutions for their pets, supported by the increasing availability of 3D-printing workshops and customized mobility solutions in the UAE and wider Middle East.

By End-User:The end-user segmentation includes Individual Pet Owners, Veterinary Clinics & Hospitals, Animal Shelters & Rescue Groups, Pet Rehabilitation & Physiotherapy Centers, and Pet Boarding & Daycare Facilities. Individual Pet Owners represent the largest segment, driven by the emotional bond between pets and their owners, leading to increased spending on mobility aids and broader pet mobility solutions such as harnesses, slings, and braces. Veterinary Clinics & Hospitals also play a crucial role in recommending these products to pet owners, often integrating wheelchairs into rehabilitation protocols for post-surgical, geriatric, or neurologically impaired animals.

The UAE Pet Wheelchair Market is characterized by a dynamic mix of regional and international players. Leading participants such as Walkin' Pets (Walkin' Wheels), K9 Carts, Eddie's Wheels for Pets, HandicappedPets.com, Best Friend Mobility, Doggon' Wheels, Walkin' Pets Middle East (Regional Distributor, UAE), ThePetVet Group (UAE Veterinary Network – Mobility Solutions Partner), Modern Vet (UAE Veterinary Clinics Network), British Veterinary Hospital (Dubai), Pet Corner LLC (UAE Pet Retail Chain), Dubai Pet Food (Online Retailer – dubaipetfood.com), Furchild Pet Nutrition LLC (Premium Pet Retail & Rehab Partnerships), Petzone (GCC Pet Retailer with UAE Operations), Local Custom Fabricators & 3D?Printing Workshops (UAE?Based Mobility Aids Makers) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE pet wheelchair market appears promising, driven by increasing pet ownership and a growing emphasis on pet health. As disposable incomes rise, more pet owners are likely to invest in mobility aids. Additionally, the integration of smart technology and eco-friendly materials in product development is expected to attract environmentally conscious consumers. The market is poised for innovation, with potential collaborations between manufacturers and veterinary clinics enhancing product accessibility and awareness.

| Segment | Sub-Segments |

|---|---|

| By Type | Rear?Support Wheelchairs Front?Support Wheelchairs Full?Support (Quad) Wheelchairs All?Terrain / Outdoor Wheelchairs Lightweight / Travel Wheelchairs Custom?Fit & 3D?Printed Wheelchairs |

| By End-User | Individual Pet Owners Veterinary Clinics & Hospitals Animal Shelters & Rescue Groups Pet Rehabilitation & Physiotherapy Centers Pet Boarding & Daycare Facilities |

| By Pet Type | Small Dogs Medium Dogs Large & Giant Breed Dogs Cats Other Small Companion Animals (e.g., rabbits, ferrets) |

| By Material | Aluminum & Aluminum Alloys Stainless Steel Titanium & Advanced Metals Composite & Polymer Frames Hybrid / Modular Materials |

| By Distribution Channel | E?commerce Marketplaces (Amazon.ae, Noon, etc.) Pet Specialty Retail Chains Veterinary Clinics & Hospitals Direct?to?Consumer Brand Websites Importers & Medical / Rehab Equipment Distributors |

| By Price Range | Economy (< AED 700) Mid?Range (AED 700–1,500) Premium (AED 1,500–3,000) Ultra?Premium (> AED 3,000) |

| By Brand Origin | International Brands (Imported) Regional GCC Brands UAE?Based Custom Fabricators Private?Label & Online?Only Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 80 | Veterinarians, Clinic Managers |

| Pet Owners | 120 | Dog and Cat Owners, Pet Care Enthusiasts |

| Pet Mobility Aid Retailers | 60 | Store Managers, Sales Representatives |

| Animal Rehabilitation Centers | 40 | Rehabilitation Specialists, Therapists |

| Pet Industry Experts | 40 | Market Analysts, Industry Consultants |

The UAE Pet Wheelchair Market is valued at approximately USD 5 million, reflecting a growing demand driven by increased pet ownership, awareness of pet health, and advancements in veterinary care.