Region:Middle East

Author(s):Shubham

Product Code:KRAA8832

Pages:94

Published On:November 2025

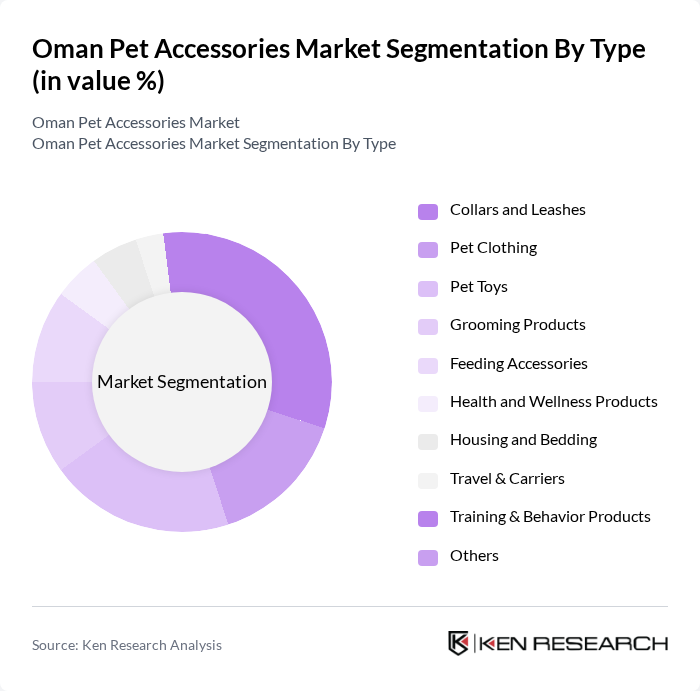

By Type:The market is segmented into various types of pet accessories, including collars and leashes, pet clothing, pet toys, grooming products, feeding accessories, health and wellness products, housing and bedding, travel & carriers, training & behavior products, and others. Among these, collars and leashes are the most popular due to their essential role in pet safety and control, while grooming products are gaining traction as pet owners increasingly prioritize hygiene and appearance. Smart collars offering GPS tracking and health monitoring capabilities are emerging as innovative product categories, reflecting the broader trend of technology integration in pet accessories.

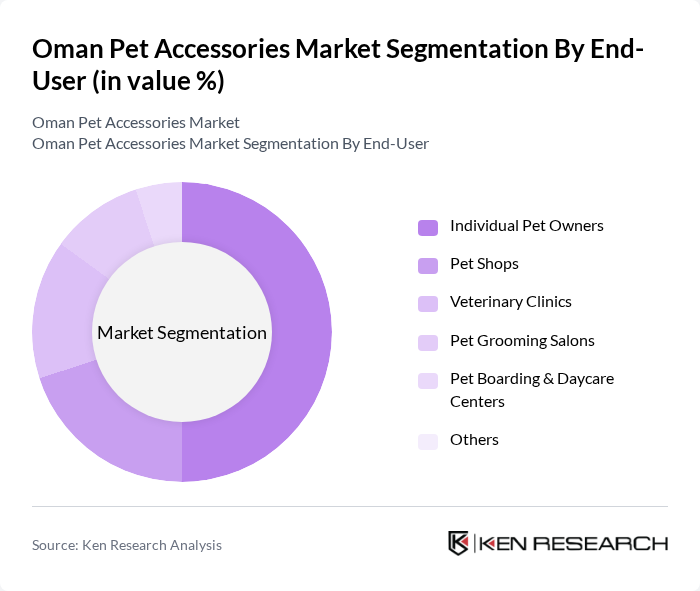

By End-User:The end-user segmentation includes individual pet owners, pet shops, veterinary clinics, pet grooming salons, pet boarding & daycare centers, and others. Individual pet owners dominate the market, driven by the increasing trend of pet ownership and the willingness to invest in quality accessories for their pets. Pet shops and veterinary clinics also play a significant role in the distribution of pet accessories.

The Oman Pet Accessories Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pet Arabia (Oman), Pet Station Oman, Al Qurum Veterinary Clinic (Retail Division), The Pet Shop Oman, Pets World Oman, Pet House Oman, Pet Zone Oman, Royal Pet Supplies, Muscat Pets, Petland Oman, Pet Planet Oman, Al Hayat Veterinary Clinic (Retail), Pet Oasis Oman, Pet Boutique Oman, Pet Express Oman contribute to innovation, geographic expansion, and service delivery in this space.

The Oman pet accessories market is poised for significant growth, driven by increasing pet ownership and rising disposable incomes. As consumers become more aware of pet health and wellness, the demand for high-quality and innovative products is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer choice. Overall, the market is likely to evolve, with a focus on sustainability and technology integration in pet care solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Collars and Leashes Pet Clothing Pet Toys Grooming Products Feeding Accessories Health and Wellness Products Housing and Bedding Travel & Carriers Training & Behavior Products Others |

| By End-User | Individual Pet Owners Pet Shops Veterinary Clinics Pet Grooming Salons Pet Boarding & Daycare Centers Others |

| By Pet Type | Dogs Cats Birds Small Mammals Reptiles & Aquatics Others |

| By Distribution Channel | Online Retail Offline Retail Specialty Stores Supermarkets/Hypermarkets Veterinary Clinics Others |

| By Price Range | Economy Mid-Range Premium Luxury Others |

| By Brand Type | Local Brands International Brands Private Labels Others |

| By Material Type | Plastic Fabric Metal Natural Materials Eco-Friendly/Biodegradable Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Accessory Retailers | 80 | Store Owners, Retail Managers |

| Pet Owners | 120 | Dog and Cat Owners, Pet Enthusiasts |

| Veterinarians and Pet Care Professionals | 50 | Veterinarians, Pet Groomers |

| E-commerce Platforms | 40 | E-commerce Managers, Marketing Directors |

| Pet Industry Experts | 20 | Market Analysts, Industry Consultants |

The Oman Pet Accessories Market is valued at approximately USD 165 million, reflecting a significant growth trend driven by increasing pet ownership, rising disposable incomes, and a shift towards premium pet products.