Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9068

Pages:100

Published On:November 2025

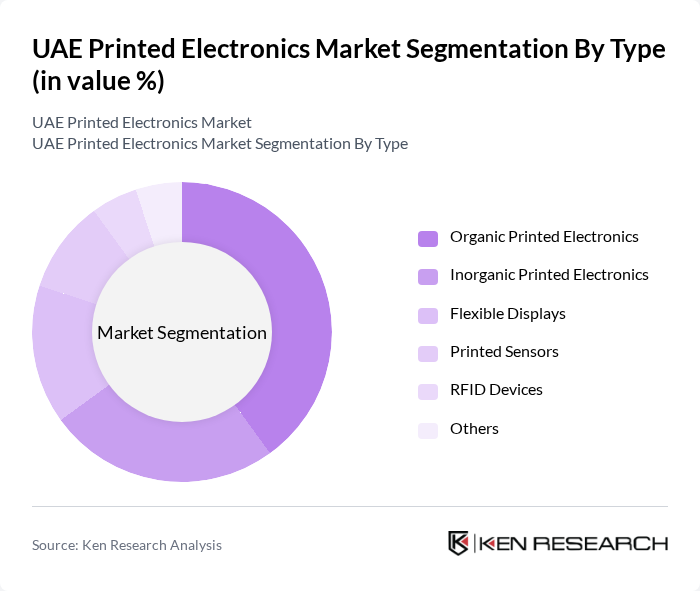

By Type:The segmentation by type includes Organic Printed Electronics, Inorganic Printed Electronics, Flexible Displays, Printed Sensors, RFID Devices, and Others. Organic Printed Electronics currently lead the market due to their flexibility, lightweight nature, and compatibility with various substrates. The demand for flexible and lightweight devices in consumer electronics and wearables continues to drive growth in this sub-segment. Inorganic Printed Electronics are gaining traction for applications requiring greater durability and performance, especially in industrial and automotive sectors.

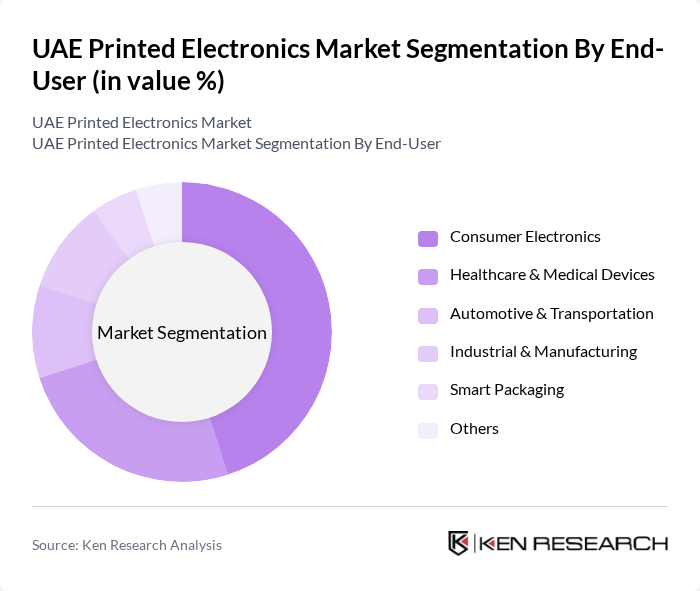

By End-User:The end-user segmentation includes Consumer Electronics, Healthcare & Medical Devices, Automotive & Transportation, Industrial & Manufacturing, Smart Packaging, and Others. The Consumer Electronics segment is the largest contributor, driven by demand for smart devices and wearables. The healthcare sector is experiencing rapid growth due to increased adoption of printed sensors and medical devices, which improve patient monitoring and diagnostics. Automotive and industrial segments are also expanding, leveraging printed electronics for enhanced performance and integration.

The UAE Printed Electronics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nano Dimension Ltd., DuPont de Nemours, Inc., Henkel AG & Co. KGaA, Agfa-Gevaert Group, E Ink Holdings Inc., Samsung Display Co., Ltd., LG Display Co., Ltd., Molex LLC, FlexEnable Limited, PragmatIC Semiconductor, Xymox Technologies, Inc., TNO (Netherlands Organization for Applied Scientific Research), Thin Film Electronics ASA, Ahlstrom-Munksjö Oyj, SmartKem Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE printed electronics market appears promising, driven by technological advancements and increasing consumer demand for innovative products. As the integration of IoT continues to rise, printed electronics will play a pivotal role in creating smarter devices. Additionally, the shift towards sustainable materials is expected to gain momentum, aligning with global trends towards eco-friendly manufacturing practices. These factors will likely foster a more dynamic and competitive market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Organic Printed Electronics Inorganic Printed Electronics Flexible Displays Printed Sensors RFID Devices Others |

| By End-User | Consumer Electronics Healthcare & Medical Devices Automotive & Transportation Industrial & Manufacturing Smart Packaging Others |

| By Application | Wearables Smart Packaging & Labels Medical & Health Monitoring Automotive Electronics Home Automation & IoT Devices Others |

| By Material | Conductive Inks Substrates (Plastic, Paper, Glass, Others) Encapsulation Materials Others |

| By Technology | Inkjet Printing Screen Printing Gravure Printing Flexography Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 100 | Product Managers, R&D Directors |

| Automotive Industry Applications | 80 | Engineering Managers, Procurement Specialists |

| Healthcare Device Producers | 70 | Quality Assurance Managers, Regulatory Affairs Officers |

| Retail Sector Implementations | 50 | Supply Chain Managers, Operations Directors |

| Research Institutions and Universities | 40 | Academic Researchers, Technology Transfer Officers |

The UAE Printed Electronics Market is valued at approximately USD 1.1 billion, driven by advancements in printing technologies, increasing demand for smart packaging, and the adoption of printed electronics in consumer electronics and healthcare applications.