Region:Middle East

Author(s):Rebecca

Product Code:KRAD7494

Pages:90

Published On:December 2025

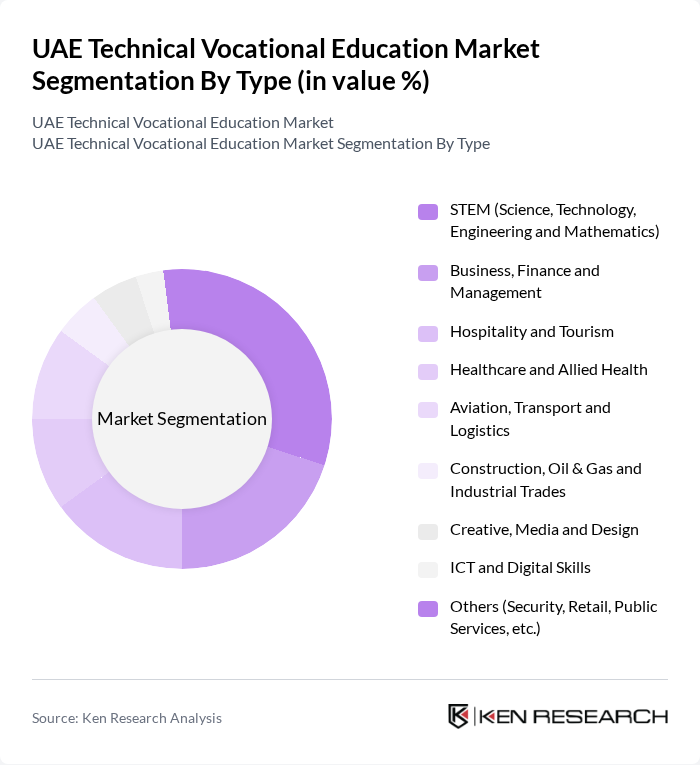

By Type:The market is segmented into various types of vocational education programs, including STEM (Science, Technology, Engineering and Mathematics), Business, Finance and Management, Hospitality and Tourism, Healthcare and Allied Health, Aviation, Transport and Logistics, Construction, Oil & Gas and Industrial Trades, Creative, Media and Design, ICT and Digital Skills, and Others (Security, Retail, Public Services, etc.). Among these, STEM programs are particularly dominant, in line with national development agendas that prioritize engineering, applied sciences, and technology fields to support economic diversification and high?tech industries. In the UAE technical and vocational education market, STEM accounted for the largest share of course-type revenue, reflecting strong demand for engineering, technical, and ICT?related qualifications. The demand for skilled professionals in engineering, digital technologies, aviation, logistics, and energy is driving higher enrollment in STEM?oriented TVET and applied programs.

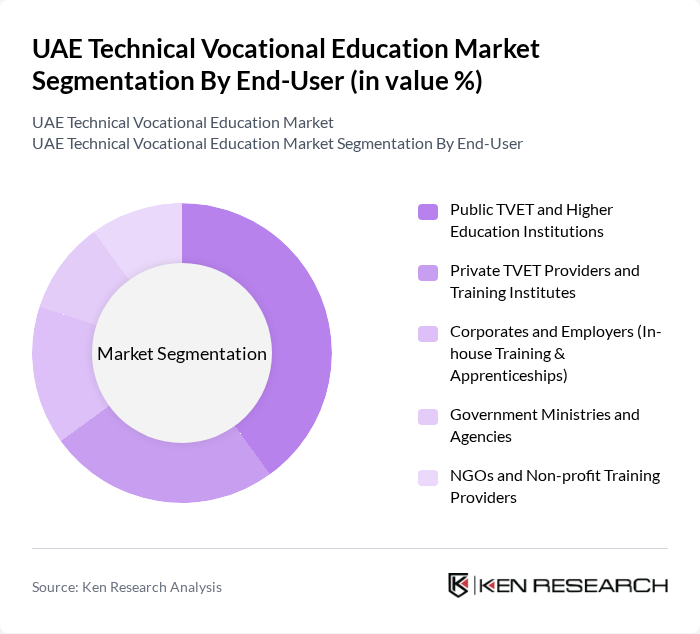

By End-User:The end-user segmentation includes Public TVET and Higher Education Institutions, Private TVET Providers and Training Institutes, Corporates and Employers (In-house Training & Apprenticeships), Government Ministries and Agencies, and NGOs and Non-profit Training Providers. Public institutions dominate the market, consistent with broader Middle East and Africa patterns where governments are the primary funders and operators of TVET systems and use them as a lever for national development and workforce strategies. In the UAE, public higher education and vocational institutions receive substantial state investment to expand capacity, modernize facilities, and align programs with priority sectors, which facilitates access to vocational training for a larger share of the population. The increasing collaboration between public institutions and private-sector employers—through internships, apprenticeships, sector skills councils, and co-designed curricula—is enhancing the quality, work?readiness, and relevance of vocational education offerings.

The UAE Technical Vocational Education Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Vocational Education and Training Institute (ADVETI), Institute of Applied Technology (IAT), Higher Colleges of Technology (HCT), Abu Dhabi Polytechnic, Emirates Aviation University, Dubai College of Tourism, Emirates Academy of Hospitality Management, Dubai Institute of Design and Innovation (DIDI), National Qualifications Centre (NQC) / TVET Awarding Body, Emirates Driving Institute, Al Ghurair University, Abu Dhabi University – Continuing Education & Professional Development Center, University of Dubai – Professional and Continuing Education Center, University of Sharjah – Community College and Professional Training Programs, Private TVET Provider Example: SAE Institute Dubai / Other Specialized Training Institutes contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE technical vocational education market appears promising, driven by increasing government support and industry collaboration. As the demand for skilled labor continues to rise, institutions are likely to expand their offerings, particularly in emerging sectors such as technology and renewable energy. Additionally, the integration of online training platforms will enhance accessibility, allowing more individuals to pursue vocational education. This evolution will ultimately contribute to a more skilled workforce, aligning with the UAE's economic diversification goals.

| Segment | Sub-Segments |

|---|---|

| By Type | STEM (Science, Technology, Engineering and Mathematics) Business, Finance and Management Hospitality and Tourism Healthcare and Allied Health Aviation, Transport and Logistics Construction, Oil & Gas and Industrial Trades Creative, Media and Design ICT and Digital Skills Others (Security, Retail, Public Services, etc.) |

| By End-User | Public TVET and Higher Education Institutions Private TVET Providers and Training Institutes Corporates and Employers (In?house Training & Apprenticeships) Government Ministries and Agencies NGOs and Non?profit Training Providers |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain |

| By Delivery Mode | Campus-based (In?Person) Training Fully Online / Virtual Training Blended / Hybrid Learning Work-based Learning and Apprenticeships Corporate / In?company Training Programs |

| By Duration of Courses | Short-Term Courses (up to 6 months) Medium-Term Courses (6–18 months) Long-Term Programs (2 years and above) Certificate Programs Diploma and Higher Diploma Programs |

| By Funding Source | Federal and Emirate Government Funding Corporate and Employer-sponsored Training Budgets Private Tuition and Self-funded Learners Scholarships and Grants (Local & International) Others (Multilateral and Philanthropic Funding) |

| By Industry Focus | Energy, Oil & Gas and Utilities Construction and Real Estate Transport, Aviation and Logistics ICT, Digital and Advanced Technologies Hospitality, Tourism and Retail Healthcare and Social Services Manufacturing and Industrial Production Public Administration, Defense and Security Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vocational Training Centers | 100 | Directors, Program Coordinators |

| Technical Colleges | 80 | Deans, Faculty Members |

| Government Education Officials | 50 | Policy Makers, Education Inspectors |

| Industry Employers | 70 | HR Managers, Training Coordinators |

| Students and Alumni | 90 | Current Students, Recent Graduates |

The UAE Technical Vocational Education Market is valued at approximately USD 14 million, driven by the increasing demand for skilled labor in sectors such as construction, healthcare, hospitality, and technology, as well as government initiatives aimed at enhancing vocational training.