Region:Middle East

Author(s):Rebecca

Product Code:KRAB6861

Pages:81

Published On:October 2025

and Telematics Market.png)

By Type:The market can be segmented into various types, including Pay-As-You-Drive, Pay-How-You-Drive, Usage-Based Fleet Insurance, and Others. Each of these sub-segments caters to different consumer needs and preferences, with Pay-As-You-Drive being particularly popular among individual consumers seeking cost-effective insurance solutions based on their actual driving behavior.

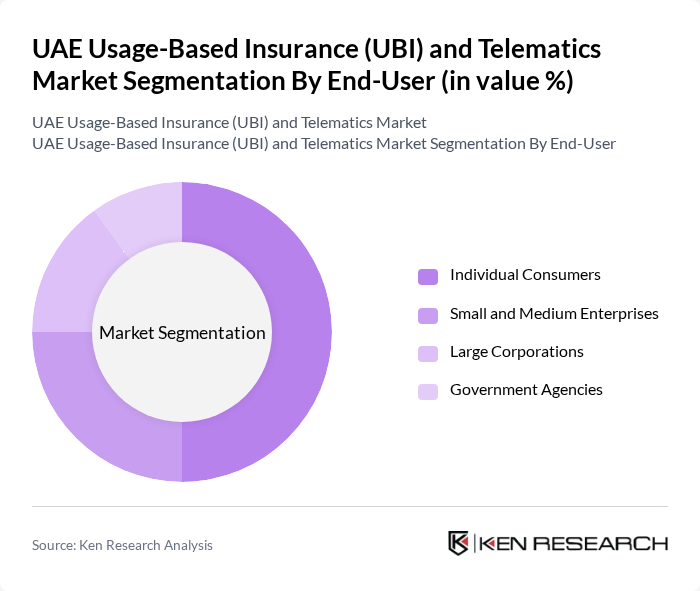

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises, Large Corporations, and Government Agencies. Individual Consumers are the largest segment, driven by the increasing demand for personalized insurance products that align with their driving habits and preferences.

The UAE Usage-Based Insurance (UBI) and Telematics Market is characterized by a dynamic mix of regional and international players. Leading participants such as AXA Gulf, Oman Insurance Company, Abu Dhabi National Insurance Company (ADNIC), Dubai Insurance Company, Al Fujairah National Insurance Company, Emirates Insurance Company, Noor Takaful, Qatar Insurance Company, RSA Insurance Group, Zurich Insurance Group, National General Insurance, Union Insurance Company, Daman National Health Insurance Company, Al Ain Ahlia Insurance Company, Takaful Emarat contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE UBI and telematics market appears promising, driven by technological advancements and evolving consumer preferences. As the market matures, insurers are likely to enhance their offerings with innovative telematics features, improving customer engagement and satisfaction. Additionally, the integration of artificial intelligence in risk assessment will streamline underwriting processes, making UBI more accessible. With the government's continued support for smart city initiatives, the market is poised for significant growth, fostering a safer driving environment and promoting responsible insurance practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Pay-As-You-Drive Pay-How-You-Drive Usage-Based Fleet Insurance Others |

| By End-User | Individual Consumers Small and Medium Enterprises Large Corporations Government Agencies |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Two-Wheelers Others |

| By Distribution Channel | Direct Sales Online Platforms Insurance Brokers Others |

| By Pricing Model | Fixed Pricing Dynamic Pricing Subscription-Based Pricing Others |

| By Data Source | Telematics Devices Mobile Applications Third-Party Data Providers Others |

| By Policy Type | Comprehensive Coverage Third-Party Liability Collision Coverage Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Insurance Providers Offering UBI | 100 | Product Managers, Underwriters |

| Telematics Service Providers | 80 | Technical Directors, Business Development Managers |

| Automotive Manufacturers with Telematics Integration | 70 | R&D Managers, Product Development Leads |

| Consumers Using UBI Policies | 150 | Policyholders, Vehicle Owners |

| Regulatory Bodies and Industry Associations | 50 | Policy Analysts, Regulatory Affairs Managers |

Usage-Based Insurance (UBI) in the UAE is a type of auto insurance that calculates premiums based on actual driving behavior. It utilizes telematics technology to monitor factors like speed, distance, and driving patterns, allowing insurers to offer personalized rates that reflect individual risk profiles.