Region:Middle East

Author(s):Shubham

Product Code:KRAB7449

Pages:81

Published On:October 2025

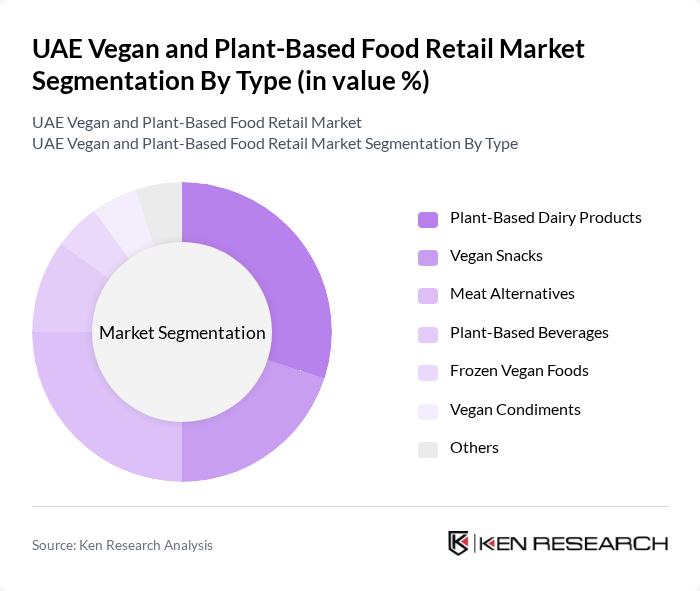

By Type:The market is segmented into various types of vegan and plant-based products, including Plant-Based Dairy Products, Vegan Snacks, Meat Alternatives, Plant-Based Beverages, Frozen Vegan Foods, Vegan Condiments, and Others. Among these, Plant-Based Dairy Products have emerged as a leading segment due to the increasing demand for lactose-free alternatives and the growing popularity of plant-based milk and yogurt. Consumers are increasingly seeking healthier options, which has led to a rise in the availability and variety of these products.

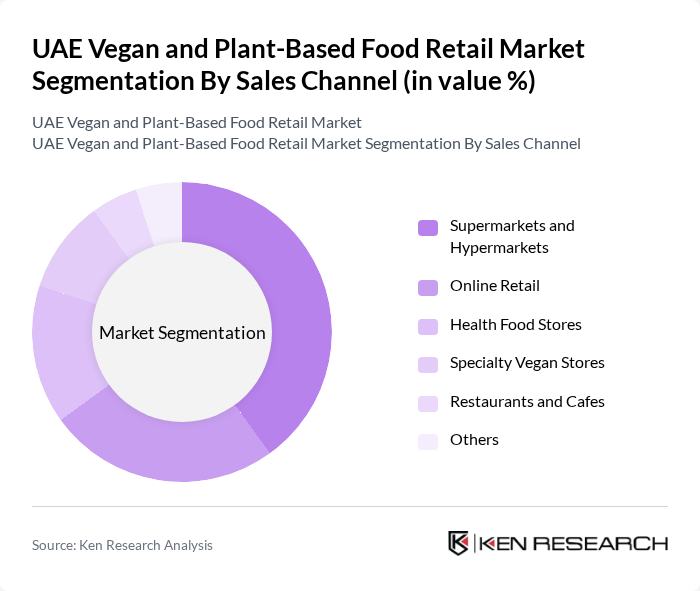

By Sales Channel:The sales channels for vegan and plant-based products include Supermarkets and Hypermarkets, Online Retail, Health Food Stores, Specialty Vegan Stores, Restaurants and Cafes, and Others. Supermarkets and Hypermarkets dominate the market due to their extensive reach and ability to offer a wide variety of products under one roof. The convenience of shopping in these large retail formats, combined with the growing trend of health-conscious consumers, has significantly boosted sales in this channel.

The UAE Vegan and Plant-Based Food Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alpro, Beyond Meat, Oatly, Quorn Foods, Tofurky, Violife, The Happy Pear, Vivera, Greenleaf Foods, Daiya Foods, Follow Your Heart, Lightlife Foods, Gardein, Tofutti, PlantFusion contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE vegan and plant-based food retail market appears promising, driven by increasing health consciousness and government initiatives. As consumer preferences shift towards sustainable and healthy eating, the market is expected to see a rise in innovative product offerings. Additionally, the expansion of e-commerce platforms will facilitate greater access to vegan products, enhancing market penetration. Collaborations with local restaurants and cafes will further boost visibility and acceptance of plant-based options among consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Plant-Based Dairy Products Vegan Snacks Meat Alternatives Plant-Based Beverages Frozen Vegan Foods Vegan Condiments Others |

| By Sales Channel | Supermarkets and Hypermarkets Online Retail Health Food Stores Specialty Vegan Stores Restaurants and Cafes Others |

| By Consumer Demographics | Age Group (Millennials, Gen Z, etc.) Income Level (Low, Middle, High) Lifestyle (Health-Conscious, Ethical Consumers) |

| By Packaging Type | Eco-Friendly Packaging Bulk Packaging Single-Serve Packaging |

| By Price Range | Premium Products Mid-Range Products Budget Products |

| By Brand Loyalty | Established Brands Emerging Brands Private Labels |

| By Nutritional Content | High-Protein Products Low-Calorie Products Fortified Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vegan Food Retailers | 100 | Store Managers, Buyers, and Category Managers |

| Consumers of Plant-Based Products | 150 | Health-Conscious Shoppers, Vegan Diet Adopters |

| Food Service Providers | 80 | Restaurant Owners, Menu Planners, Chefs |

| Nutrition and Health Experts | 60 | Dietitians, Nutritionists, Health Coaches |

| Distributors and Wholesalers | 70 | Supply Chain Managers, Sales Representatives |

The UAE Vegan and Plant-Based Food Retail Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing consumer awareness of health benefits and environmental sustainability.