Region:Middle East

Author(s):Dev

Product Code:KRAB7815

Pages:80

Published On:October 2025

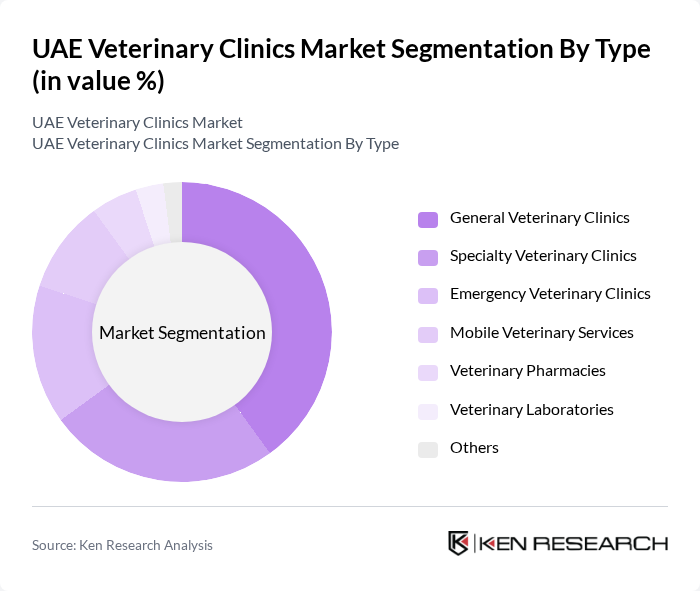

By Type:The market is segmented into various types of veterinary clinics, including General Veterinary Clinics, Specialty Veterinary Clinics, Emergency Veterinary Clinics, Mobile Veterinary Services, Veterinary Pharmacies, Veterinary Laboratories, and Others. General Veterinary Clinics are the most prevalent, providing a wide range of services for common pet health issues. Specialty Veterinary Clinics cater to specific animal needs, while Emergency Veterinary Clinics offer urgent care. Mobile Veterinary Services are gaining traction due to their convenience, and Veterinary Pharmacies and Laboratories support the overall healthcare ecosystem.

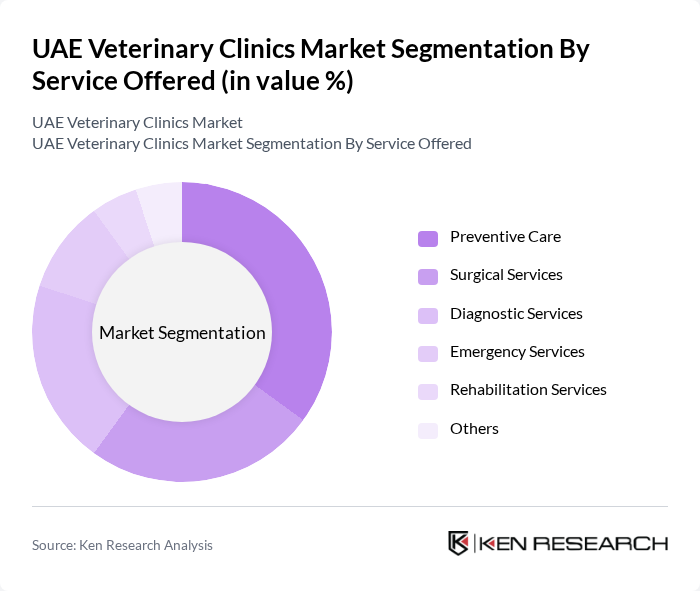

By Service Offered:The services offered by veterinary clinics include Preventive Care, Surgical Services, Diagnostic Services, Emergency Services, Rehabilitation Services, and Others. Preventive Care is the leading service segment, driven by pet owners' increasing focus on regular health check-ups and vaccinations. Surgical Services and Emergency Services are also critical, addressing urgent health issues. Diagnostic Services are essential for accurate treatment, while Rehabilitation Services are gaining popularity as pet owners seek comprehensive care for their animals.

The UAE Veterinary Clinics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vets4Pets, Dubai Animal Hospital, Pet Care Veterinary Clinic, The Animal Clinic, Al Ain Animal Hospital, Abu Dhabi Veterinary Hospital, Pet Zone Veterinary Clinic, The Vet Clinic, Dubai Veterinary Clinic, Emirates Veterinary Clinic, Animal Care Clinic, The Pet Hospital, Veterinary Medical Center, Al Quoz Veterinary Clinic, Oasis Veterinary Clinic contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE veterinary clinics market appears promising, driven by technological advancements and a shift towards preventive care. As telemedicine becomes more prevalent, clinics are expected to adopt digital platforms for consultations, enhancing accessibility for pet owners. Additionally, the increasing focus on specialized veterinary services will likely lead to the establishment of niche clinics, catering to specific pet health needs, thereby expanding the market landscape significantly.

| Segment | Sub-Segments |

|---|---|

| By Type | General Veterinary Clinics Specialty Veterinary Clinics Emergency Veterinary Clinics Mobile Veterinary Services Veterinary Pharmacies Veterinary Laboratories Others |

| By Service Offered | Preventive Care Surgical Services Diagnostic Services Emergency Services Rehabilitation Services Others |

| By Animal Type | Dogs Cats Exotic Pets Farm Animals Others |

| By Geographic Location | Urban Areas Suburban Areas Rural Areas Others |

| By Customer Segment | Pet Owners Breeders Shelters and Rescues Veterinary Professionals Others |

| By Payment Model | Pay-Per-Visit Subscription Services Insurance-Based Payments Others |

| By Marketing Channel | Online Marketing Referral Programs Community Events Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics in Dubai | 100 | Clinic Owners, Veterinarians |

| Pet Owners in Abu Dhabi | 150 | Pet Owners, Animal Caregivers |

| Veterinary Technicians Across UAE | 80 | Veterinary Technicians, Support Staff |

| Pet Supply Retailers | 60 | Retail Managers, Product Buyers |

| Animal Welfare Organizations | 50 | Non-profit Managers, Animal Welfare Advocates |

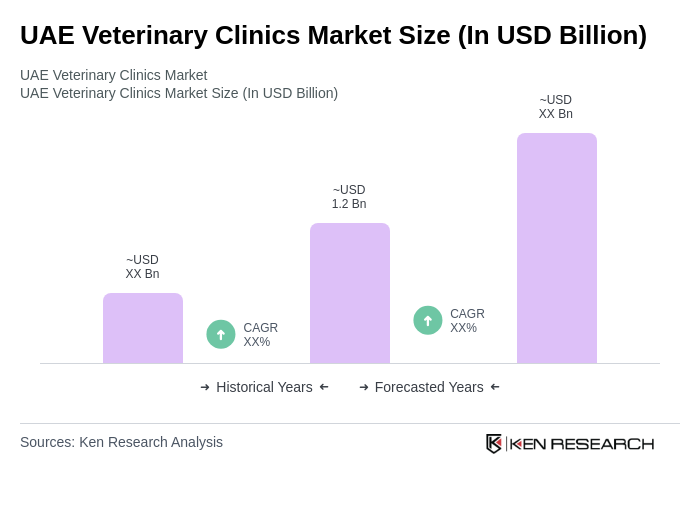

The UAE Veterinary Clinics Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing pet ownership, rising disposable incomes, and heightened awareness of animal health and welfare among pet owners.