Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3380

Pages:81

Published On:January 2026

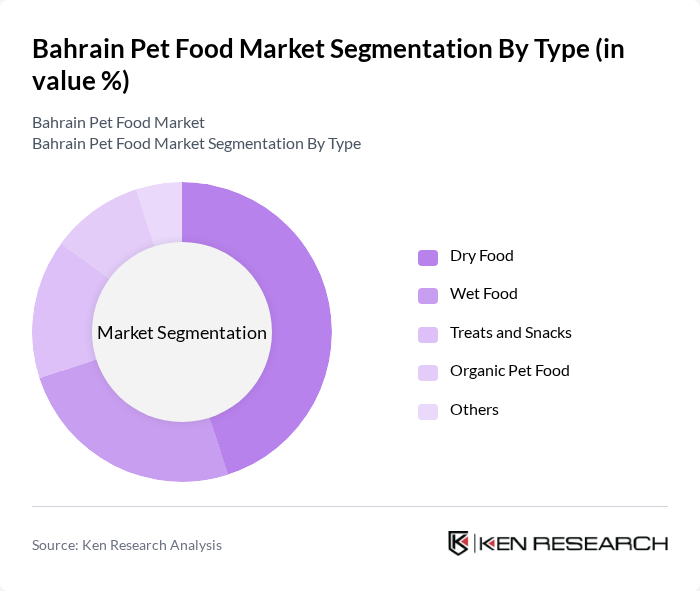

By Type:The pet food market can be segmented into various types, including Dry Food, Wet Food, Treats and Snacks, Organic Pet Food, Functional Pet Food, and Others. Among these, Dry Food is the most popular choice among pet owners due to its convenience, longer shelf life, and cost-effectiveness. Wet Food, while also popular, tends to be more expensive and is often used as a supplement to dry food. Treats and Snacks are gaining traction as pet owners increasingly view them as a way to reward and bond with their pets. Organic and Functional Pet Foods are emerging trends, driven by health-conscious consumers seeking natural and specialized nutrition for their pets.

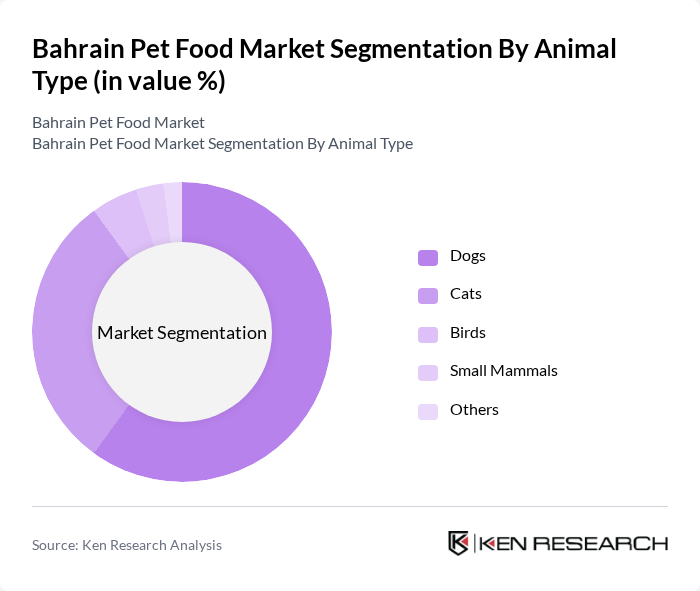

By Animal Type:The market can also be segmented based on the type of animals, including Dogs, Cats, Birds, Small Mammals, and Others. Dogs and Cats dominate the market, with dog food accounting for a larger share due to the higher number of dog owners in Bahrain. The trend towards premium and specialized diets for pets is particularly strong among dog owners, who are increasingly seeking high-quality nutrition. Birds and Small Mammals represent niche segments, but they are growing as more consumers adopt these pets and seek appropriate food options.

The Bahrain Pet Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mars Petcare, Nestlé Purina PetCare, Hill's Pet Nutrition, Royal Canin, Spectrum Brands, PetSmart, Blue Buffalo, WellPet, Diamond Pet Foods, Canidae, Tuffy's Pet Foods, Nutro, Fromm Family Foods, Merrick Pet Care, Zignature contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain pet food market is poised for significant evolution, driven by increasing pet ownership and a shift towards premium products. As consumer preferences evolve, the demand for natural and organic pet food is expected to rise, reflecting a broader trend towards health and wellness. Additionally, the growth of e-commerce platforms will facilitate easier access to a wider range of products, enhancing market dynamics. These factors will collectively shape a more competitive and diverse pet food landscape in Bahrain.

| Segment | Sub-Segments |

|---|---|

| By Type | Dry Food Wet Food Treats and Snacks Organic Pet Food Functional Pet Food Others |

| By Animal Type | Dogs Cats Birds Small Mammals Others |

| By Distribution Channel | Supermarkets/Hypermarkets Pet Specialty Stores Online Retail Veterinary Clinics Others |

| By Price Range | Economy Mid-Range Premium Super Premium Others |

| By Packaging Type | Bags Cans Pouches Others |

| By Brand Type | National Brands Private Labels Imported Brands Others |

| By Consumer Demographics | Age Group Income Level Urban vs Rural Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Owner Insights | 150 | Dog and Cat Owners, Pet Enthusiasts |

| Retailer Feedback | 100 | Pet Store Managers, Supermarket Buyers |

| Veterinary Perspectives | 80 | Veterinarians, Animal Nutritionists |

| Distributor Insights | 70 | Pet Food Distributors, Supply Chain Managers |

| Market Trend Analysts | 60 | Market Researchers, Industry Analysts |

The Bahrain Pet Food Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by increasing pet ownership, rising disposable incomes, and heightened awareness of pet nutrition among consumers.