Region:Middle East

Author(s):Rebecca

Product Code:KRAD8486

Pages:84

Published On:December 2025

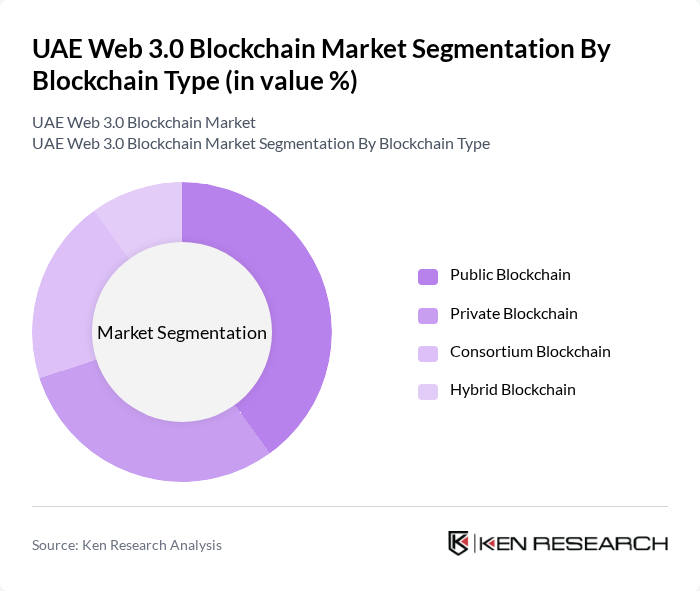

By Blockchain Type:The blockchain type segmentation includes Public Blockchain, Private Blockchain, Consortium Blockchain, and Hybrid Blockchain. Public Blockchain is gaining traction due to its decentralized nature, allowing for greater transparency and security. Private Blockchain is preferred by enterprises for its control and privacy features. Consortium Blockchain is emerging as a collaborative solution for industries requiring shared governance, while Hybrid Blockchain combines the benefits of both public and private models, catering to diverse business needs.

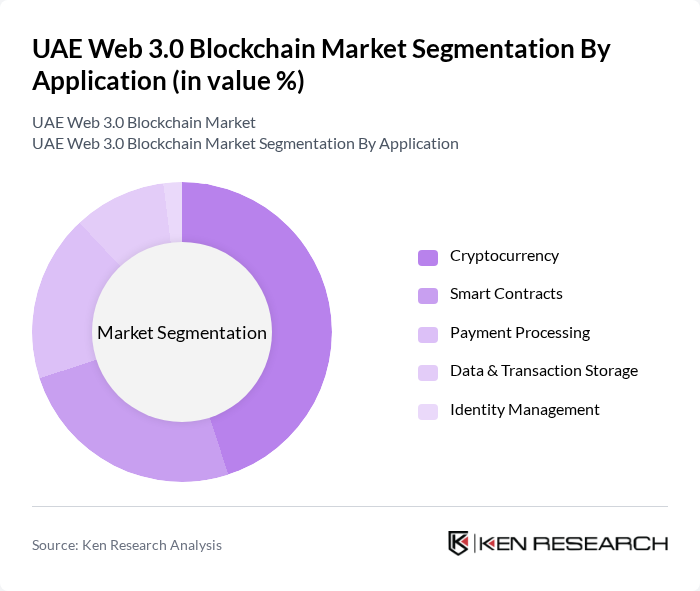

By Application:The application segmentation encompasses Cryptocurrency, Smart Contracts, Payment Processing, Data & Transaction Storage, and Identity Management. Cryptocurrency applications are leading the market due to the growing interest in digital currencies and decentralized finance platforms. Smart Contracts are gaining popularity for automating agreements and enhancing operational efficiency, while Payment Processing is essential for facilitating secure transactions. Data & Transaction Storage is crucial for maintaining immutable records, and Identity Management is emerging as a critical application for enhancing security and user verification in blockchain ecosystems.

The UAE Web 3.0 Blockchain Market is characterized by a dynamic mix of regional and international players. Leading participants such as ConsenSys, Binance, BitOasis, Flexsin, Nadcab Labs, Crypto.com, IBM Blockchain, ChainSafe Systems, Alchemy, Ledger, VeChain, Tezos, Blockstream, Circle, Polygon contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE Web 3.0 blockchain market appears promising, driven by increasing investments and technological advancements. As the government continues to support blockchain initiatives, the integration of blockchain with emerging technologies like AI and IoT is expected to enhance operational efficiencies. Furthermore, the growing interest in decentralized applications and smart contracts will likely lead to innovative solutions across various sectors, positioning the UAE as a leader in blockchain technology in future.

| Segment | Sub-Segments |

|---|---|

| By Blockchain Type | Public Blockchain Private Blockchain Consortium Blockchain Hybrid Blockchain |

| By Application | Cryptocurrency Smart Contracts Payment Processing Data & Transaction Storage Conversational AI |

| By Industry Vertical (End-User) | Banking, Financial Services, and Insurance (BFSI) Retail & E-commerce Media & Entertainment Healthcare & Pharmaceuticals IT & Telecom |

| By Organization Size | Small and Medium-Sized Enterprises (SMEs) Large Enterprises |

| By Technology Platform | Ethereum Hyperledger Corda Layer 0 Infrastructure Solutions |

| By Deployment Model | On-Premises Cloud-based Hybrid |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Blockchain Adoption | 60 | Chief Technology Officers, Blockchain Project Managers |

| Supply Chain Transparency Solutions | 45 | Logistics Managers, Supply Chain Analysts |

| Healthcare Data Management Systems | 40 | Healthcare IT Directors, Compliance Officers |

| Smart Contracts in Real Estate | 50 | Real Estate Developers, Legal Advisors |

| Blockchain Startups and Innovation | 55 | Startup Founders, Venture Capitalists |

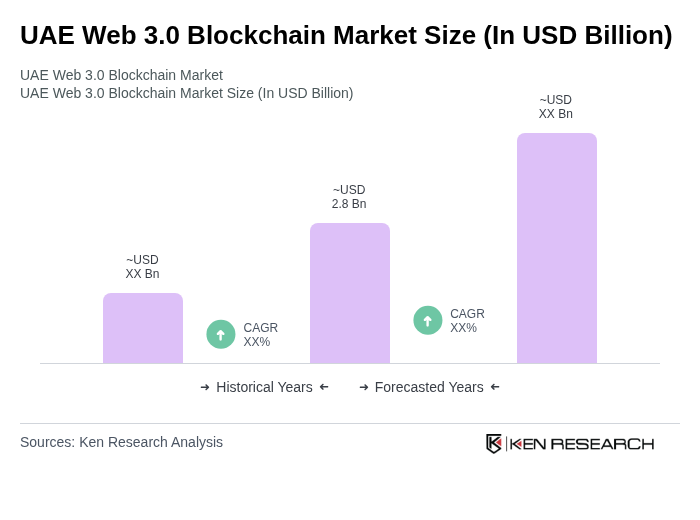

The UAE Web 3.0 Blockchain Market is currently valued at approximately USD 2.8 billion. This valuation reflects significant growth driven by investments in blockchain technology and government initiatives aimed at digital transformation across various sectors.