Region:Europe

Author(s):Dev

Product Code:KRAB4272

Pages:96

Published On:October 2025

Platforms Market.png)

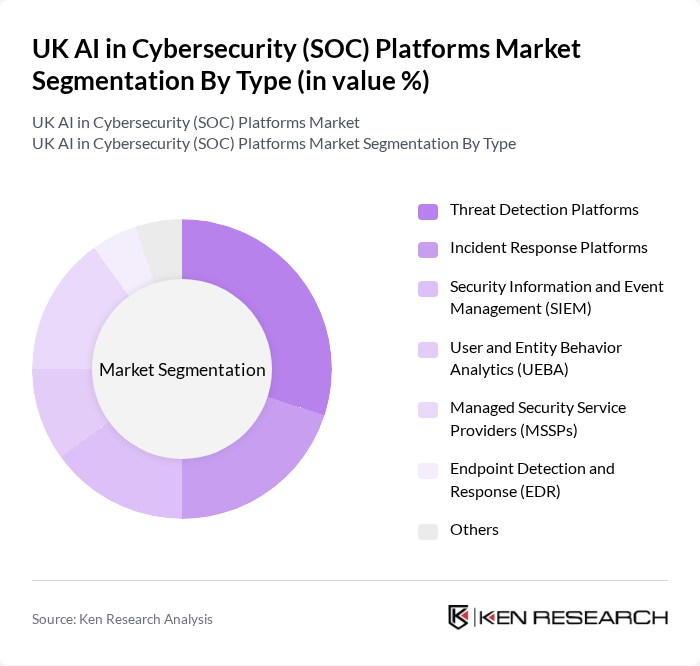

By Type:

The market is segmented into various types, including Threat Detection Platforms, Incident Response Platforms, Security Information and Event Management (SIEM), User and Entity Behavior Analytics (UEBA), Managed Security Service Providers (MSSPs), Endpoint Detection and Response (EDR), and Others. Among these, Threat Detection Platforms are leading the market due to the increasing demand for proactive security measures. Organizations are prioritizing threat detection to mitigate risks before they escalate into significant breaches. The growing sophistication of cyber threats has made these platforms essential for real-time monitoring and analysis.

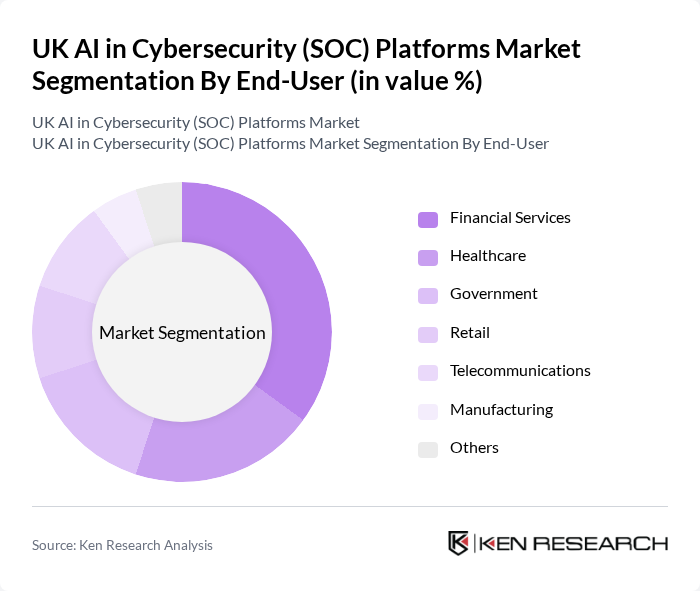

By End-User:

The end-user segmentation includes Financial Services, Healthcare, Government, Retail, Telecommunications, Manufacturing, and Others. The Financial Services sector is the dominant end-user, driven by stringent regulatory requirements and the high value of sensitive data. Financial institutions are increasingly adopting AI-driven SOC platforms to enhance their security posture and comply with regulations, making them a key driver of market growth.

The UK AI in Cybersecurity (SOC) Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Darktrace, Sophos, McAfee, Palo Alto Networks, Check Point Software Technologies, IBM Security, Cisco Systems, Fortinet, CrowdStrike, Splunk, FireEye, RSA Security, Trend Micro, CyberArk, and SentinelOne contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK AI in cybersecurity market appears promising, driven by ongoing technological advancements and increasing awareness of cyber threats. As organizations continue to prioritize cybersecurity, the integration of AI technologies will become more prevalent, enhancing threat detection and response capabilities. Additionally, the growing trend towards cloud-based solutions and managed security services will further shape the market landscape, enabling businesses to adopt more flexible and scalable cybersecurity measures to combat evolving threats effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Threat Detection Platforms Incident Response Platforms Security Information and Event Management (SIEM) User and Entity Behavior Analytics (UEBA) Managed Security Service Providers (MSSPs) Endpoint Detection and Response (EDR) Others |

| By End-User | Financial Services Healthcare Government Retail Telecommunications Manufacturing Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Application | Network Security Application Security Data Security Endpoint Security Cloud Security Others |

| By Industry Vertical | BFSI Government Healthcare Retail IT and Telecom Others |

| By Company Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Pricing Model | Subscription-Based Pay-Per-Use License-Based Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cybersecurity | 100 | IT Security Managers, Risk Assessment Officers |

| Healthcare Sector SOC Implementation | 80 | Compliance Officers, IT Directors |

| Retail Industry AI Security Solutions | 70 | Cybersecurity Analysts, Operations Managers |

| Government Cyber Defense Strategies | 60 | Policy Makers, Cybersecurity Advisors |

| Telecommunications Security Measures | 90 | Network Security Engineers, SOC Team Leaders |

The UK AI in Cybersecurity (SOC) Platforms Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increasing cyber threats and the rising demand for advanced security solutions utilizing AI technologies.