Region:Europe

Author(s):Shubham

Product Code:KRAB6157

Pages:86

Published On:October 2025

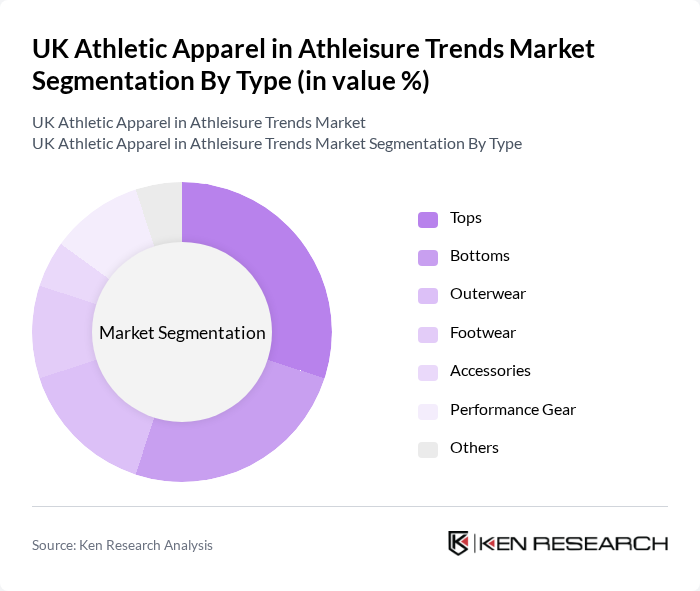

By Type:The athletic apparel market is segmented into various types, including Tops, Bottoms, Outerwear, Footwear, Accessories, Performance Gear, and Others. Among these, Tops and Bottoms are the most popular categories, driven by consumer demand for versatile and stylish options that can be worn in both athletic and casual settings. The trend towards athleisure has led to a significant increase in the sales of these segments, as consumers seek comfort without compromising on style.

By End-User:The market is segmented by end-user into Men, Women, and Children. Women represent the largest segment, driven by a growing focus on fitness and wellness, as well as the increasing availability of stylish and functional athletic wear tailored specifically for them. Men’s and Children’s segments are also growing, but the women’s segment leads due to higher engagement in fitness activities and a broader range of product offerings.

The UK Athletic Apparel in Athleisure Trends Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Under Armour, Inc., Lululemon Athletica Inc., Puma SE, ASICS Corporation, New Balance Athletics, Inc., Gymshark Ltd., Reebok International Ltd., Fabletics, Inc., Sweaty Betty Ltd., Decathlon S.A., The North Face, Inc., Columbia Sportswear Company, H&M Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK athletic apparel market appears promising, driven by ongoing trends in health consciousness and the integration of technology in apparel design. As consumers increasingly seek multifunctional clothing, brands that prioritize innovation and sustainability are likely to thrive. Additionally, the rise of e-commerce and social media marketing will continue to shape consumer purchasing behaviors, providing opportunities for brands to engage with their audience effectively and expand their market reach.

| Segment | Sub-Segments |

|---|---|

| By Type | Tops Bottoms Outerwear Footwear Accessories Performance Gear Others |

| By End-User | Men Women Children |

| By Distribution Channel | Online Retail Brick-and-Mortar Stores Specialty Stores Department Stores |

| By Price Range | Budget Mid-Range Premium |

| By Fabric Type | Cotton Polyester Nylon Blends |

| By Occasion | Casual Wear Sports and Fitness Outdoor Activities |

| By Sustainability Level | Eco-Friendly Products Conventional Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Athleisure | 150 | Active Lifestyle Consumers, Fitness Enthusiasts |

| Retail Insights on Athletic Apparel | 100 | Store Managers, Merchandising Directors |

| Brand Perception Studies | 80 | Marketing Executives, Brand Strategists |

| Trends in Sustainable Athleisure | 70 | Sustainability Managers, Product Designers |

| Impact of Social Media on Purchases | 90 | Social Media Influencers, Digital Marketing Specialists |

The UK Athletic Apparel market is valued at approximately USD 7.5 billion, reflecting a significant growth trend driven by increased consumer interest in fitness and athleisure wear that combines comfort with style.