Region:Europe

Author(s):Dev

Product Code:KRAB4330

Pages:93

Published On:October 2025

By Type:The market is segmented into various types of drones, each serving distinct purposes. Delivery drones are primarily used for transporting goods directly to consumers, while cargo drones are designed for larger shipments. Medical supply drones facilitate the rapid delivery of healthcare products, and agricultural drones are utilized for farming-related tasks. Other types include specialized drones for unique delivery needs.

The Delivery Drones sub-segment is currently leading the market due to the increasing consumer preference for quick and efficient delivery services. This trend is driven by the rise of e-commerce, where customers expect faster delivery times. The convenience of having packages delivered directly to their doorsteps has made delivery drones a popular choice among retailers and logistics companies. As technology continues to advance, the capabilities of delivery drones are expected to expand, further solidifying their dominance in the market.

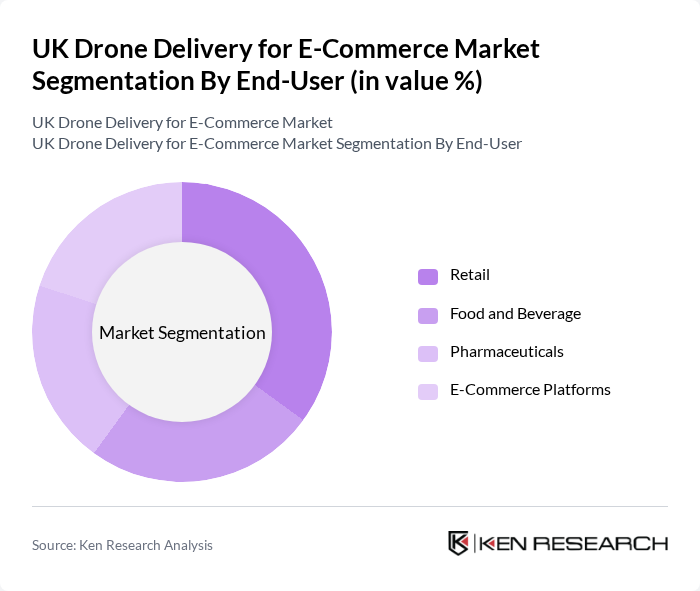

By End-User:The market is segmented based on end-users, including retail, food and beverage, pharmaceuticals, and e-commerce platforms. Each sector utilizes drone delivery to enhance operational efficiency and meet consumer demands for rapid service.

The Retail segment is the largest end-user of drone delivery services, driven by the need for quick and efficient delivery solutions. Retailers are increasingly adopting drone technology to meet consumer expectations for fast shipping, especially in urban areas. The convenience of drone delivery not only enhances customer satisfaction but also helps retailers reduce operational costs associated with traditional delivery methods. As a result, the retail sector is expected to continue leading the market.

The UK Drone Delivery for E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Prime Air, DHL Parcelcopter, UPS Flight Forward, Wing (Alphabet Inc.), Zipline, Flytrex, Drone Delivery Canada, Matternet, Skyports, Volansi, Flirtey, EHang, AirMap, A2Z Drone Delivery, DroneUp contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK drone delivery market for e-commerce appears promising, driven by technological advancements and increasing consumer acceptance. In the future, the integration of drones into logistics is expected to enhance delivery efficiency significantly, with companies exploring innovative solutions to address regulatory and safety concerns. As partnerships between e-commerce platforms and drone service providers grow, the market is likely to witness a surge in operational capabilities, paving the way for a more streamlined delivery ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Delivery Drones Cargo Drones Medical Supply Drones Agricultural Drones Others |

| By End-User | Retail Food and Beverage Pharmaceuticals E-Commerce Platforms |

| By Sales Channel | Direct Sales Online Marketplaces Third-Party Logistics Providers |

| By Distribution Mode | Urban Delivery Suburban Delivery Rural Delivery |

| By Payload Capacity | Light Payload Drones Medium Payload Drones Heavy Payload Drones |

| By Customer Segment | Individual Consumers Small Businesses Large Enterprises |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Retailers Utilizing Drone Delivery | 100 | Logistics Managers, E-commerce Directors |

| Drone Technology Providers | 75 | Product Development Managers, Technical Leads |

| Regulatory Bodies and Aviation Authorities | 50 | Policy Makers, Compliance Officers |

| Consumer Acceptance Studies | 120 | General Consumers, Tech Enthusiasts |

| Logistics and Supply Chain Consultants | 80 | Consultants, Industry Analysts |

The UK Drone Delivery for E-Commerce Market is valued at approximately USD 1.2 billion, driven by the increasing demand for faster delivery services and advancements in drone technology, making it a crucial part of modern logistics.