Region:Europe

Author(s):Shubham

Product Code:KRAD0720

Pages:81

Published On:August 2025

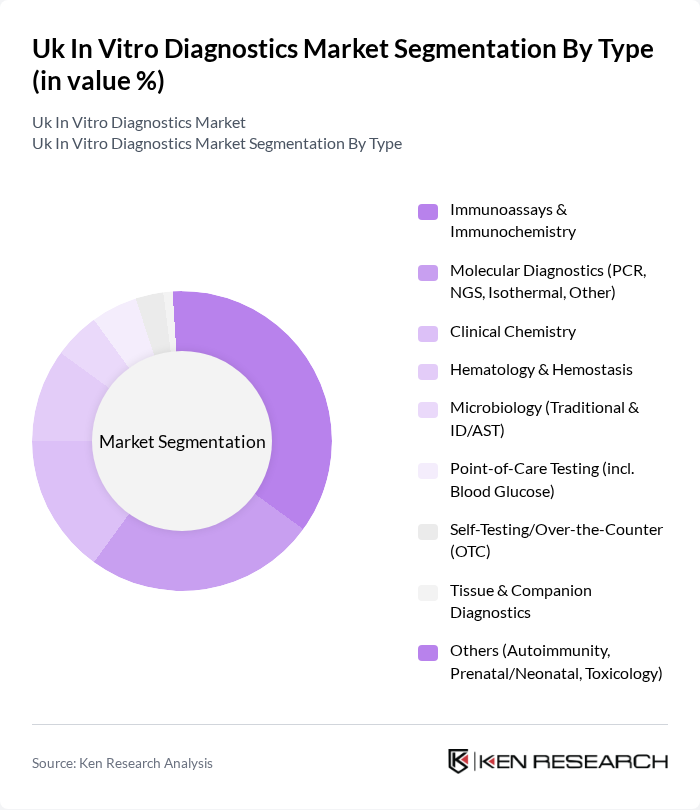

By Type:The market is segmented into various types, including Immunoassays & Immunochemistry, Molecular Diagnostics, Clinical Chemistry, Hematology & Hemostasis, Microbiology, Point-of-Care Testing, Self-Testing/Over-the-Counter, Tissue & Companion Diagnostics, and Others. Among these, Immunoassays & Immunochemistry is the leading sub-segment due to its widespread application in infectious disease serology, cardiac markers, oncology markers, and chronic condition monitoring across centralized labs and point-of-care platforms.

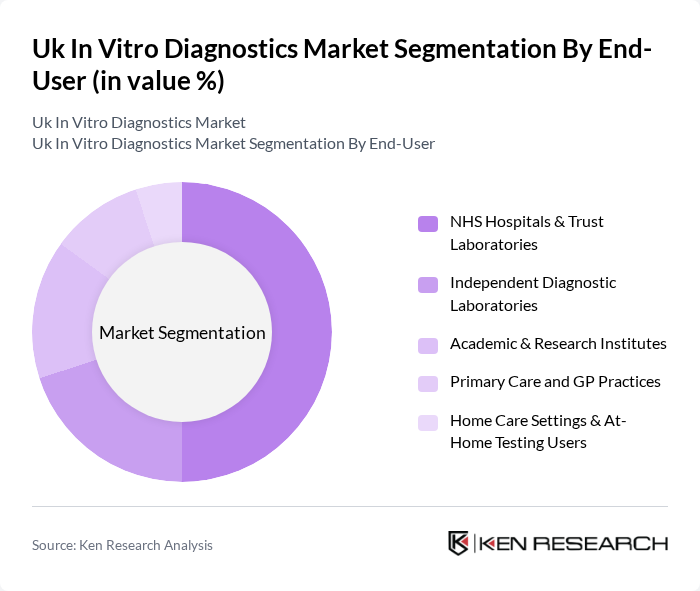

By End-User:The end-user segmentation includes NHS Hospitals & Trust Laboratories, Independent Diagnostic Laboratories, Academic & Research Institutes, Primary Care and GP Practices, and Home Care Settings & At-Home Testing Users. NHS Hospitals & Trust Laboratories dominate this segment due to their extensive patient base, centralized testing networks, and their critical role in public health diagnostics and national screening programs, as well as surge capacity management during infectious outbreaks.

The UK In Vitro Diagnostics market is characterized by a dynamic mix of regional and international players. Leading participants such as F. Hoffmann-La Roche Ltd (Roche Diagnostics), Abbott Laboratories, Siemens Healthineers AG, Thermo Fisher Scientific Inc., Becton, Dickinson and Company (BD), Bio-Rad Laboratories, Inc., QIAGEN N.V., Hologic, Inc., Ortho Clinical Diagnostics (QuidelOrtho Corporation), Agilent Technologies, Inc., Revvity, Inc. (formerly PerkinElmer’s diagnostics), Danaher Corporation (Beckman Coulter, Cepheid), Sysmex Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (Mindray), Grifols, S.A., bioMérieux S.A., Illumina, Inc., Randox Laboratories Ltd, Oxford Nanopore Technologies plc, Novacyt S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The UK in vitro diagnostics market is poised for transformative growth, driven by technological advancements and an increasing focus on personalized medicine. As healthcare systems prioritize early detection and preventive care, the integration of artificial intelligence and data analytics into diagnostics will enhance patient management. Additionally, the expansion of point-of-care testing will facilitate quicker decision-making in clinical settings, ultimately improving patient outcomes and operational efficiency across the healthcare landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Immunoassays & Immunochemistry Molecular Diagnostics (PCR, NGS, Isothermal, Other) Clinical Chemistry Hematology & Hemostasis Microbiology (Traditional & ID/AST) Point-of-Care Testing (incl. Blood Glucose) Self-Testing/Over-the-Counter (OTC) Tissue & Companion Diagnostics Others (Autoimmunity, Prenatal/Neonatal, Toxicology) |

| By End-User | NHS Hospitals & Trust Laboratories Independent Diagnostic Laboratories Academic & Research Institutes Primary Care and GP Practices Home Care Settings & At-Home Testing Users |

| By Application | Infectious Diseases (respiratory, STIs, sepsis, gastrointestinal) Oncology (solid tumors, hematologic malignancies, liquid biopsy) Cardiometabolic (cardiovascular, diabetes, lipid disorders) Genetic & Genomic Testing (carrier, NIPT, pharmacogenomics) Blood Screening & Transfusion Medicine Women’s & Reproductive Health Others (renal, liver, autoimmune, therapeutic drug monitoring) |

| By Distribution Channel | Direct to NHS Procurement Distributors & Group Purchasing Organizations Online and E-Procurement Portals |

| By Component | Reagents & Consumables Instruments & Analyzers Software & Services |

| By Pricing Model | Capital Purchase Reagent Rental/Cost-per-Test Managed Service/Long-Term Service Contracts |

| By Regulatory Approval Status | CE-Marked (IVDD/IVDR) Products UKCA-Marked Products Products Under MHRA Exceptional Use/Review |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 120 | Laboratory Managers, Clinical Pathologists |

| Hospitals and Healthcare Providers | 110 | Healthcare Administrators, Procurement Officers |

| Diagnostic Product Manufacturers | 90 | Product Managers, R&D Directors |

| Regulatory Bodies | 60 | Regulatory Affairs Specialists, Compliance Officers |

| End-Users (Clinicians and Patients) | 80 | General Practitioners, Patients using diagnostic tests |

The UK In Vitro Diagnostics market is valued at approximately USD 4.0 billion, reflecting significant growth driven by the rising prevalence of chronic diseases and advancements in diagnostic technologies, particularly since the COVID-19 pandemic.