Region:Europe

Author(s):Shubham

Product Code:KRAA4994

Pages:91

Published On:September 2025

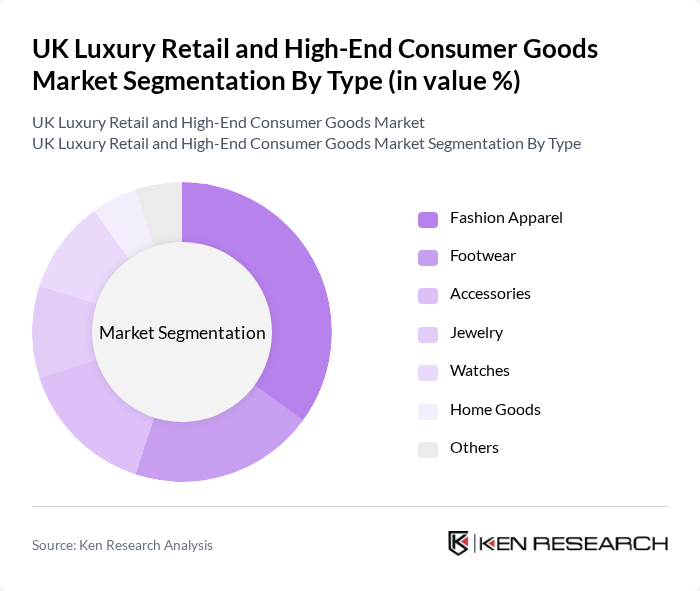

By Type:The luxury retail market is segmented into various types, including Fashion Apparel, Footwear, Accessories, Jewelry, Watches, Home Goods, and Others. Among these, Fashion Apparel is the leading sub-segment, driven by consumer preferences for high-end clothing and designer brands. The demand for unique and exclusive fashion items continues to rise, with consumers increasingly valuing quality and craftsmanship.

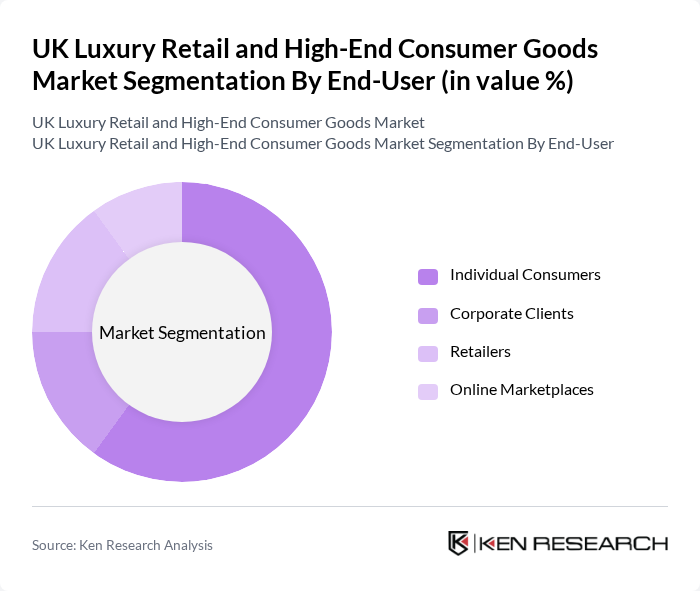

By End-User:The market is segmented by end-users, including Individual Consumers, Corporate Clients, Retailers, and Online Marketplaces. Individual Consumers dominate the market, driven by a growing trend of personal luxury consumption. The rise of social media influencers and celebrity endorsements has significantly impacted consumer behavior, leading to increased spending on luxury goods among affluent individuals.

The UK Luxury Retail and High-End Consumer Goods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Burberry Group PLC, Louis Vuitton Moët Hennessy (LVMH), Gucci (Kering), Chanel S.A., Prada S.p.A., Richemont Group, Tiffany & Co., Hermès International S.A., Valentino S.p.A., Versace (Capri Holdings Limited), Alexander McQueen (Kering), Ralph Lauren Corporation, Dolce & Gabbana, Fendi (LVMH), Bvlgari (LVMH) contribute to innovation, geographic expansion, and service delivery in this space.

The UK luxury retail market is poised for transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value for consumers, brands that embrace eco-friendly practices will likely thrive. Additionally, the integration of augmented reality in shopping experiences is expected to enhance customer engagement, making luxury shopping more interactive. The focus on personalized services will also grow, as retailers seek to create unique experiences that resonate with discerning consumers, ensuring long-term loyalty and market relevance.

| Segment | Sub-Segments |

|---|---|

| By Type | Fashion Apparel Footwear Accessories Jewelry Watches Home Goods Others |

| By End-User | Individual Consumers Corporate Clients Retailers Online Marketplaces |

| By Sales Channel | Direct Sales E-commerce Department Stores Specialty Stores |

| By Price Range | Premium Super Premium Ultra Luxury |

| By Distribution Mode | Online Distribution Offline Distribution |

| By Consumer Demographics | Age Group Gender Income Level |

| By Brand Loyalty | Brand Loyal Customers Brand Switchers New Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Fashion Purchases | 150 | Affluent Consumers, Fashion Enthusiasts |

| High-End Cosmetics Usage | 100 | Beauty Product Consumers, Skincare Aficionados |

| Luxury Accessories Market | 80 | Accessory Buyers, Trendsetters |

| Luxury Travel Experiences | 70 | Frequent Travelers, Luxury Experience Seekers |

| High-End Home Goods Purchases | 90 | Home Decor Enthusiasts, Interior Designers |

The UK Luxury Retail and High-End Consumer Goods Market is valued at approximately USD 60 billion, reflecting a robust growth trajectory driven by increasing disposable incomes and a rising number of affluent consumers seeking premium products.