Region:Middle East

Author(s):Rebecca

Product Code:KRAE0921

Pages:82

Published On:December 2025

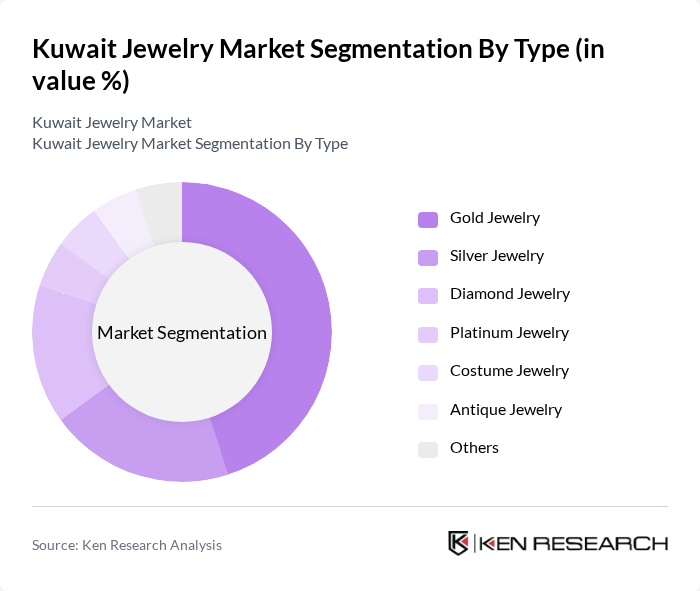

By Type:The jewelry market in Kuwait is diverse, with various types of jewelry catering to different consumer preferences. Gold jewelry remains the most popular choice due to its cultural significance and investment value. Silver jewelry is also gaining traction, especially among younger consumers looking for affordable yet stylish options. Diamond jewelry, while more expensive, is favored for special occasions, particularly engagements and weddings. Other types, such as platinum, costume, antique, and others, contribute to the market's richness, appealing to niche segments.

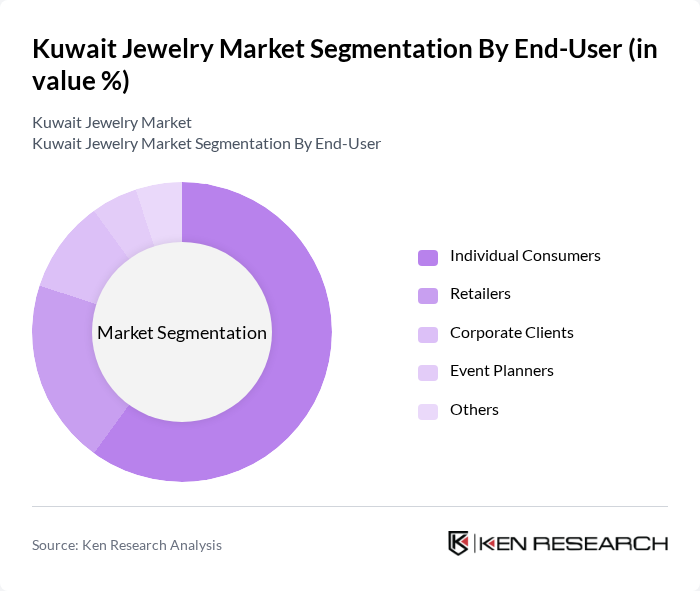

By End-User:The end-user segmentation of the jewelry market in Kuwait highlights the diverse consumer base. Individual consumers dominate the market, driven by personal purchases for self-expression and gifting. Retailers play a significant role in the distribution of jewelry, catering to both local and tourist markets. Corporate clients and event planners also contribute to the market, particularly for bulk purchases during weddings and corporate events. This segmentation reflects the varied motivations behind jewelry purchases, from personal adornment to gifting and ceremonial use.

The Kuwait Jewelry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Hussaini Jewelry, Damas Jewelry, Al-Futtaim Jewelry, Al-Mansoori Jewelry, Al-Sayer Jewelry, Al-Majed Jewelry, Al-Othman Jewelry, Al-Shaab Jewelry, Al-Qatami Jewelry, Al-Mansour Jewelry, Al-Muhanna Jewelry, Al-Sabah Jewelry, Al-Khaldi Jewelry, Al-Mahmoud Jewelry, Al-Rashid Jewelry contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait jewelry market is poised for significant evolution, driven by changing consumer preferences and technological advancements. As consumers increasingly seek personalized and sustainable jewelry options, local jewelers are likely to adapt by offering customized designs and ethically sourced materials. Additionally, the integration of e-commerce platforms will facilitate broader market access, allowing jewelers to reach a wider audience. The combination of these trends is expected to create a dynamic market environment, fostering innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Gold Jewelry Silver Jewelry Diamond Jewelry Platinum Jewelry Costume Jewelry Antique Jewelry Others |

| By End-User | Individual Consumers Retailers Corporate Clients Event Planners Others |

| By Material | Precious Metals Semi-Precious Stones Synthetic Materials Others |

| By Occasion | Weddings Festivals Corporate Events Everyday Wear Others |

| By Distribution Channel | Online Retail Physical Stores Wholesale Distributors Others |

| By Price Range | Luxury Segment Mid-Range Segment Budget Segment Others |

| By Brand Type | Local Brands International Brands Designer Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Jewelry Sales | 150 | Store Managers, Sales Associates |

| Consumer Jewelry Preferences | 200 | Jewelry Buyers, Fashion Enthusiasts |

| Jewelry Manufacturing Insights | 100 | Manufacturers, Production Managers |

| Online Jewelry Shopping Trends | 120 | E-commerce Managers, Digital Marketing Specialists |

| Luxury Jewelry Market Analysis | 80 | Luxury Brand Managers, High-Net-Worth Individuals |

The Kuwait Jewelry Market is valued at approximately USD 130 million, reflecting a robust growth driven by increasing demand from tourists and a rise in engagements and weddings, which significantly boosts sales of engagement rings and wedding bands.