Region:Asia

Author(s):Geetanshi

Product Code:KRAD3895

Pages:94

Published On:November 2025

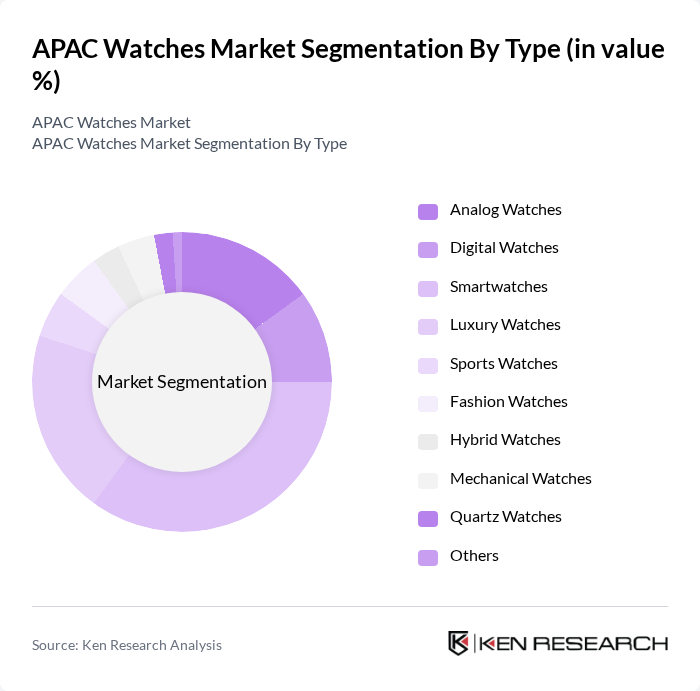

By Type:The market is segmented into various types of watches, including Analog Watches, Digital Watches, Smartwatches, Luxury Watches, Sports Watches, Fashion Watches, Hybrid Watches, Mechanical Watches, Quartz Watches, and Others. Each type caters to different consumer preferences and technological advancements. Traditional watches represent the largest revenue-generating product segment in the market.

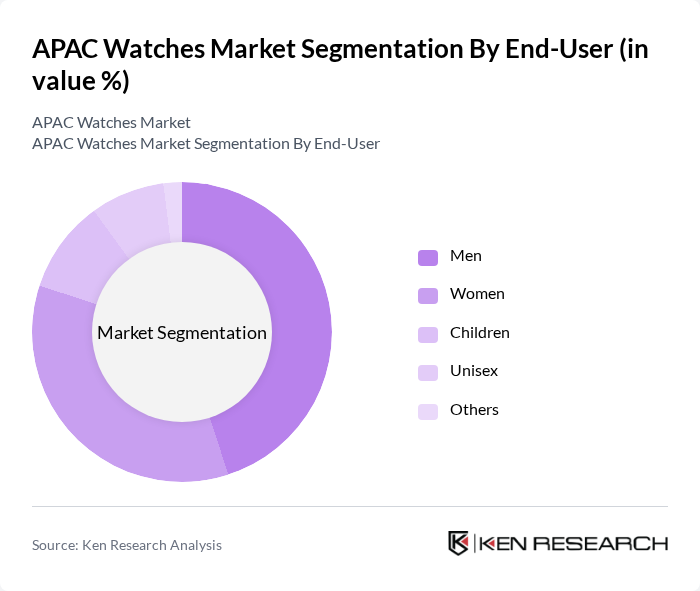

By End-User:The market is segmented based on end-users, including Men, Women, Children, Unisex, and Others. This segmentation reflects the diverse preferences and needs of different demographic groups.

The APAC Watches Market is characterized by a dynamic mix of regional and international players. Leading participants such as Seiko Holdings Corporation, Casio Computer Co., Ltd., Citizen Watch Co., Ltd., Orient Watch Co., Ltd., Titan Company Limited, Fossil Group, Inc., Swatch Group Ltd., Rolex SA, TAG Heuer (LVMH Moët Hennessy Louis Vuitton), Omega SA, Tissot SA, Apple Inc., Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., and Xiaomi Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The APAC watches market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As disposable incomes rise, consumers are increasingly willing to invest in luxury timepieces that reflect their personal style. Additionally, the integration of smart technology into traditional watches is expected to attract a broader audience. Brands that embrace sustainability and customization will likely capture emerging market segments, particularly in Southeast Asia, where demand for unique and eco-friendly products is on the rise.

| Segment | Sub-Segments |

|---|---|

| By Type | Analog Watches Digital Watches Smartwatches Luxury Watches Sports Watches Fashion Watches Hybrid Watches Mechanical Watches Quartz Watches Others |

| By End-User | Men Women Children Unisex Others |

| By Region | China Japan India South Korea Australia Singapore Taiwan Southeast Asia Rest of APAC |

| By Price Range | Budget Watches Mid-Range Watches Premium Watches Luxury Watches |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Authorized Dealers Others |

| By Material | Stainless Steel Leather Plastic/Resin Ceramic Precious Metals Others |

| By Brand Positioning | Luxury Brands Mid-Tier Brands Budget Brands Smartwatch Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Watch Retailers | 100 | Store Managers, Brand Representatives |

| Smartwatch Manufacturers | 80 | Product Development Managers, Marketing Directors |

| Fashion Watch Brands | 70 | Sales Executives, Brand Managers |

| Watch Collectors and Enthusiasts | 60 | Collectors, Hobbyist Group Leaders |

| E-commerce Watch Sales | 90 | eCommerce Managers, Digital Marketing Specialists |

The APAC Watches Market is valued at approximately USD 41 billion, driven by increasing disposable incomes, a trend towards luxury consumption, and the rising popularity of smartwatches among consumers in the region.