Region:Europe

Author(s):Geetanshi

Product Code:KRAA0321

Pages:93

Published On:August 2025

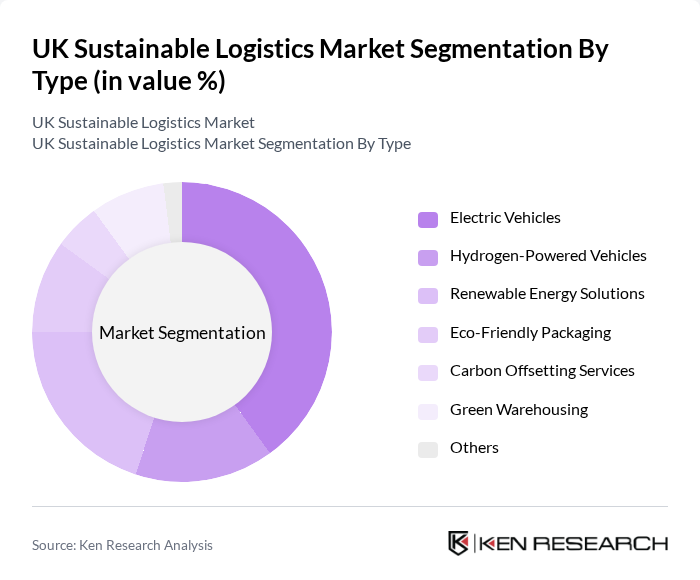

By Type:The market is segmented into Electric Vehicles, Hydrogen-Powered Vehicles, Renewable Energy Solutions, Eco-Friendly Packaging, Carbon Offsetting Services, Green Warehousing, and Others. Electric Vehicles are leading the market, driven by widespread adoption among logistics companies seeking to reduce emissions and operational costs. Hydrogen-Powered Vehicles are gaining momentum, particularly for long-haul and heavy-duty logistics, supported by advancements in hydrogen fuel technology and government incentives. Renewable Energy Solutions are increasingly implemented as companies transition to sustainable power sources for logistics operations. Eco-Friendly Packaging and Carbon Offsetting Services are also becoming standard as companies respond to consumer and regulatory demands for sustainability .

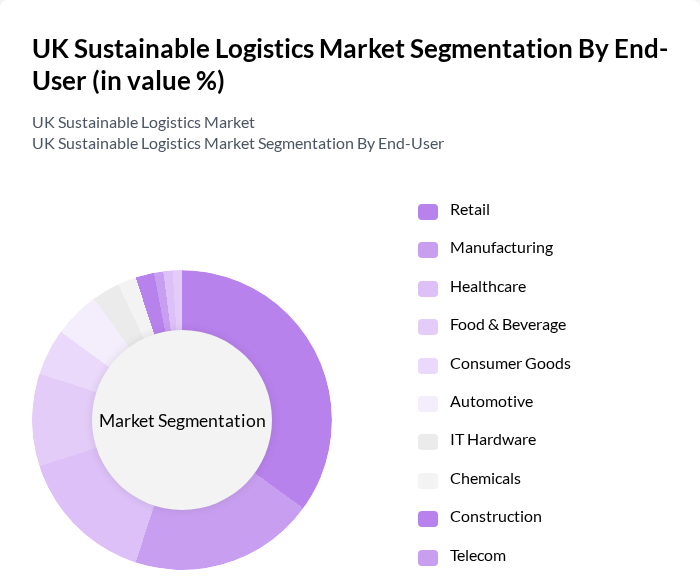

By End-User:The end-user segmentation includes Retail, Manufacturing, Healthcare, Food & Beverage, Consumer Goods, Automotive, IT Hardware, Chemicals, Construction, Telecom, Oil & Gas, and Others. The Retail sector is the dominant segment, reflecting the surge in e-commerce and the demand for sustainable supply chain practices. Manufacturing and Healthcare are also significant, as these sectors implement sustainable logistics to comply with regulations and advance corporate social responsibility. The Food & Beverage industry is increasingly prioritizing sustainable packaging and transportation methods to align with consumer expectations .

The UK Sustainable Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, XPO Logistics, Kuehne + Nagel, DPD Group, FedEx, UPS, Geodis, DB Schenker, CEVA Logistics, Wincanton, Stobart Group, Palletways, Yodel, Clipper Logistics, DSV Panalpina, Royal Mail, Hermes (Evri), Hydrogen Transport Solutions, and JCB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK sustainable logistics market appears promising, driven by increasing consumer demand for eco-friendly solutions and robust government support. As the logistics sector continues to embrace technological advancements, the integration of AI and big data will enhance operational efficiencies and sustainability. Furthermore, the ongoing expansion of electric vehicle infrastructure and the push for carbon neutrality will likely create a more competitive landscape, encouraging traditional logistics providers to adopt greener practices and innovate their service offerings.

| Segment | Sub-Segments |

|---|---|

| By Type (Electric Vehicles, Hydrogen-Powered Vehicles, Renewable Energy Solutions, Eco-Friendly Packaging, Carbon Offsetting Services, Green Warehousing) | Electric Vehicles Hydrogen-Powered Vehicles Renewable Energy Solutions Eco-Friendly Packaging Carbon Offsetting Services Green Warehousing Others |

| By End-User (Retail, Manufacturing, Healthcare, Food & Beverage, Consumer Goods, Automotive, IT Hardware, Chemicals, Construction, Telecom, Oil & Gas, Others) | Retail Manufacturing Healthcare Food & Beverage Consumer Goods Automotive IT Hardware Chemicals Construction Telecom Oil & Gas Others |

| By Delivery Method (Road, Rail, Air, Sea, Multimodal) | Road Rail Air Sea Multimodal Others |

| By Service Type (Freight Transport, Warehousing & Distribution, Last-Mile Delivery, Reverse Logistics, Inventory Management, Value-Added Services, Integration & Consulting) | Freight Transport Warehousing & Distribution Last-Mile Delivery Reverse Logistics Inventory Management Value-Added Services Integration & Consulting Others |

| By Sustainability Certification (ISO 14001, Green Freight, Carbon Trust, BREEAM, Others) | ISO 14001 Green Freight Carbon Trust BREEAM Others |

| By Geographic Coverage (Urban, Suburban, Rural, Regional, National) | Urban Suburban Rural Regional National Others |

| By Customer Segment (B2B, B2C, B2G, Others) | B2B B2C B2G Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Sustainable Logistics | 100 | Logistics Managers, Sustainability Coordinators |

| Food and Beverage Supply Chain | 70 | Operations Managers, Supply Chain Analysts |

| Construction Materials Logistics | 50 | Procurement Managers, Environmental Compliance Officers |

| Consumer Electronics Returns Management | 60 | Customer Experience Managers, Logistics Analysts |

| Textile and Apparel Supply Chain | 80 | Sustainability Managers, Product Lifecycle Managers |

The UK Sustainable Logistics Market is valued at approximately USD 92 billion, reflecting significant growth driven by regulatory pressures, consumer demand for sustainable practices, and advancements in green technologies.